“Golden Troubles”: A Breakdown

As was emphasized yesterday (Apr. 14), gold’s most recent small upswing is nothing more than a correction in a medium-term downtrend.

It’s time for a recap and to mention all the important factors that are playing a role in indicating weakness in the yellow metal and what the incoming weather spells for the precious metals.

What a boring week… One might say that about the precious metals market, and they wouldn’t be far from the truth. However, just because the week didn’t feature spectacular price moves, doesn’t mean that we didn’t get any clues. Even during yesterday’s (Apr. 14) practically non-existent price movement, we saw a subtle indication of what’s likely to happen next.

This indication comes from the relative performance of gold, silver, and mining stocks. The thing is that there’s a kind of performance that is specific to the precious metals market that one can observe at the tops. It’s the day when mining stocks underperform gold, while silver outperforms it.

To be clear, we don’t really see short-term weakness in mining stocks right now. We don’t see their strength either – they’re performing normally. However, the context here is the relentlessly rallying general stock market, which often exerts pressure on miners’ prices. If miners were truly neutral now, they would still be showing some strength relative to gold due to the stock market’s strength. So, their “average” or “normal” performance compared to gold is not necessarily such.

So, the miners’ relative weakness is there, it’s simply not visible at first sight.

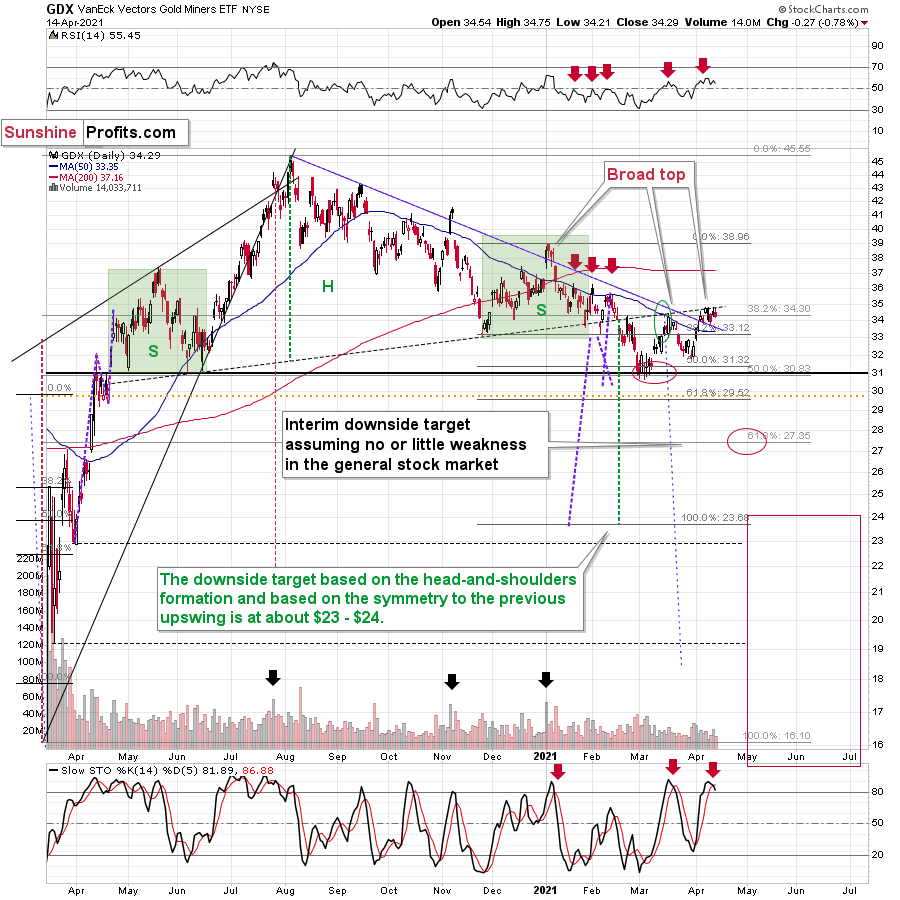

Technically, nothing really changed yesterday – the sell signal from the stochastic indicator simply became more visible. Please keep in mind that there were two similar situations with regard to the shape of the top and the stochastic’s sell signal: in mid-March and in early January.

This is important in light of what’s happening in gold.

