Hertz' Own Lawyer Admits Stock Price "Disconnected From Fundamentals," Will Go Ahead With Stock Offering Anyway

We live in truly fascinating times.

On Friday, June 12, a bankruptcy judge approved Hertz (HTZ)' unprecedented, stunning attempt to sell up to $1 billion in stock. The bankrupt company was taking advantage of the euphoria gripping retail speculators who have sent the worthless stock as high as $6/share, knowing full well there is virtually zero chance that the stock will have any value after the reorganization process is complete and bondholders are impaired.

Still, as a result of purely bureaucratic considerations, the judge approved the request:

"The cost [of equity financing] is significantly less than a loan...and the dollars that come in will go to the value of the enterprise as a whole,” said Judge Mary Walrath of the US bankruptcy court in Delaware.

What is remarkable is that none other than Hertz' own lawyer, Tom Lauria from White and Case, admitted that the stock is worthless - or will be worthless once the euphoria dies down.

At the court hearing, held by video, he acknowledged that, while travel had slowly picked up in recent weeks, the trading price of Hertz shares was "disconnected from fundamentals."

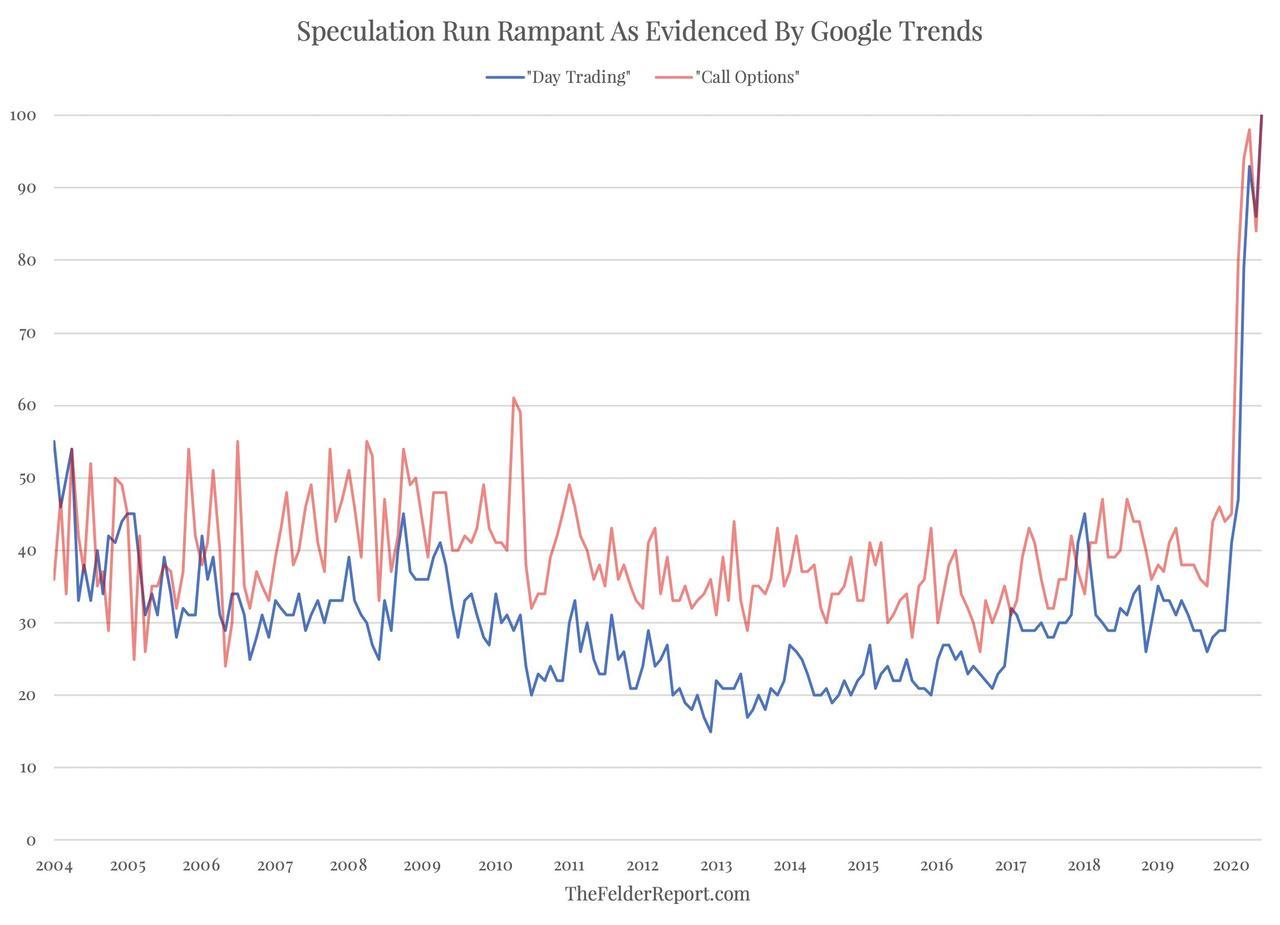

“New platforms for day traders may be facilitating this,” Lauria said as quoted by the FT, referring to Robinhood, the stock trading app popular with young retail investors. "There are forces at work that us non-financial people, that we can only observe."

Tom's "naive" joking aside, he is essentially admitting that Hertz, together with the creditors and the bankruptcy judge, are all complicit in taking advantage of ignorant, momentum-chasing traders who have made a market that makes no sense, and yet, just because there is clear demand for the stock at a price point of over $2/share, they will take advantage of this opportunity and sell at the money.

And sure enough, they will do so quickly, before the euphoria fades. Lauria said Hertz may try to tap the market as soon as Monday, because once the bid disappears, this historic opportunity will be gone, too.

