Gold: Fed Shutting Down Its Money Supply Data Is Alarming

Hyperinflation Is Inevitable?

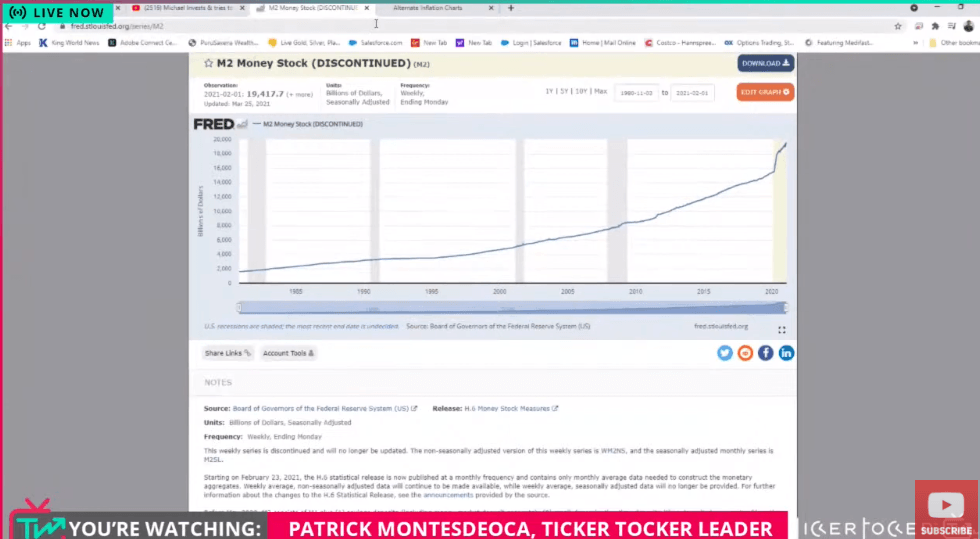

The Federal Reserve has stopped reporting its money supply data as often as money supply has significantly increased (here), making inflation a major threat. In a recent video, Michael Cowann said that the Federal Reserve has stopped recording the increase in the M1 and M2 money supply, which he said is a major crime against the American people. M1 money supply includes those monies that are very liquid such as cash, checkable (demand) deposits, and traveler's checks. M2 money supply is less liquid in nature and includes M1 plus savings and time deposits, certificates of deposits, and money market funds. As the government pumps more money into the economy, it makes your money worth less and less. The M1 supply has increased by 450% in one year and yet they say no inflation is coming. The M2 money supply is up 30% in the past year. Cowann said that a financial crisis is coming and fears that they stopped reporting the money supply because they believe they will need to produce even more money to pump into the economy. If they do that, inflation is bound to hit hard.

Courtesy: Ticker Tocker

Central banks are now saying they can increase the money supply by 500% and it won’t affect inflation and it won’t debase currencies. Cowann said, “Those are lies.” You can’t print money and not have debasement of currency and inflation. Basic economics states that fact. The government stopping public access to money supply information is extremely worrying.

Central banks can be a threat, as is happening now. By printing money, they're looting the economy. They're buying bonds, corporate debt, stocks, and other assets, which makes the billionaires wealthier and destroys the middle class. If you hold dollars, get out of them now before they lose even more value.

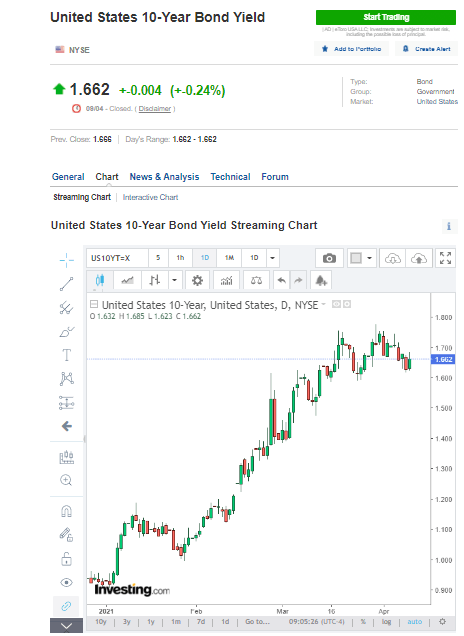

The 10-year note is starting to show inflationary tendencies. The rate is 1.660 and has reached 1.77 recently. The market is telling us in the 10-year note, which has risen from 0.51 in August 2020 to 1.660 today, that inflation is coming. Rates have tripled in just a few months.

