Global Recession "Appears Inevitable" - Guggenheim's Minerd Fears Cascading 'Butterfly Effect'

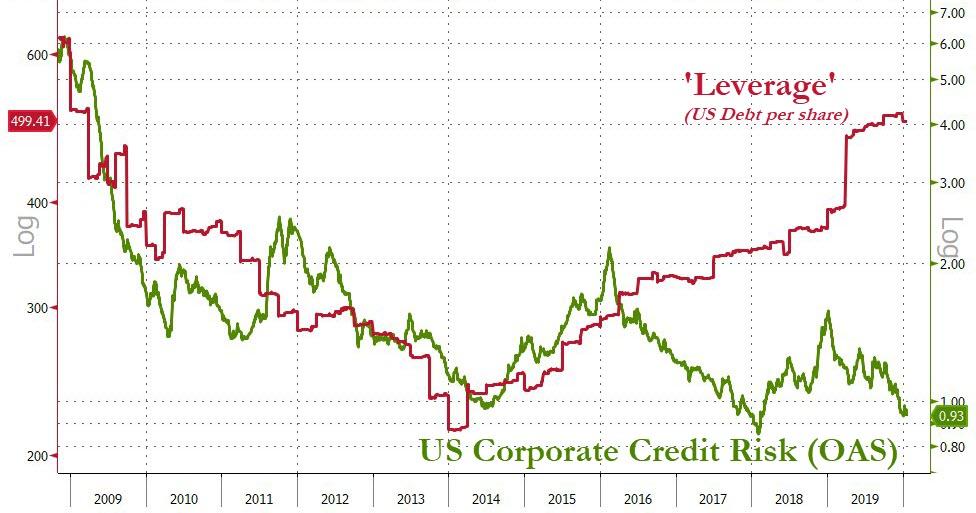

In January, Guggenheim CIO Scott Minerd warned that ultimately, markets will need to reprice for this rising risk with increased bond spreads relative to Treasury securities. However, that day of reckoning when spreads rise is being held off by the flood of central bank liquidity and international investors fleeing negative yields overseas.

(Click on image to enlarge)

And let’s not forget downgrade risk of BBBs: today 50 percent of the investment-grade market is rated BBB, and in 2007 it was 35 percent. More specifically, about 8 percent of the investment-grade market was BBB- in 2007 and today it is 15 percent. It has more than quintupled in size outstanding, from $800 billion to $3.3 trillion. We expect 15–20 percent of BBBs to get downgraded to high yield in the next downgrade wave: This would equate to $500–660 billion and be the largest fallen angel volume on record—and would also swamp the high yield market.

Ultimately, we will reach a tipping point when investors will awaken to the rising tide of defaults and downgrades. The timing is hard to predict but this reminds me a lot of the lead-up to the 2001 and 2002 recession.

The prolonged period of tight credit spreads experienced in the late 1990s lulled investors into unwittingly increasing risk at a time they should have been upgrading their portfolios.

This brings to mind the famous observation by economist Hyman Minsky, who stated that stability is inherently destabilizing. That is to say that long periods of relative stability in risk assets causes investors to keep upping the risk during a long period of calm.

Ultimately, this leads to what he called a Ponzi Market where the only reason investors keep adding to risk is the fear that prices will be higher tomorrow (or in the case of bonds, yields will be lower tomorrow).

But the larger-than-life CIO went further in February, even more ominously during an interview with CNBC, warning that:

"I have never in my career seen anything as crazy as what’s going on right now," adding "this will eventually end badly."

Adding that...

“We are either moving into a completely new paradigm, or the speculative energy in the market is incredibly out of control. I think it is the latter. I have said before that we have entered the silly season, but I stand corrected,” Minerd said at the end of his recent letter.

“We are in the ludicrous season.”

Ludicrous indeed!