Gold – A Deceptive Rally

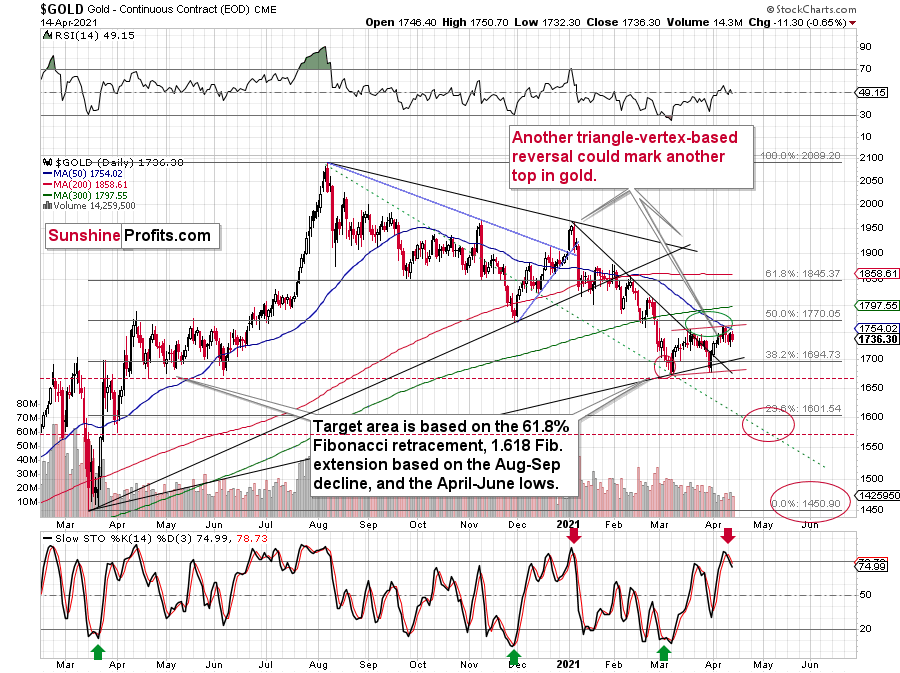

In the case of the yellow precious metal, we see only one similarity – and it’s the one for the situation in early January. The sell signal from the stochastic indicator based on gold is now clearly visible and it now moved back below the 80 level. This was the case in early January.

Moreover, please note that the January top was preceded by approximately a monthly rally. Last week’s top (gold topped last Thursday, right at its triangle-vertex-based reversal point) was also preceded by approximately a monthly rally. It was not as big as the one that we saw in December 2020, but it took as much time. And time is more important than price.

Besides, if gold was to remain symmetrical in its performance compared to the April – June 2020 performance, it couldn’t rally much higher. Consequently, my comments from yesterday are more (they were confirmed) than up-to-date:

Gold topped right at its triangle-vertex-based reversal, just like it did in mid-March and in early January (please note the points that are marked on the above chart for confirmation – they are described in red). That happened on Thursday (Apr. 8), and since that time gold has continued to move lower.

Gold invalidated the breakout above its mid-March highs, proving that what we saw was nothing more than just an ABC (zigzag) correction within a bigger downswing. The moves that follow such corrections are likely to be similar to the moves that precede it. In this case, the move that preceded the correction was the 2021 decline of over $150. This means that another $150+ decline could have just begun.

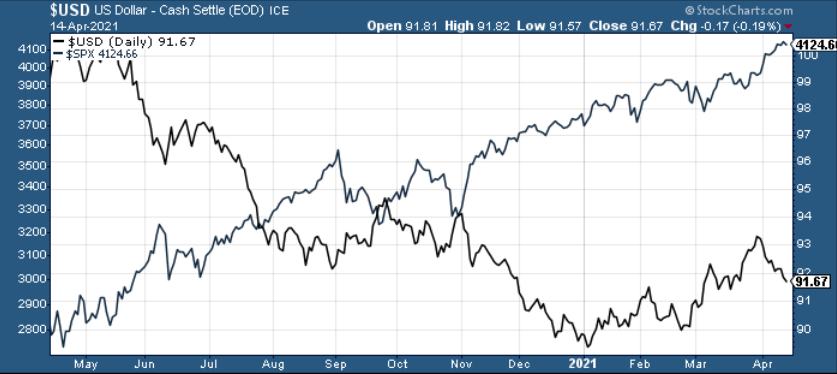

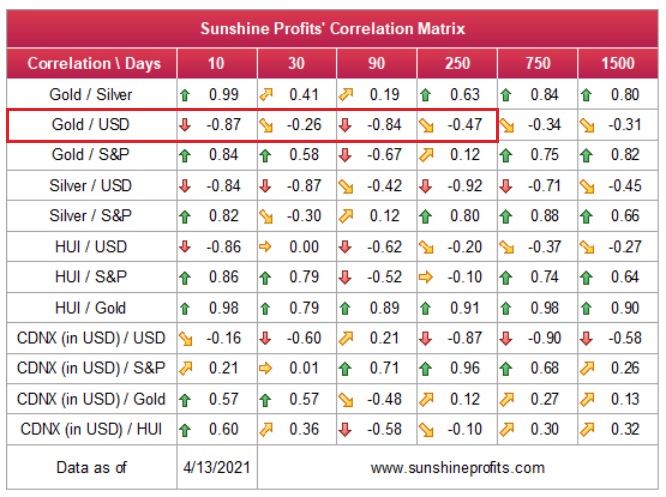

It might appear bullish that gold rallied yesterday (Apr. 13), but it only appears this way until one compares this rally with what happened in the USD Index during the same time. Paying attention to today’s (Apr. 14) pre-market price moves further emphasizes the fake nature of yesterday’s rally in gold.