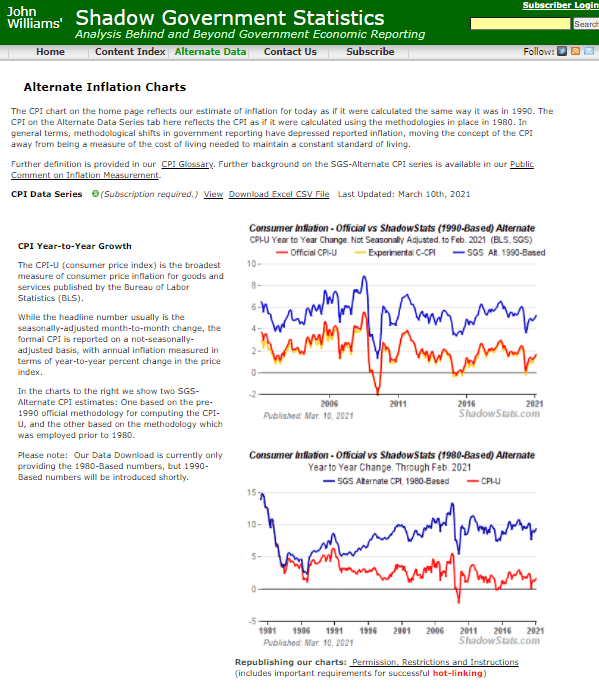

We look at Shadowstats.com for how inflation would be running if it was calculated the same way as it was in 1980. The CPI, if it was calculated using the method used in 1980, would be significantly higher than what the government says it is now. Inflation under the 1980 rate is at 6%, which is far higher than what the government says it is using its newer formula.

Inflation fears are one reason why we trade gold and silver. In August gold hit $2089 and now it has finally found a bottom, it appears. We're bullish on gold and silver for the long term. As governments print more and more money, paper currencies will lose value and precious metals will increase in value. Central bank money printing will speed the implosion of the US dollar’s value. We expect precious metals to move to the upside over the near term.