And then, just last week, Minerd warned specifically that time is up:

"This is not a buy-the-dip market. It is a don’t-catch-a-falling-knife market. "

And now, today,in his latest letter to investors - the outspoken and literal - giant of the markets warns that the market is waking up to not just the viral contagion of coronavirus, but also to financial, economic, and geopolitical contagion.

If I had written a commentary on how 4,000 people dying from the flu would topple global financial markets, I think I would have been deemed insane. Yet today that is exactly the story.

After all, the World Health Organization estimates that influenza kills 290,000 to 650,000 people per year. How does this statistically small number of 4,000 versus a global population of 7 billion bring the market to its knees? I don't think I have to explain that right now, but if anyone thinks I need to, feel free to reach out to me in a socially distant fashion once you have washed your hands for 20 seconds and then rinsed them in Purell.

Amazingly, the market is finally waking up to the prospects of not just viral contagion but also to financial contagion. The phenomenon of a relatively insignificant event cascading through an unpredictable series of circumstances resulting in a severe outcome has been referred to as the "butterfly effect."

The concept is derived from how a seemingly insignificant phenomenon like a butterfly flapping its wings in Brazil leads to a hurricane on the other side of the globe.

Who could predict the exact chain of events set off by the coronavirus that leads us to the circumstances that we face today? Besides the public health and economic crisis, would anyone have considered that this would also turn into a geopolitical crisis? Russia is attempting to use this critical moment to its own advantage, and the collapse of the Russian-OPEC alliance—precipitated by Russia’s goal of killing off the U.S. shale industry—has turned into an all-out price war that is causing chaos in the energy markets.

Now the financial contagion is spreading rapidly into the credit markets where not only energy bonds are plunging but other sectors like airlines, lodging, and retail are sure to follow suit.

Then there is the knock-on effect to corporate earnings and cash flows across a broad swath of industries once the world enters a global recession which now appears to be inevitable.

We arrive at this moment with the overleveraged corporate sector about to face the prospect that new-issue bond markets may seize up, as they did last week, and that even seemingly sound companies will find credit expensive or difficult to obtain.

The prospect of a crisis at maturity—that a borrower with maturing debt finds it impossible to roll the debt over to pay it off—is a very real prospect even for companies that are solvent. It has happened before, and it will happen again.

All of this points to the fact that it is virtually impossible to identify the next domino to fall but one thing seems certain: They will continue to fall.

How did we get into such a precarious position? After a decade of profligate borrowing by corporations, it would seem that any reasonable investor would have realized the fragility of the financial system.

Rumors are circulating in the market hoping for a return of crisis-era programs like TAF, TARP, TALF, TLGP, and TSLF. (Can anyone remember what all these alphabet programs stand for?) But resurrection of these programs may arrive in time for Easter.

For now, stocks are limit down, the entire yield curve for Treasury securities yields under 1 percent and credit spreads are exploding, especially in energy bonds.

What next?

I hate to admit this, but our proprietary models indicate that fair value on the 10-year Treasury note will reach -50 basis points before year-end and the possibility that rates could overshoot to -2 percent.

