Gold In Q1: Price Softens, But New Catalysts Emerge

Gold in Q1: Price Softens, But New Catalysts Emerge

The big story in Q1 was the sharp rise in bond yields, putting pressure on gold and silver prices. But as the world begins to transition from pandemic to recovery, new potential catalysts emerge for precious metals.

Our ITV report looks at the performance of precious metals and other major asset classes during the first quarter of 2021, along with a review of the conditions that are likely to impact them as the year progresses.

Gold and Silver in Q1: Spiking Yields Pressured Prices

The U.S. 10-year yield rose from 0.916% on December 30 to 1.744% by March 31. This near doubling of the benchmark bond within three months is outsized by historical standards and impacted most assets including gold and silver.

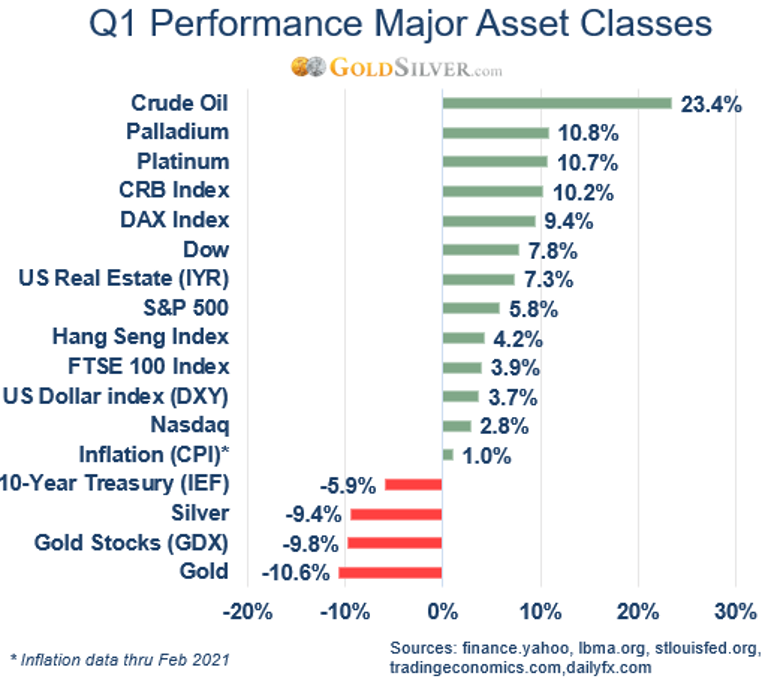

Here’s how precious metals and other major asset classes performed in Q1.

Gold declined 10.6%, ending Q1 at $1,691.05. It was gold’s worst quarterly performance since Q4-2016 and worst Q1 since 1982. Silver fell 9.4% to $24.

The US dollar rose 3.7%, while Treasuries logged their worst quarter since 1980, pushing yields sharply higher. Both of these factors put a damper on gold and silver.

Platinum and palladium were leaders last quarter, boosted by the prospects of economic recovery.

Crude oil prices saw a hefty rebound, and the commodity complex continues to show signs of strength. Broad stock markets also continued to rise, largely in response to optimism surrounding an improving economy.

Bitcoin (not shown) continued its volatile surge, rising 103.2% in the quarter.

The View for the Rest of 2021

As we start Q2, recovery efforts are picking up speed worldwide, despite some countries seeing an uptick in Covid-19 cases. President Biden announced that 90% of adult Americans will be eligible for vaccination by April 19, a goal that if met would surely impact economies and markets.

Reflation is arguably the dominant driver of current global price action. A $1.9 trillion coronavirus relief plan was approved, and a $2.25 trillion infrastructure bill is on deck. Similar measures have taken place in many advanced economies.

All this and more brings a shift to the factors that could impact markets going forward. Here’s what we’re watching that will likely have the most effect on precious metals.

Interest Rates: The size of the U.S. stimulus packages is likely to continue to push global bond yields higher, at least in the short-term. And the Fed has made clear it will maintain an easy monetary policy; according to San Francisco Fed President Mary Daly, “We still have almost 10 million people on the sidelines looking for jobs… we really aren’t projecting achieving either side of our dual mandate in 2021 and that’s why policy is remaining accommodative.”

A CNBC poll of over 100 chief investment officers, equity strategists, and portfolio managers showed that almost half cited rising interest rates as the #1 factor that could impact markets the most going forward. Over 60% believe the 10-year Treasury yield will exceed 2% by the end of 2021. Rising yields could dampen gold’s appeal, though the real interest rate is the bigger determinant.

