Gold’s Cyclical Bull Run Isn’t Over Just Yet

A vaccine is unlikely to end gold’s cyclical bull run in 2021. Rising inflation expectations, lower real yields, a weaker dollar and a likely recovery in physical demand from some major emerging market consumers should see gold moving higher in 2021.

Gold (GLD) has had a remarkable run this year, with spot prices trading at an all-time high, as investors turned to safe-haven assets amid the growing uncertainty of COVID-19.

Falling yields only pushed gold prices higher over the year, with 10-year US Treasury yields falling to a low of almost 50 basis points, while real yields have remained firmly in the negative territory since late March, increasing the attractiveness of gold.

While rising inflation expectations amid further stimulus packages should be supportive for gold, vaccine news has led to a sharp downward correction in gold prices. This is despite the fact that the USD has traded lower, whilst both five-year and 10 year real yields have weakened. Clearly, this more recent correction in gold has been a result of asset rotation, with the latest COVID-19 news increasing investor appetite for risk assets. This is evident when looking at the copper/gold ratio, which has rallied to more than a year high (JJC).

Much of the short-term view for gold will depend on the timing and scale of a US stimulus package, along with how the roll-out of vaccines progress in the coming months. Although a vaccine is on the horizon, the reality is that we see a double-dip in some economies, given the latest waves of lockdowns. As our rate strategists have noted, a re-elevation in macro angst at the turn of the new year and well into the first quarter of next year could act as a drag on market rates. We doubt there would be enough to pull the 10-year down to 50bps, but a pullback to the 75bps area is conceivable. Should this timing coincide with a stimulus package, this should be enough for another leg higher in gold prices.

In the medium term, our rates team is expecting a modest rise in US treasury yields into 2021; however, inflation expectations are likely to outstrip the rise in nominal yields, therefore we should see further weakness in real yields, which supports our constructive view on gold in the medium term. The expectation of further stimulus, the unleashing of pent-up demand once COVID-19 is under control, and the expectation of higher oil prices in 2021 supports the view of rising breakeven inflation over the course of next year.

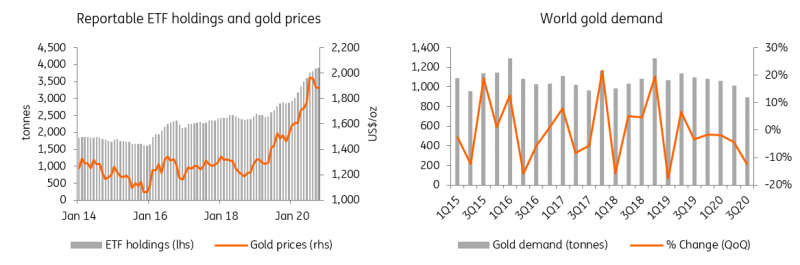

In 2020, financial demand continued driving the bull run, and ETF buying has been a prominent driver for gold. Total known ETF holdings of gold increased to a fresh high of 3,899 tonnes by the end of October 2020, compared to 2,877 tonnes at the end of 2019. However, physical demand for gold has been hit hard by lockdowns. Limited international flights, along with restrictive measures on imports of foreign goods, pushed gold imports in China and India to multi-year lows, especially during the first half of the year.

It is also true that physical demand in these key regions is also counter-cyclical, as consumers are price-sensitive, so higher prices this year would have dented consumer demand. Data from the World Gold Council shows that gold demand dropped 10%YoY to 3,304t over the first three quarters of the year. While demand in the last quarter of this year has begun to show signs of recovery, it still remains below pre-pandemic levels. Pent-up demand is likely to push up physical demand firmly in 2021, as consumers return to the market, especially for festival and marriage demand. While higher prices might deter some consumers, government stimulus and an increase in disposable income are likely to provide enough liquidity for consumers to increase gold purchases.

Strong investment demand partly offsets weaker consumer demand

Source: LBMA,WGC,ING

While vaccine developments have proved to be a stumbling block for gold prices, we continue to see upside over 2021. Rising inflation expectations, lower real yields, expectations for a weaker USD and a recovery in physical demand should prove supportive.

ING forecasts

Source: ING Research

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more