And speaking of the USD Index, let’s take a look at its recent price movement.

The USD Index – Monthly Lows

In yesterday’s analysis, I commented on it in the following way:

During yesterday’s session, the USD Index moved to new monthly lows and this decline continued in today’s pre-market trading. Consequently, if gold was at least reacting to the USD’s movement “normally”, it should move to new monthly highs. If gold “wanted” to rally, it would have likely exploded to the upside. But what happened instead? Gold moved higher only somewhat yesterday – not to new monthly highs – and in today’s pre-market trading it’s actually slightly lower.

This tells us that gold “wants” to move lower now.

The USD Index moved lower, and it can move even lower on a very short-term basis, perhaps to the 50% Fibonacci retracement based on the entire 2021 rally, and the previous lows. And what would be the likely effect on gold? Based on what we saw yesterday, and what we see so far today, it seems that gold will likely ignore this decline in the USD Index, while waiting for the latter to finally show strength – so that it (gold) could decline.

After all, gold has already topped right at its triangle-vertex-based reversal point. Consequently, it’s no wonder that it now continues to trade sideways, waiting for a trigger to move much lower.

Moreover, please note that the recent zigzag makes the situation similar (approximately symmetrical) to what we saw about a year ago – between April and early June. Once gold breaks to new yearly lows, one could view this as a breakdown below the neckline of a major head and shoulders pattern where the April 2020 – June 2020 and the recent consolidations are the shoulders of the pattern. Based on such a pattern, gold would be likely to slide profoundly, probably well below $1,500. And the relative performance of gold vs. the USD Index tells us that such a short-term breakdown (to new yearly lows) is a likely outcome in the following weeks.

Yesterday’s session ended with the USD Index lower, and gold closed lower as well. Gold is moving higher today (Apr. 15), while the USDX is slightly lower once again. Overall, the bearish implications remain intact. Gold continues to do nothing as the USD Index is forming or finding a bottom. Once it rallies back up, gold would be likely to fall, and it seems that’s what it wants to do anyway.

The USD Index just reached its February highs and its right between the 38.2% and 50% Fibonacci retracement level. This means that it can rally right away, or after declining a bit more (to the 50% retracement). However, this is not the key thing right now. The key thing is that gold doesn’t want to respond to a declining USDX, so even if the latter continues to move lower, the best course of action for gold – in my opinion – would be to simply wait it out. It will find a bottom eventually (again, that’s likely to happen shortly) and then gold will slide anyway. Since the yellow metal is unlikely to rally in any visible way in the meantime, the outlook for it remains bearish.

A Short Word About Silver

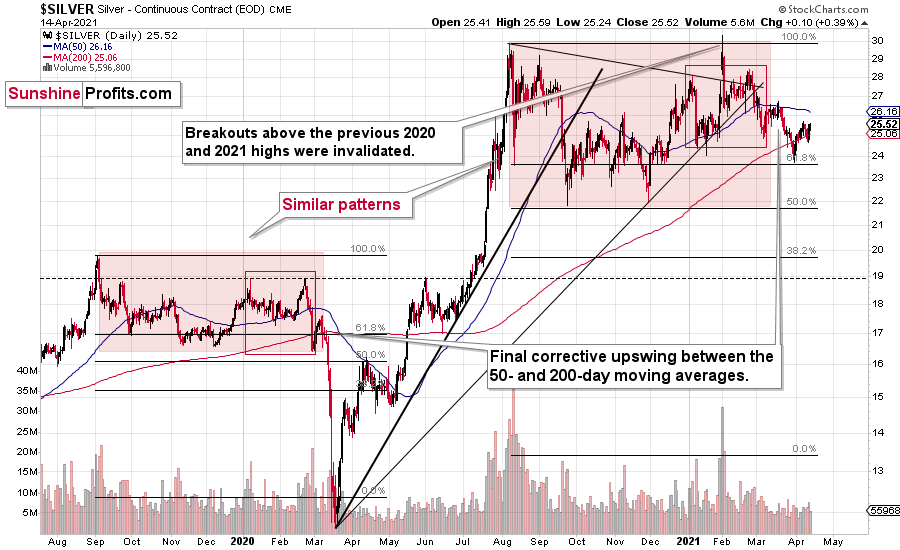

In the opening part of today’s analysis, I also wrote about silver’s short-term outperformance of gold being a bearish indication for the PMs.

While gold and gold stocks declined yesterday, silver moved (slightly but still) higher yesterday. So, this subtle confirmation is also present.

