How Equities And Yields Worsen Gold’s Dejected State

Let’s face it, gold is in the doldrums and needs to seek a psychiatrist. The strength to surge back is simply not there yet. Gold will eventually prevail, but not until it gets the support it needs. Will Powell’s Operation Twist 3.0 save the day?

With U.S. equities suffering another derailment on Mar. 3, the precious metals were once again caught up in the wreckage. And because the PMs don’t operate in a vacuum, I’ve warned on several occasions that equity-market stress often reverberates across the precious metals’ market.

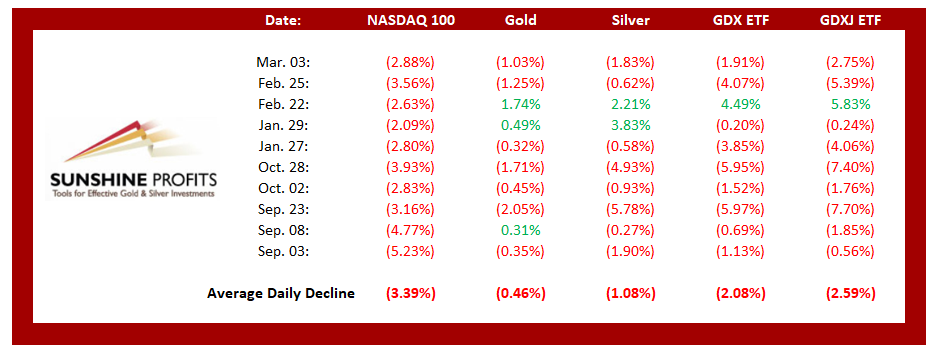

Please see below:

Figure 1

If you analyze the table above, you can see that Nasdaq 100 drawdowns of more than 2.00% tend to unnerve the PMs. Moreover, if you exclude silver’s short squeeze on Jan. 29 and the NASDAQ 100’s relatively ‘quiet’ 2.63% drawdown on Feb. 22, bouts of equity volatility significantly impact the PMs (especially the miners).

But what’s causing the sudden crisis of confidence?

Well, to reiterate what I wrote on Feb. 24, Jerome Powell, Chairman of the U.S. Federal Reserve (FED), has lost control of the bond market.

Waking up to another spike on Mar. 3, the behavior of the U.S. 5-Year, 7-Year, and 10-Year Treasury yields continue to rattle investors. Surging by nearly 9% on the day, the U.S. 5-Year Treasury yield has become increasingly unhinged.

Please see below:

Figure 2

While he’ll never admit it, it’s clear that investors are starting to doubt Powell’s ability to maintain a financial-market nirvana.

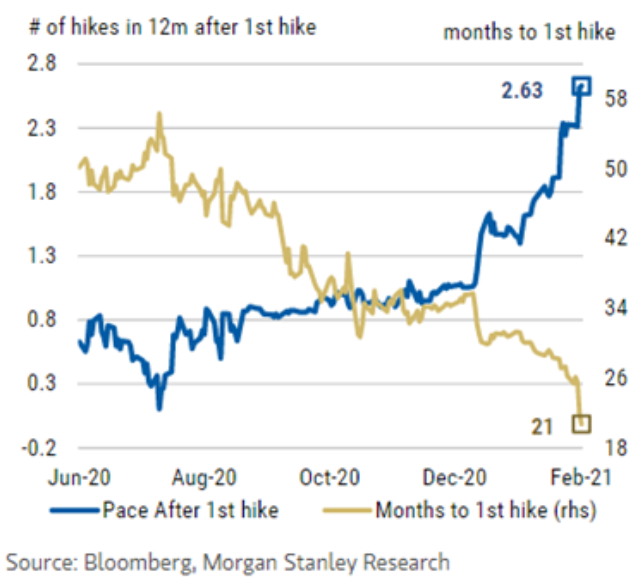

Figure 3

To explain, the gold line above tracks investors’ belief in how long it will be until the FED raises interest rates. Likewise, the blue line tracks investors’ belief in how quickly subsequent rate hikes will follow the initial rate hike. If you follow the gold line, you can see that at the end of December, investors expected roughly 36 months (three years) of bliss before the first rate hike (and only one rate hike occurring thereafter).

Conversely, investors’ now fear that an initial rate hike may occur within 21 months (less than two years), with another 2.63 rate hikes occurring within the following 12 months.