In a statement provided to the Financial Times, Lauria, said: "Through vigilance and creativity, Hertz has now gotten the opportunity to turn things around a bit. If successful, it may be able to reinforce its balance sheet by actually capitalizing on the truly extraordinary set of circumstances that have followed in the wake of COVID-19."

By the "extraordinary circumstances," Lauria meant the epic bubble euphoria unleashed by the Fed's recent actions, which sent stocks soaring by a record 40% in the past three months before the euphoria fizzled modestly on Thursday, and which has sent retail investors into a panic scramble to buy any stock that goes down with zero regard for fundamentals...just as the Fed intended.

Naturally, the newly formed committee of unsecured creditors was fully supportive of the share sale, since the new capital would rank lower than even unsecured liabilities, and all the money raised from Robinhooders would go straight into creditors' pockets.

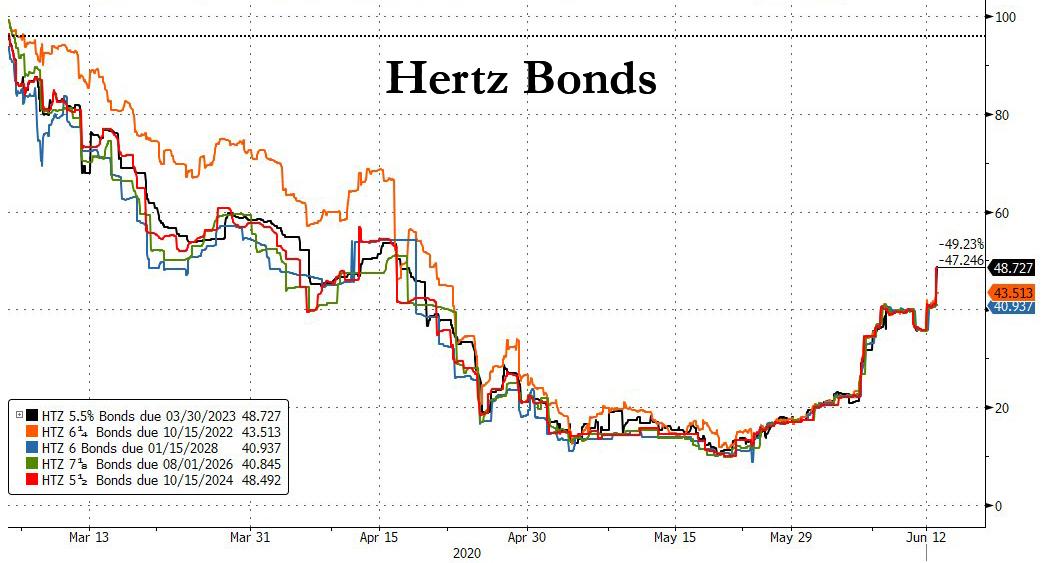

Yet, even as Hertz' unsecured bonds naturally jumped on the news that the company could proceed with this first-ever "Initial Bankruptcy Offering," with the most actively traded bonds, the 5.5% notes due 2024, rising 12.5 cents to 48.5 cents on the dollar and five other Hertz bonds traded up by at least 5 cents on the dollar Friday afternoon, the creditors - those who know what the true value of the company is based on actual facts and data - still kept the $4 billion in non-auto ABS bonds below 50 cents on the dollar, suggesting a more than $2 billion impairment and confirming that the equity will be worthless, something which everyone - including the bankruptcy court judge - knows, yet nobody on Robinhood seems to be aware of.

Instead, having pushed the market cap of HTZ stock back to $400 million in market cap, the Robinhooders are effectively saying that none of the bonds will be impaired and will get a par recovery. Apparently, nobody told the creditors this.

Maybe Robinhood should just open up its platform to allow its Gen-Z userbase to also buy corporate debt: in that case the Fed would never have to buy another junk bond every again as every single fixed income asset would be trading limit up.

"The equity raise is mind-boggling to me,” said David Skeel, a professor of bankruptcy law at the University of Pennsylvania. “I’ve never heard of a firm selling more stock in the middle of a bankruptcy case — it seems like a naked ploy to take advantage of an irrational movement in the market."

Skeel is right: the opportunistic Hertz "offering" of worthless stock is nothing more than a "naked ploy to take advantage" of gullible investors who have been sent into a buying frenzy by none other than the Fed, and since there is only a small window of opportunity in which the company can capitalize on this some would argue rational exuberance - after all it is greenlit by the Fed itself, which admitted last week it would never burst a bubble if it means losing even one low paying job - Hertz will rush to get this deal done as soon as Monday morning.

And since all those retail investors who will be allowed to participate in the offering will lose their money, one wonders just what is the purpose of the SEC if not to protect the most gullible investors from self-admitted, professional opportunists who are taking advantage of the froth in the market.

One final point: as Tesla Charts points out, by approving the Hertz offering, the US Bankruptcy Court has now opened a can of worms whereby any company that is about to file for bankruptcy (or is already bankrupt), but has been swept up in the Robinhood buying frenzy, will try do the same and dump billions in stock to retail daytraders in hopes of boosting cash levels, even if it means a total loss for all those who participate as long as there is a large, red disclaimer in the offering warning that the shares you are about to buy are worthless.

Board members at $CHK,

— TC (@TESLAcharts) June 13, 2020

Before filing for bankruptcy, do an at-the-market offering of all unissued stock from your latest shelf registration. In the prospectus, spell out your intent to file, and make clear the shares you are selling are essentially worthless.

You’re welcome,

TC

Disclaimer: TM Editors Note: This article discusses one or more penny stocks and/or microcaps. Such stocks are readily manipulated; do your own careful due ...

more