Consequently, the outlook for the precious metals market remains bearish.

Having said that, let’s take a look at the market from a more fundamental angle.

Bond Yields - Hiding in Plain Sight

With the USD Index’s strong relative fundamentals suppressed by investors’ ‘risk-on’ rhetoric, the greenback has become akin to insurance.

In a nutshell: why own the U.S. dollar when EVERYTHING is perfect?

In the very short-term, investors often create their own reality. And with nearly every risk metric suppressed by the U.S. Federal Reserve’s (FED) excess liquidity – when other markets are bidding up the highest-risk assets, why shouldn’t currency traders?

Well, for one, investors only notice the waterfall once they reach the precipice. And if foreign markets are any indication, corporate bonds could be the canary in the coal mine.

To explain, I wrote on Mar. 24:

Because equities are at the bottom of the capital structure, they often take their cues from assets that have higher bankruptcy protection. For example, senior secured bonds have the highest priority, while in fixed-income land, high yield bonds have the lowest priority. And because additional rates of interest are meant to compensate for the excess risk, high yield bonds often have the widest corporate ‘credit spreads.’

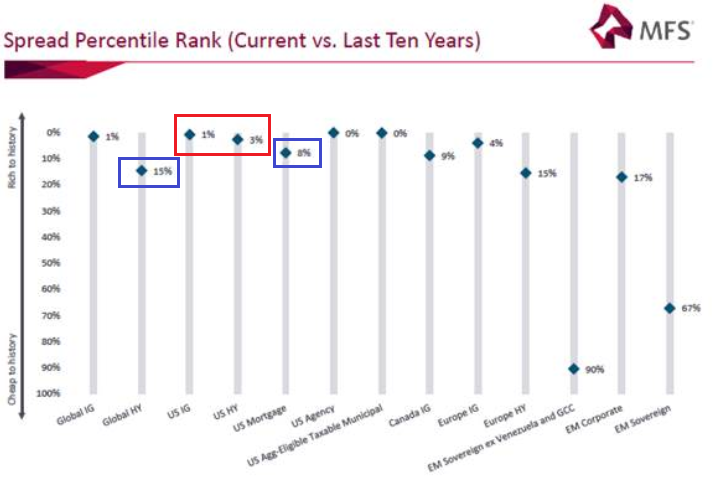

To explain, the blue diamonds above depict the percentile rank of current corporate spreads relative to their 10-year history. And despite U.S. investment grade (IG) and U.S. high yield (HY) spreads being extremely low (the red box above), global high yield spreads have risen to the 15th percentile, while U.S. mortgage spreads have risen to the 8th percentile (the blue boxes above).

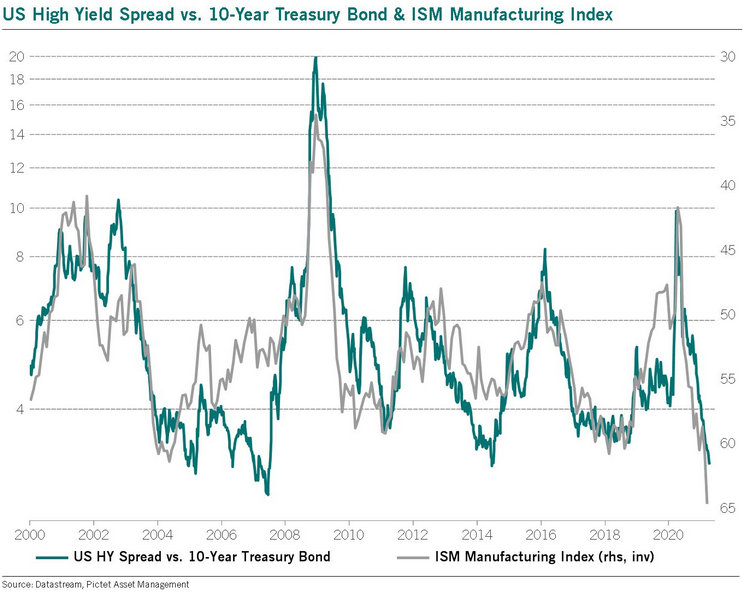

Thus, while we can see that U.S. high yield spreads are near their all-time low, a rapid rise could eventually shake equities’ foundation. Case in point: at 64.7%, the Institute for Supply Management’s (ISM) Manufacturing PMI has risen for 10-straight months and has only been higher 5% of the time over the last 70 years. More importantly, though, a peak in the ISM Manufacturing PMI often results in a bottom in U.S. high yield spreads.

Please see below:

To explain, the blue line above tracks the U.S. high yield spread, while the gray line above tracks the inverted ISM Manufacturing PMI. For context, inverted means that the latter’s axis is flipped upside down and that a falling gray line represents a rising ISM Manufacturing PMI. And if you focus on the peaks and valleys, you can see that a historically high ISM Manufacturing PMI often coincides with a historically low high yield spread. More importantly though, when the ISM Manufacturing PMI begins to roll over, the shock often coincides with a rising high yield spread, equity-market stress, and a rising USD Index. Thus, with the current reading at a more than 20-year high, a reversion to the mean could result in a drastic shift in asset allocation.

