Higher Yields Suggest Attractive Opportunity Set For Cash

Central banks cite COVID-decimated job markets as a reason to maintain rock-bottom overnight lending rates and bond-buying programs. The trouble is that they have little power over the five to ten-year bond yields that set consumer borrowing costs, and these have risen violently over the past seven months. From a low of .50 in the US and .43 for Canada last August, ten-year yields have risen 245% and 284%, respectively.

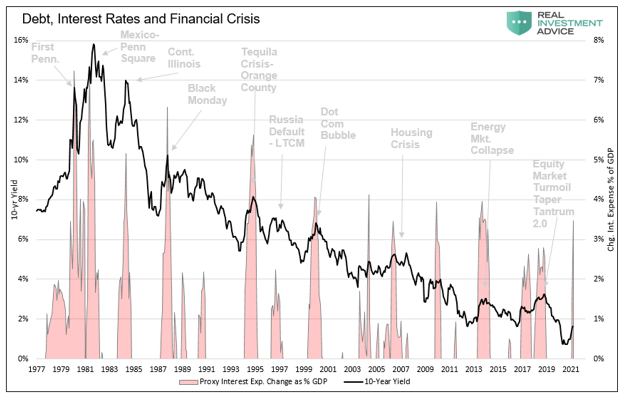

Big picture, rates remain historically low, and recent moves are only back to where they were pre-pandemic in December 2019 (US 10-year yield below in black since 1977 courtesy of Real Investment Advice). However, a heavily indebted economy feels the increase in interest expense as a percentage of GDP (far right pink bar below), and sustained episodes in the past have helped to trigger financial market dislocation and recessions.

(Click on image to enlarge)

Aggravating the impact, consumers, companies, governments, and investors are servicing a lot more debt now than they were 17 months ago. Simultaneously, the cost of living has risen in key areas like energy, fuel, vehicles, food, building materials, and home prices, while employment has weakened.

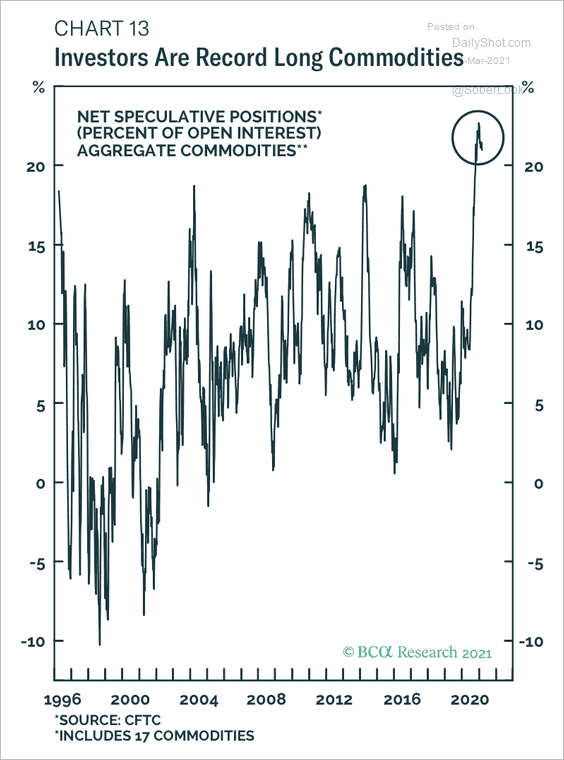

(Click on image to enlarge)

As the US dollar fell against the basket of global trade currencies between March and December 2020, record long speculation in commodities (the other side of the USD teeter-totter) has magnified an inflationary price shock that helped to kill past recoveries (as shown on the left since 1995 courtesy of DailyShot.com).

After holding long-term support in the $88 area in December 2020, year to date, the US Dollar Index has risen just over 2% and demands close attention.

Our base case remains that the US dollar index is likely to strengthen and treasury prices rebound as the current reflation trade runs out of steam, likely in the second half of 2021. In the meantime, the spread between ten and two-year Treasury yields today reaching 1.58%–the widest since 2015–is likely to steepen with some further downside for long bonds before another buying opportunity.

As shown in my partner Cory Venable’s chart below since 1996, a spread widening past .80% was enough to trigger both the tech-led market bust in 2000 and the US housing and commodities-led implosion in 2007. With extreme exuberance evident in pretty much every asset class today and financial leverage that much higher, it would not be surprising if medium to long rates topped out lower than in the prior two cycles.

(Click on image to enlarge)

This all suggests another opportunity in the making to add cash to government bonds while corporate bonds and equities enter their next nervous breakdown. Everyone gets their turn in market cycles. What’s bad for speculators and price-indiscriminate buyers will be good for cash investors as usual.

Disclosure: None.