Gold and Silver

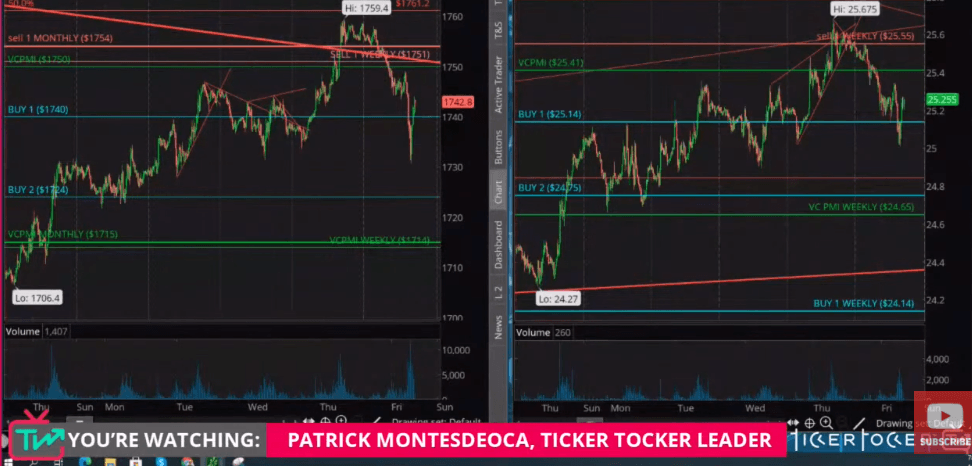

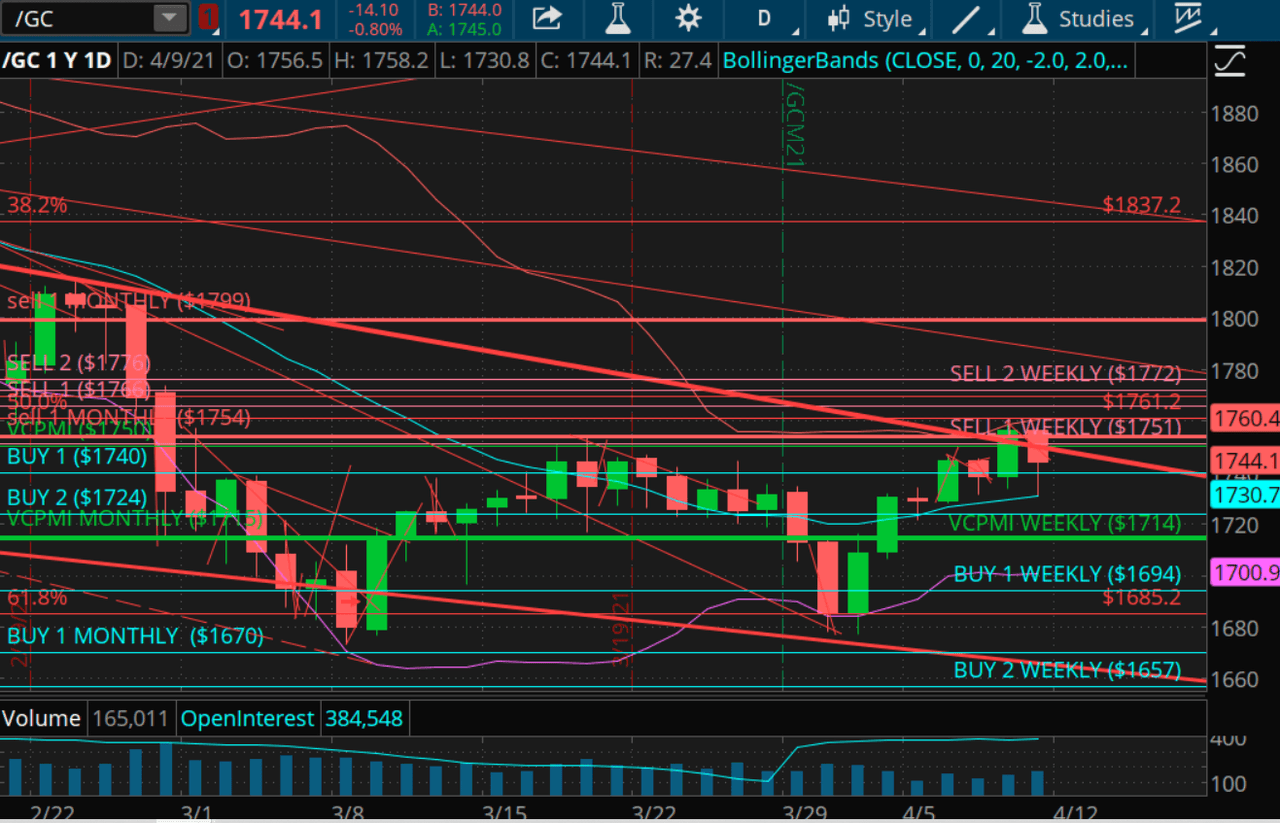

Gold and silver are reverting back up to the mean in gold of $1750. We have activated a Variable Changing Price Momentum Indicator (VC PMI) Buy 1 signal at $1740. We also have a big trigger in silver from the Buy 1 level of $25.14. It looks like we have found buyers for the supply that's being offered.

If gold trades above $1740 and then $1759, which was yesterday’s high, we're looking at the upper end of the supply zone, all the way up to $1776 as a new target.

Gold and silver are both above the VC PMI Buy 1 level. They have both activated buy triggers. We recommend that our traders in our private trading room get on the long side of gold and silver. We thought silver would come down to about $25.14 and gold into the $1740 area, which both did roughly.

Courtesy: ema2trade.com

$1677 appears to have been the bottom of this correction in gold. Closing above the VC PMI daily level of $1751 would turn that level of resistance into support. The next target for gold is $1772, which represents a weekly breakout above, and the daily Sell 2 level of $1776. Both levels could mark an acceleration area for gold if it reaches those levels. If it does, it could go all the way up to the $1800 level rather quickly or even up to $1930 before we see any Fibonacci resistance.

Courtesy: TDAmeritrade

This is an area where you want to buy gold and silver for the long term. You can day trade short on pullbacks, but our core position remains long and we are increasing those long positions in gold and silver.

Disclosure: I am/we are long GDX.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and silver, check us out on more

The only missing points...

Gold price is rigged and manipulated. Why crypto soars and have no value in fact and gold is just barely moving. Why no real numbers on physical gold and papergold and why allowing printing more than real physical.

Yes gold was a asset against inflation.

With russia getting out of usd and loading gold, gold will be banned from private as a treatous act. Take my words

The central bank people are lying, as they are prone to do. Of course they are doing that to save their skins, because they knew all along what the outcome would be. That is also why the information about how much money is being printed is now withheld.

Of course our new president has already mandated printing another 2.3 TRILLION dollars, which when it hits will dilute the value of my assets quite a bit. The result will be that I am unhappy about all of this.