As further evidence, despite U.S. investors’ belief that corporate bonds are ‘risk-free,’ Asian investment-grade spreads have already decoupled.

Please see below:

Source: Patrick Perret-Green

To explain, the white line above tracks the U.S high yield option-adjusted spread (OAS), while the orange line above tracks the Asian investment-grade OAS. If you analyze the right side of the chart, you can see that the orange line has made a noticeable move higher in 2021. And while the white line continues to move lower, the former’s rerating could be an early warning sign.

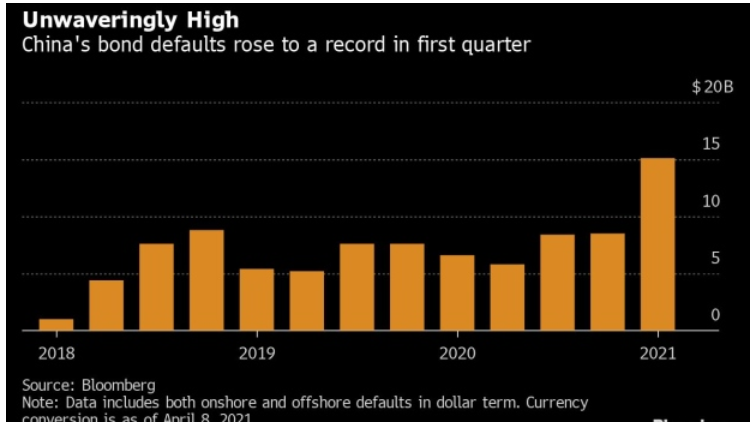

Headlining the Asian jitters, corporate bond defaults are surging in China. In the first quarter of 2021, delinquencies were the highest on record.

Please see below:

Moreover, with corporate bond defaults occurring alongside record-low interest rates and record-low credit spreads, what’s likely to occur if we see a material uptick in both?

Source: Bloomberg

The bottom line?

Risk happens fast. And with stress in the corporate bond market often a precursor to stress in the equity market, an awakening of both could propel the USD Index well above 94.5.

The EUR/USD

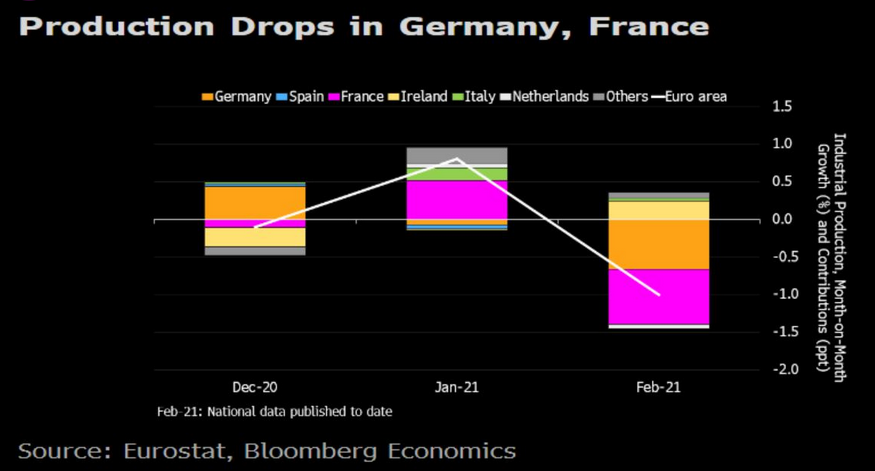

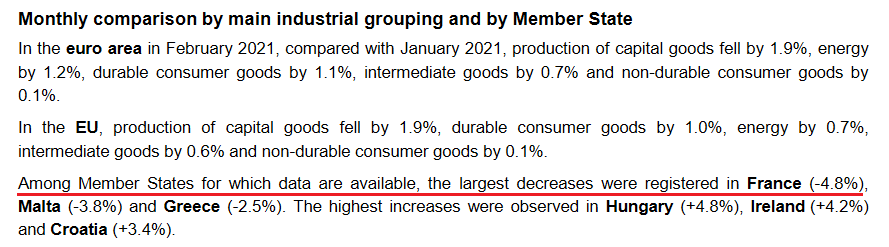

In addition, the EUR/USD – which accounts for nearly 58% of the movement of the USD Index – has been the main driver of the latter’s recent swoon. And while the currency pair continues to diverge from weak economic data, the fundamental axe continues to chop away. Case in point: released on Apr. 14. Eurozone industrial production declined by 1% month-over-month (MoM) – rolling over again in February.