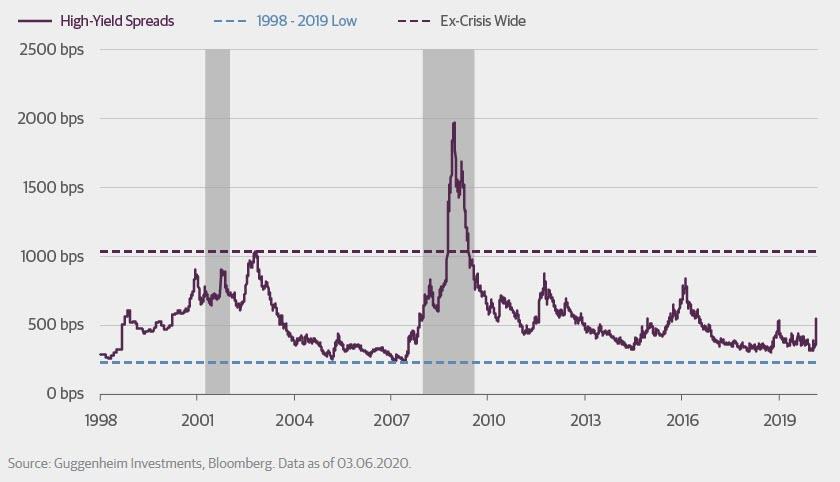

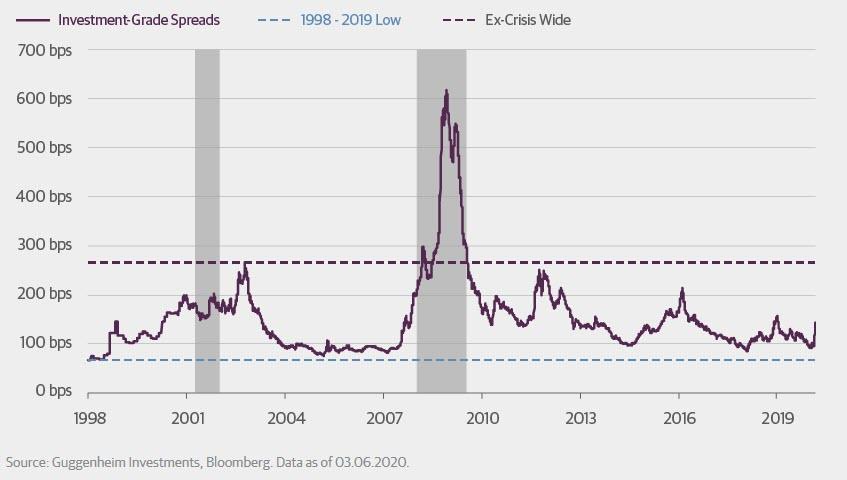

Credit spreads have a long way to expand. BBB bonds could easily reach a spread of 400 basis points over Treasurys while high yield would follow suit with BB bonds at 750 basis points over and single B bonds at 1100 basis points over. The risk is that it could be worse.

High-Yield Bond Spreads Have a Long Way to Expand

(Click on image to enlarge)

Source: Guggenheim Investments, Bloomberg. Data as of 03.06.2020.

And don't forget that a large number of investment-grade bonds already have leverage ratios equivalent to high yield. As the market learned in the case of Kraft Heinz (KHC) last month, rating agency forbearance may soon dissipate, especially as earnings and free cash flow declines. KHC, a well-known household brand with a market cap of over $30 billion, saw its corporate bond rating slashed from BBB- to BB+ by both S&P and Fitch in one day. The downgrade made 19 KHC bonds totaling $22 billion in total outstanding ineligible for the most broadly-followed investment-grade corporate bond index benchmarks.

Investment-Grade Bond Spreads Are Poised to Widen

(Click on image to enlarge)

Source: Guggenheim Investments, Bloomberg. Data as of 03.06.2020.

And don't forget that a large number of investment-grade bonds already have leverage ratios equivalent to high yield. As the market learned in the case of Kraft Heinz (KHC) last month, rating agency forbearance may soon dissipate, especially as earnings and free cash flow declines. KHC, a well-known household brand with a market cap of over $30 billion, saw its corporate bond rating slashed from BBB- to BB+ by both S&P and Fitch in one day. The downgrade made 19 KHC bonds totaling $22 billion in total outstanding ineligible for the most broadly-followed investment-grade corporate bond index benchmarks.

Our estimate is that there is potentially as much as a trillion dollars of high-grade bonds heading to junk. That supply would swamp the high yield market as it would double the size of the below investment grade bond market. That alone would widen spreads even without the effect of increasing defaults.

As for stocks, technical analysis suggests that there should be support around 2600 on the S&P 500, but in a recession scenario, a level closer to 2000 could be the ultimate outcome.

Many skeptics have challenged this idea, saying that the panic is close to an end. In this circumstance I recall the quote from Winston Churchill:

"This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning."