Gold Approaches $1,700 On Rising Economic Confidence

Gold remains in a bearish trend as economic confidence has improved, however, inflation can change all that around.

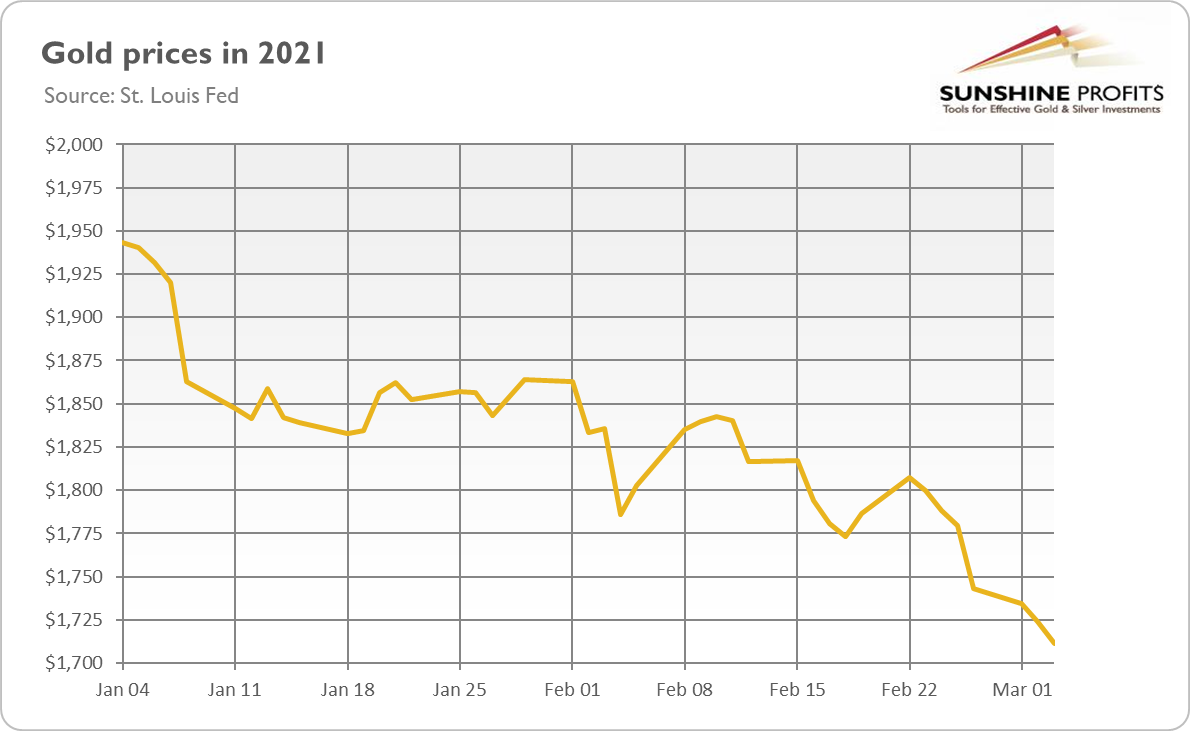

The chart presenting gold prices in 2021 doesn’t look too encouraging. The yellow metal continued its bearish trend at the turn of February and March. So, as one can see, the price of gold has declined from $1,943 on January 4 to $1,711 on Wednesday (Mar. 3) This means a drop of 232 bucks, or 12 percent since the beginning of the year.