Please see below:

Even more revealing, despite being heralded as the Eurozone’s bellwether of 2021 GDP growth, Europe’s second-largest economy actually led the decline.

Source: Eurostat

If that wasn’t enough, Reuters revealed on Apr. 14 that Germany’s economic institutes will reduce their 2021 GDP growth forecast for Europe’s largest economy from 4.7% to 3.7%. However, in typical hope-vs.-reality fashion, the groups’ pacified the downgrade by upgrading their 2022 GDP growth forecast.

Please see below:

Source: Reuters

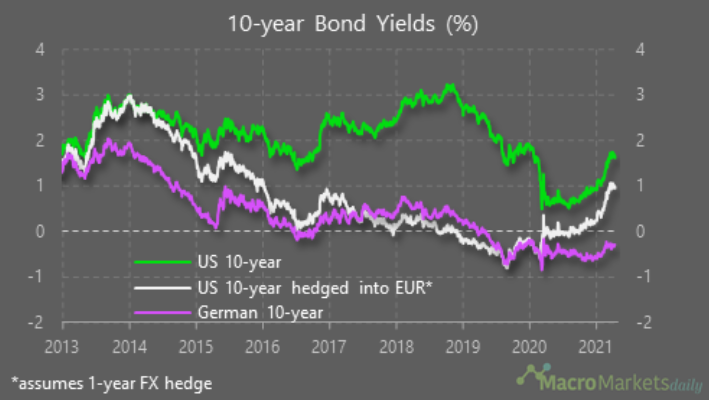

Adding to the irrationality, I mentioned previously that higher interest rates are a precursor to a stronger currency. And while the relative outperformance of the U.S. 10-Year Treasury yield versus the German 10-Year Bond yield has been well documented, the currency-hedged yield differential also supports a weaker EUR/USD.

Please see below:

To explain, the purple line above tracks the German 10-Year Bond yield, while the green line above tracks the U.S. 10-Year Treasury yield. Most interesting, the white line above tracks the currency-hedged U.S. 10-Year Treasury yield. If you analyze the right side of the chart, you can see that a German 10-Year Bond offers a – 0.29% yield. However, if European investors were to convert their euros to U.S. dollars, hedge their currency exposure with a one-year futures contract and invest the funds in the U.S. 10-Year Treasury yield, they would earn an effective yield of 0.95%. Thus, not only do U.S. Treasuries offer a higher return for U.S. investors, but they also offer a higher return for European investors.

The bottom line? Once the EUR/USD more accurately reflects its fundamental value, a rising USD Index will likely elicit an adverse reaction from gold.

Inflation or Deflation?

Moving on to another important topic, much has been made about inflation and its potential impact on the PMs. Are we headed toward an inflationary environment? A deflationary environment?

Well, contrary to popular opinion, both are actually relatively bearish for the PMs. Regarding the latter, deflation reduces the value of real assets, so commodities like gold and silver are likely to underperform. Conversely, while an inflationary environment elicits the most debate, it’s important to remember that rising inflation is a precursor to higher interest rates. And due to the heighted volatility experienced across the bond market, rising inflation often results in nominal yields increasing at a faster pace.

And why does all of this matter? Because the reaction function gives way to a higher real yield.

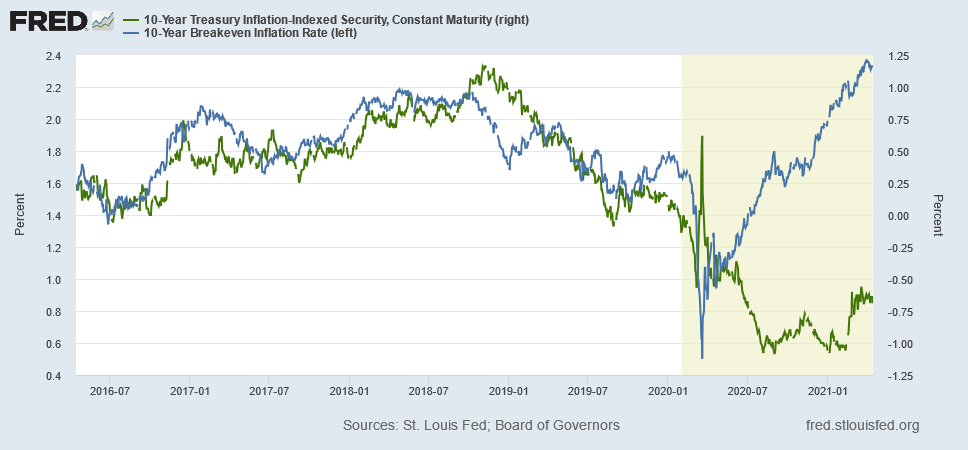

To explain, please have a look at the chart below:

If you analyze the right side of the chart, notice how the U.S. 10-Year breakeven inflation rate (the blue line) had completely decoupled from the U.S. 10-Year real yield (the green line)? What this means is: with the blue line rising and the green line falling, the U.S. 10-Year breakeven inflation rate was rising at a faster pace than the U.S. 10-Year Treasury yield (the nominal yield). As a result, with the real yield moving sharply lower, the summertime development unsurprisingly coincided with gold making a new all-time high.

In stark contrast, notice how the green line has moved sharply higher in 2021?

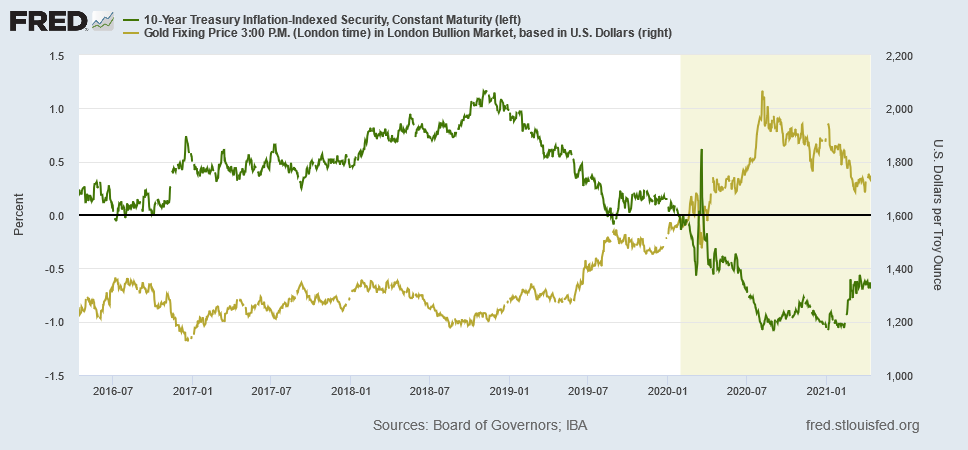

With the blue line also rising, it means that the U.S. 10-Year Treasury yield (nominal) is increasing at a faster pace than the U.S. 10-Year breakeven inflation rate. And unsurprisingly, it’s no coincidence that gold has suffered mightily ever since. Case in point: notice how gold and the U.S. 10-Year real yield have a strong negative correlation?

As you can see, the U.S. 10-Year real yield’s summertime bottom coincided with the yellow metal’s top. Moreover, following some consolidation during the back-half of 2020, the U.S. 10-Year real yield’s material rise since the New Year has only accelerated gold’s drawdown.

And is this likely to continue?

Well, with more and more companies mentioning the term “inflation” during their corporate earnings calls, the talk of the town may end being a self-fulfilling prophecy. To explain, I warned on Apr. 13 that another bout of interest rate volatility could be on the horizon.

I wrote:

While U.S. CPI has remained relatively dormant, all other measures of inflation continue to skyrocket. For example, the Commodity Producer Price Index (PPI) – which was released on Apr. 9 – surged by 3.7% in March, the largest month-over-month (MoM) percentage increase since July 1974. Moreover, in only one month, the cost of fuel, power, petroleum, industrial chemicals, iron and steel increased by more than 10%, while the cost of lumber increased by more than 7%.

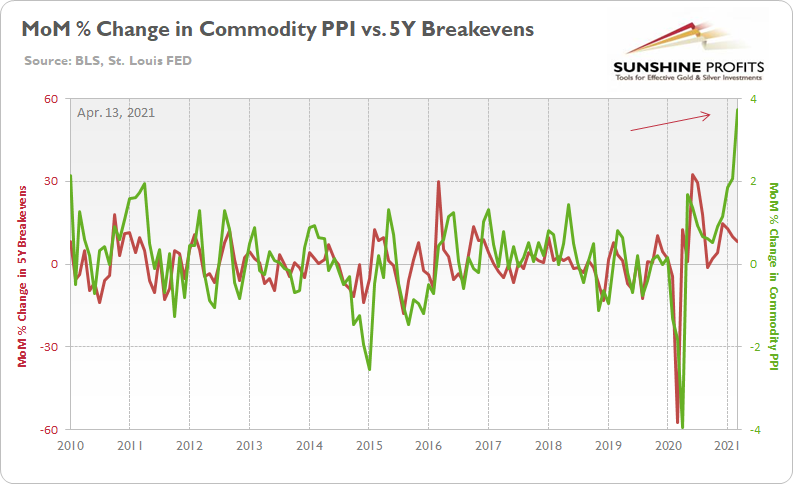

More importantly though, notice the close connection between commodity PPI and the U.S. 5-Year breakeven inflation rate?

To explain, the green line above tracks the MoM percentage change in commodity PPI, while the red line above tracks the MoM percentage change in the U.S. 5-Year breakeven inflation rate. If you analyze the right side of the chart, you can see that commodity PPI has completely decoupled from the U.S. 5-Year breakeven inflation rate. As a result, where do you think the U.S. 5-Year breakeven inflation rate is headed next?