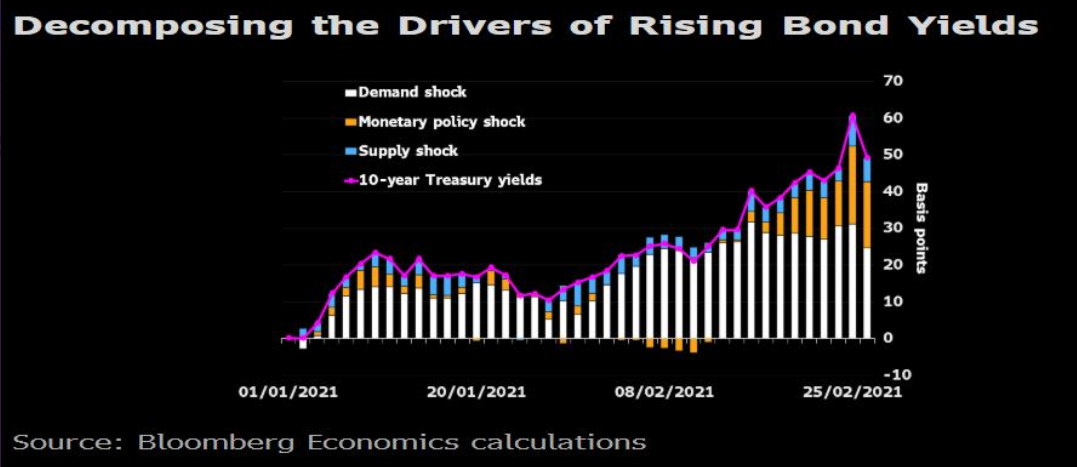

And with confidence suddenly teetering on the edge, according to Bloomberg Economics, fear of a monetary policy shock is driving the bond market’s recent sell-off.

Please see below:

Figure 4

To explain, the purple line above tracks the U.S. 10-Year Treasury yield, while the vertical bars quantify the effect of three different variables – a demand shock, a monetary policy shock and a supply shock. If you analyze the right side of the chart, you can see that the orange bar (a monetary policy shock) continues to exert greater influence over the U.S. 10-Year Treasury yield’s movement. As a result, Powell’s cobra flute isn’t hypnotizing investors like it once did.

Amid the chaos, Cathie Wood’s Ark Innovation ETF – home to speculative technology stocks like Tesla, Square, and Roku – ended Wednesday (Mar. 3) in bear market territory.

Please see below:

Figure 5

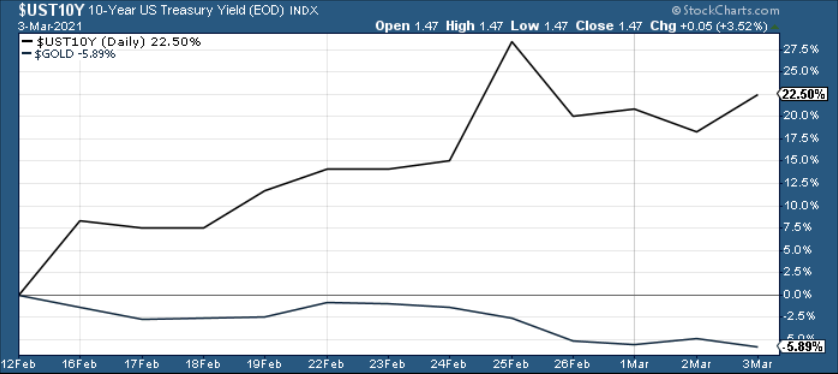

Also suffering from the yield surge, gold has become completely dejected.

On Feb. 17, I warned that gold topped (on Aug. 7), exactly one day after the U.S. 10-Year Treasury yield bottomed (Aug. 6). As a result, the yield curve story remains one of the most compelling narratives contributing to gold’s plight.

Figure 6

And two weeks later, the script remains the same.

Figure 7

As further evidence, investors are dumping gold-backed ETFs at their fastest pace since 2016.

Please see below:

Figure 8

To explain, the yellow line above tracks the performance of spot gold (XAU), while the white line tracks worldwide holdings of gold-backed ETFs. Suffering 12-straight days of outflows, the current swoon marks gold-backed ETFs’ longest losing streak in roughly five years.

But with the behavior of U.S. Treasury yields, U.S. equities and the PMs signaling that a regime change is underway, has the bubble finally burst or is this just another ‘buy the dip’ opportunity?