Money supply growth hit another all-time high in February, the 11th consecutive month of remarkably high growth. The money supply grew 39.1% from a year ago, historically very large, the 1970s the only comparable period. Monetary dilution provides a strong incentive to hold monetary metals like gold and silver.

The US dollar hit a one-year high versus the yen and multi-month peaks against other currencies by quarter’s end. The dollar rose for the third consecutive month against the yen, its biggest ascent since the end of 2016. The dollar responded mostly to the surge in U.S. bond yields, currently at a one-year high.

In the bigger picture, I’ll point out that the global share of US-dollar-denominated reserves dropped to 59.0% in Q4 (IMF’s most recent data), its lowest level since 1995. The dollar’s share has dropped by a full 7 percentage points since 2014—if the current pace continued the dollar’s share would fall below 50% by the end of the decade. Precious metals prices are inversely correlated to the U.S. dollar and are thus excellent hedges against dollar weakness.

Inflation: Most economists and investors anticipate some level of higher inflation, due to a myriad of factors, most of which picked up steam in Q1.

Shortages, stockpiling, supply chain bottlenecks, and some continued Covid-19 restrictions all contributed to increased costs. Kimberly-Clark, J.M. Smucker, and General Mills all announced plans to hike prices.

Meanwhile, U.S. manufacturing expanded at the fastest pace since December 1983. The Purchasing Managers Index hit its highest reading since the survey began in 1997. Factory activity in the Eurozone also grew at its fastest monthly pace in nearly 24 years.

Chinese exporters are raising prices too, due to higher raw-material costs and supply-chain constraints. Prices for U.S. imports from China rose 1.2% over the past year, the fastest increase since 2012 according to the Bureau of Labor Statistics. Shipping rates have climbed roughly 90% since last June, pushing some Chinese exporters to raise prices for new orders by 10% to 15% just since the beginning of March.

And as most investors know, commodity prices have surged. Many are up double-digits over the past year, with lumber prices up triple digits. Some businesses report they have little choice but to pass the higher costs on to customers; according to the National Association of Home Builders, soaring lumber costs have added more than $24,000 to the price of a new home in the U.S.

It seems inevitable consumer price inflation will climb this year—if so, investors are bound to look for hedges, gold and silver being obvious choices.

Housing Trend: US home prices surged by 11.2% vs. a year ago, the biggest increase since the peak in 2006 (based on January’s National Case-Shiller Home Price Index)

One factor in determining if this trend continues is home availability. According to the National Association of Realtors, there were only 1.03 million homes for sale at the end of February, the lowest level since 1982. Above-average demand may thus continue for a while, but soaring home prices makes the market increasingly vulnerable, which gold can hedge.

Higher Taxes: While a political hot potato, President Biden proposed increasing the U.S. corporate tax rate from 21% to 28%. If adopted company profits would be impacted. It would also affect multinational companies, as it would be harder to qualify for federal tax deductions based on payments to certain foreign governments. Gold can hedge the impact higher taxes would have on stocks and even entire industries that might see lower profit margins.

Silver Outperformance: Part monetary metal like gold, but also an industrial metal whose uses will climb in the infrastructure and clean-energy spending plan proposed by Biden, this dual role could push it to advance more than gold. It’s noteworthy that despite a more volatile metal, silver fell less than gold in Q1.

The gold/silver ratio (gold price divided by silver price) ended Q1 at 70; despite the decline from its record high of 123 a year ago, the ratio is still 22% above its long-term average of 55, showing it remains undervalued relative to gold. The ratio fell to 32 in 2011.

Black Swans: The environment remains ripe for an unforeseen event. Potential candidates include unexpected delays with the vaccine rollout, a surge in Covid variants, and a stock market or real estate reversal. Another shock to the global economy would underscore the importance of gold’s hedging abilities.

The Hard Asset Hedge

The current circumstances of runaway money supply growth, rising inflation expectations, and ongoing fiscal stimulus plans creates an ideal scenario for gold.

The most likely scenario for the remainder of 2021 is one where gold and silver continue to offer meaningful and necessary hedges, along with the distinct possibility of record-high prices.

We recommend investors continue to accumulate precious metals in the current environment, one that seems increasingly vulnerable to financial, market, and monetary threats.