Thus, with input costs already surging – highlighted by the commodity PPI reading above – corporations have two options:

- Absorb the excess costs and accept lower profit margins

- Pass the excess costs on to the consumer by increasing the price of their finished goods

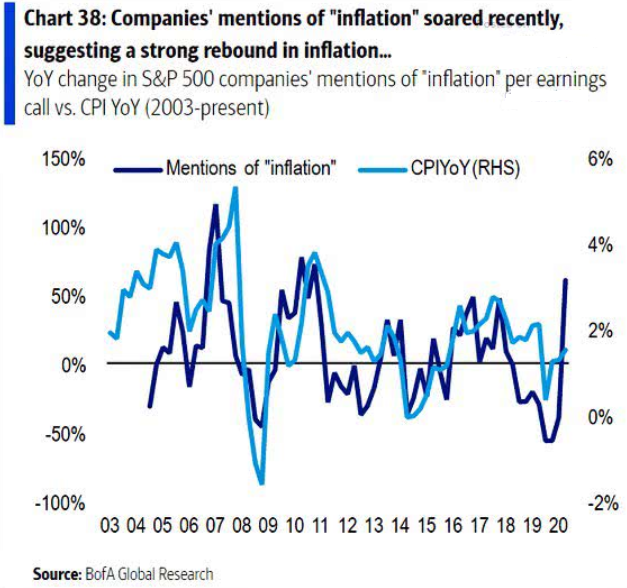

And which one do you think they’ll choose? Well, if you analyze the chart below, it’s abundantly clear:

To explain, the dark blue line above tracks the year-over-year (YoY) percentage change in executives’ mentions of “inflation” during their corporate earnings calls, while the light blue line above tracks the YoY percentage change in core CPI (which excludes food and energy). As you can see, when executives begin mentioning “inflation” it doesn’t take long for price hikes to find their way into the real economy.

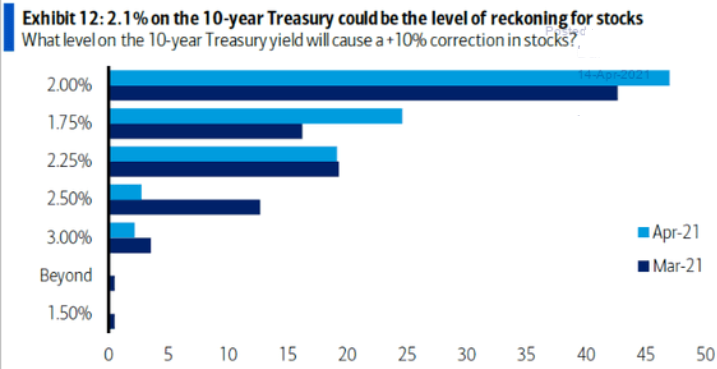

Furthermore, notice how nearly 50% of respondents to Bank of America’s Global Fund Manager Survey revealed that a U.S. 10-Year Treasury yield at 2% could cause a 10%+ correction in U.S. equities (with ~25% also responding that 1.75% would spark a 10%+ sell-off)? Thus, if this were to occur, the cascading effect could place even more downward pressure on the PMs.

Source: Bank of America

In addition, notice how the Cboe Interest Rate Swap Volatility Index (SRVIX) still suffers from extreme anxiety? For context, the SRVIX quantifies volatility in the expected forward swap rate (a future interest rate that investors can lock in today). And with the gauge moving higher in recent days and now only 9.6% below its March 2020 high, the coming months could elicit plenty of fireworks.

In conclusion, the PMs’ trepidation was on full display on Apr. 14, as a retreating USD Index wasn’t enough to propel the metals’ higher. Moreover, with the slightest jump in the U.S. 10-Year Treasury yield causing the PMs’ gains to disappear, what’s likely to happen when their main adversaries eventually hit their stride? Thus, until the PMs regain their mojo, and rally in spite of a rising USD Index and U.S. 10-Year Treasury yield, any short-term momentum is likely a correction within a medium-term downtrend.

So, to summarize:

- Gold’s short-term rally is deceptive. If gold really had the strength to move up, it would have risen much higher on account of the USDX’s apparent weakness.

- The USDX made new monthly lows. It’s currently finding a bottom, and from there it will gather steam and press ahead…upwards.

- Silver outperformed both gold and the miners, which is actually bearish.

- Stress in the corporate bond market is often a precursor to stress in the equity market, which could propel the USDX forward.

- The fundamentals in the EUR/USD currency pair point to troubles ahead for the euro, which will only mean the USD’s strength.

- Rising inflation is a precursor to higher interest rates, which is bearish for the precious metals.

Disclaimer: All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be ...

more