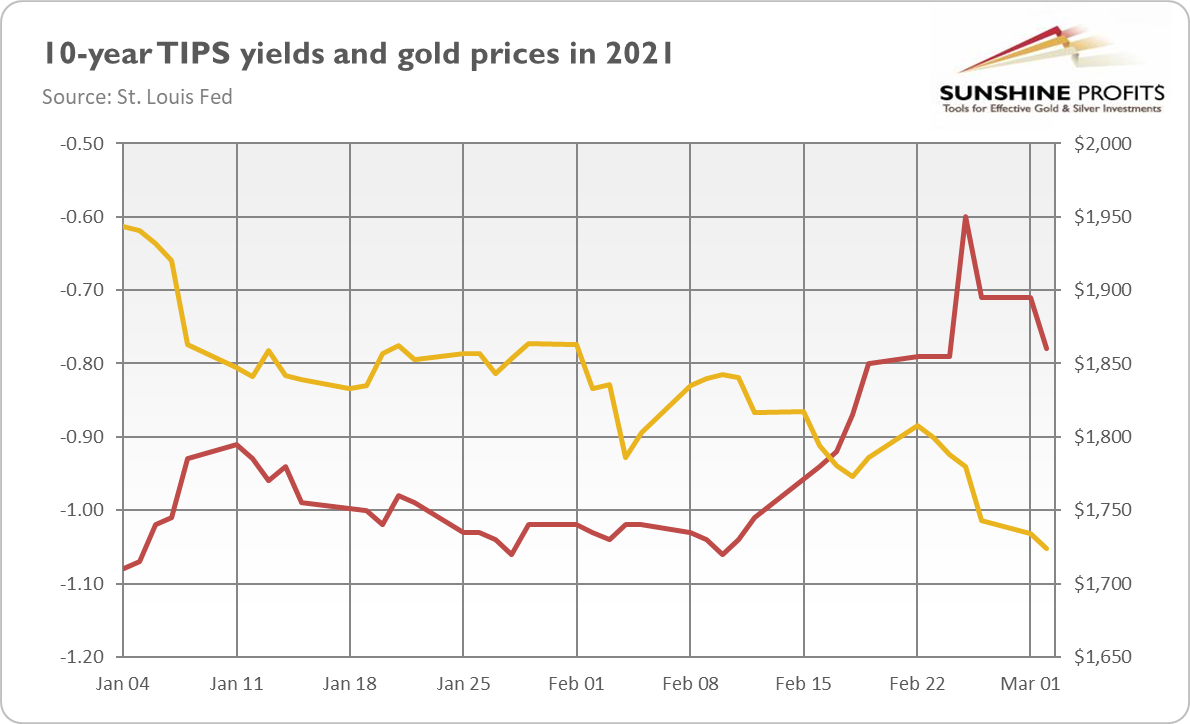

What is happening in the gold market? I would like to blame the jittering bond market and increasing bond yields, but the uncomfortable truth is that the yellow metal has slid in the past few days despite the downward correction in the bond yields. If you don’t believe it, take a look at the chart below. This is an important bearish signal, given how closely gold is usually linked to real interest rates.

So, it seems that there are more factors at work than just the bond yields. One of them is the recent modest strengthening of the greenback, probably amid rising U.S. interest rates and ECB officials’ remarks about a possible expansion of the ECB’s accommodative stance if the selloff in the bond market continues.

Another piece of bearish news for the gold market is that President Joe Biden struck a last-minute stimulus deal with Democratic Senators that narrows the income eligibility for the next round of $1,400 stimulus checks. It means that the upcoming fiscal stimulus will be lower than previously expected, negatively affecting inflation expectations and, thus, the demand for gold as an inflation hedge.

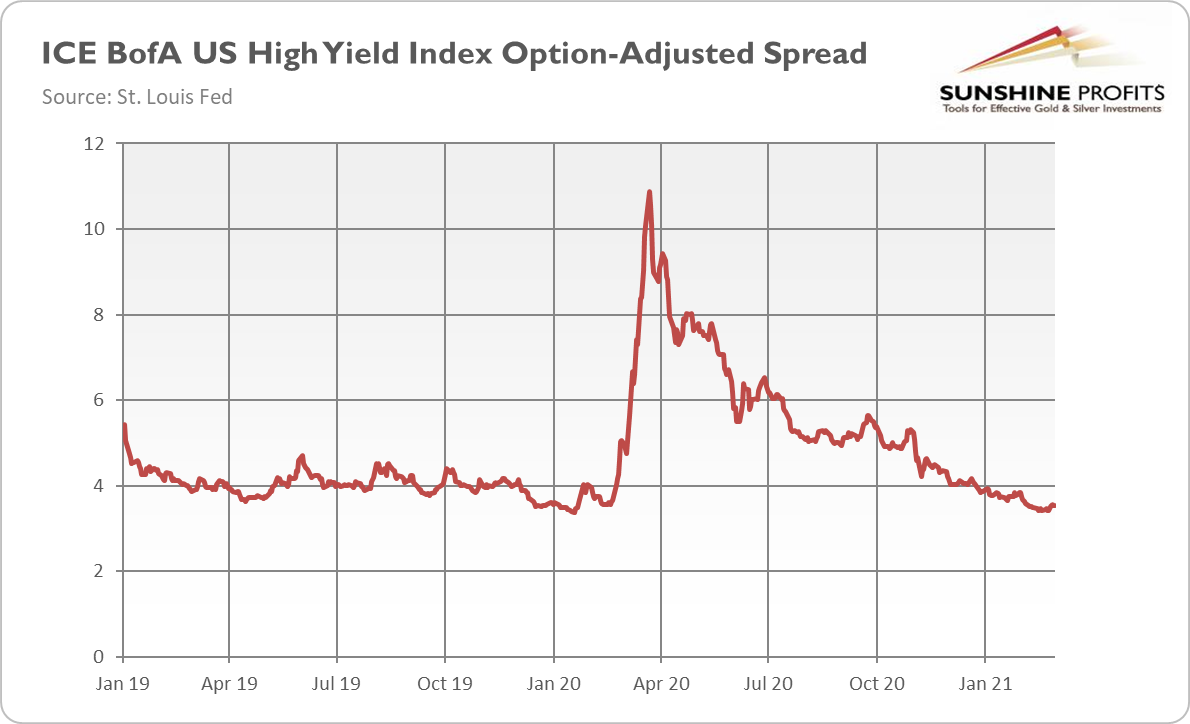

Lastly, I have to mention the high level of confidence in the economy. Indeed, the recent rise in the bond yields may just be a sign of more optimism about the economic recovery from the pandemic recession. Hence, despite all the economic problems the U.S. will have to face – mainly the huge indebtedness or actually the debt-trap – investors have decided to not pay too much attention to the elephants in the room. As the chart below shows, the credit spread (ICE BofA US High Yield Index Option-Adjusted Spread), which is a useful measure of economic confidence, has returned to the pre-pandemic level, indicating a strong belief in the state of the economy. This is, of course, bad for safe-haven assets such as gold.

Implications for Gold

What does this all mean for gold prices? Well, from the long-term perspective, the recent slide to almost $1,700 could just be noise in the marketplace. But gold’s disappointing performance is really disturbing given the seemingly perfect environment for the precious metals. After all, we live in a world of negative interest rates, a weak U.S. dollar, rising fiscal deficits and public debt, soaring money supply, and unprecedented dovish monetary and fiscal policies. So, the bearish trend may be more lasting, as market sentiment is still negative. Investors usually turn to gold, a great portfolio diversifier, and a safe haven, when other investment are falling. But the worst is already behind us, the economy has already bottomed out, so confidence in the economy is now high, and equities are rising.

Having said that, the recent jump in the bond yields also means rising inflation expectations. Indeed, as the chart below shows, they have already surpassed the levels seen before the outbreak of the pandemic.

Actually, the 5-year breakeven inflation rate has reached 2.45 percent, the highest level since the midst of the Great Recession. So, in some parts, investors are selling bonds, as they are preparing for a reflation environment marked by higher inflation. At some point, if the fear of inflation strengthens, then economic confidence will waver, and investors could again turn toward gold.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it ...

more