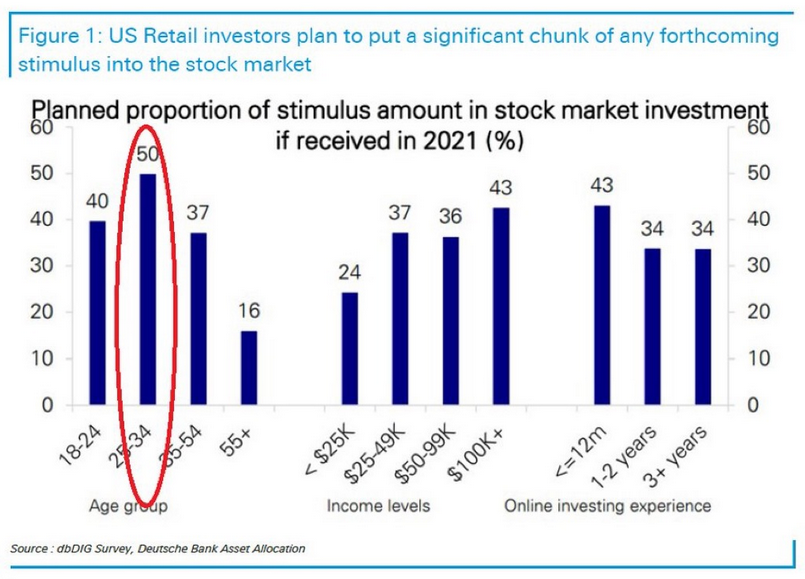

Well, on one side of the coin, 50% of respondents aged 25-34 told Deutsche Bank that their forthcoming stimulus checks are heading straight into the stock market.

Please see below:

Figure 9

On the other side of the coin, Bank of America’s Equity & Quant Strategy team believe that we’re approaching a precipice. As of Feb. 28, the group’s Sell Side Indicator is flashing a warning signal.

Figure 10

To explain, the blue line above tracks the historical readings from BofA’s Sell Side Indicator. And plotting 1 standard deviation above and below the indicator’s 15-year average, the green and purple lines signal when to buy and sell equities. As it stands, the indicator (59.2%) is only 1.1% away from a screaming sell signal (determined by reaching the 60.3% threshold). More importantly, though, the last time the indicator was this close to 60.3% was November 2007 – roughly one month after the S&P 500 began its nearly 58% plunge during the Global Financial Crisis (GFC).

Conversely, while a righteous drawdown would serve as vindication for those that study history and perform diligent fundamental and technical analysis, could Superman – I mean Powell – save the day once again?

Enter Operation Twist 3.0.

With Powell speaking at the Wall Street Journal’s Jobs Summit on Mar. 4, whispers of an old strategy are becoming louder. Dubbed Operation Twist 3.0, the strategy (a version of yield curve control) requires the FED to buy long-term Treasuries and sell short-term Treasuries in order to flatten the yield curve (reduce the spread between short-term and long-term interest rates). And with the first ‘Twist’ occurring in 1961 and the second occurring in 2011 – following the GFC – Fed Governor Lael Brainard hinted on Mar. 2 that 3.0 could be next.

“I am paying close attention to market developments,” she said. “Some of those moves last week and the speed of the moves caught my eye. I would be concerned if I saw disorderly conditions or persistent tightening in financial conditions that could slow progress towards our goals.”

But analogous to putting out a fire by pouring on more gasoline, FED officials remain clueless to the indirect effect of their policies. Despite the implementation likely to suppress bond yields, buoy equities and breathe new life into the PMs, the sugar high will inevitably wear off.

The FED remains stuck between a rock and a hard place:

- If they let yields rise, the cost of borrowing rises, the cost of equity rises, and the U.S. dollar is supported (all leading to shifts in the bond and stock markets and destroying the halcyon environment they worked so hard to create).

- To stop yields from rising, the U.S. Federal Reserve (FED) has to increase its asset purchases (and buy more bonds in the open market). However, the added liquidity should have the same net-effect because it increases inflation expectations (which is a precursor to higher interest rates).

And with Powell’s deny-and-suppress strategy seemingly evolving into acknowledge-and-deflect, Operation Twist 3.0 will only provide a short-term reprieve. Conversely, over the medium-term, it’s the same story: you can only stretch a rubber band so far before it snaps.

In conclusion, the medium-term outlook for the PMs remains profoundly bearish. However, if gold can find a bottom at roughly $1,675, it will likely trigger a short-term corrective upswing. Moreover, if Powell can convince the bond market to settle down, equities should rally, and the PMs could participate in the upward momentum (given their moderate-to-strong correlations with the S&P 500). Conversely, the positivity is likely to be short-lived, as the PMs and U.S. equities are likely to suffer significant drawdowns over the medium-term.

Disclaimer: All essays, research, and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more