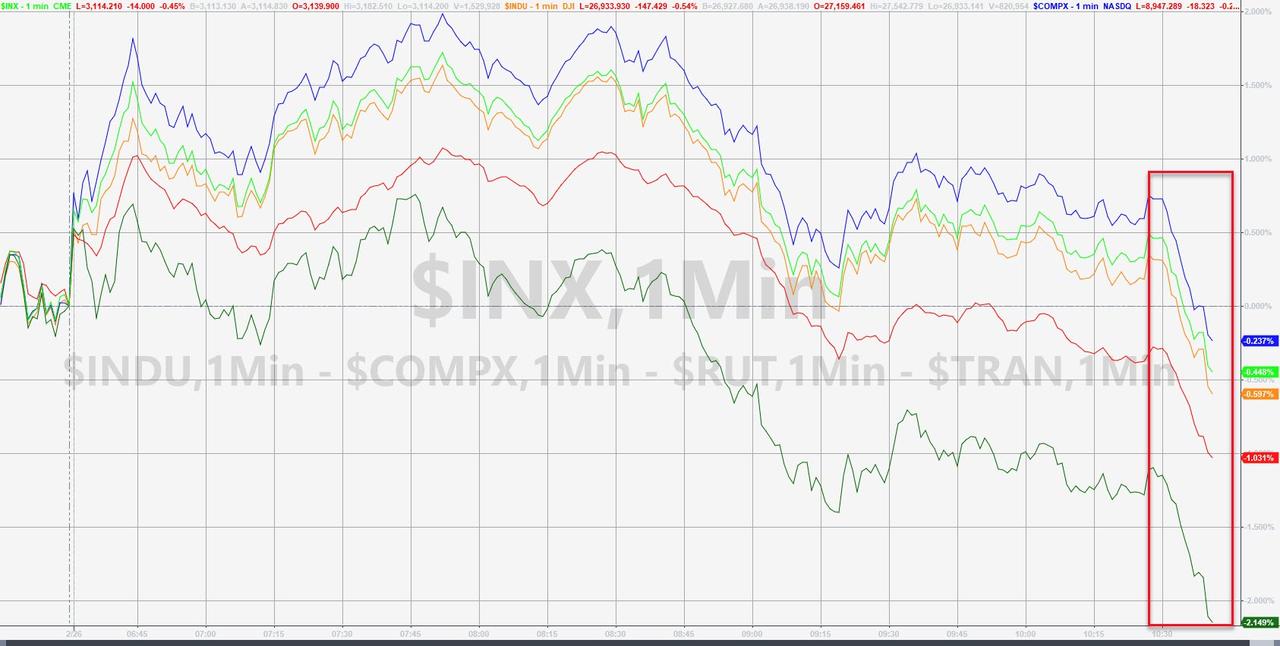

Gartman Was Right - BTFD Fails As Stocks Slump Into Red

After trading up over 500 points, the Dow is back in the red as BTFDers have failed once again.

All the majors are in the red!

(Click on image to enlarge)

It's been a dip-buying-famine...

(Click on image to enlarge)

Traders are unsure of the immediate catalyst (just as many scratched their heads at the rebound), but some are pointing to headlines that 83 people in Nassau County being monitored for possible coronavirus exposure.

This all fits with comments from the infamous Dennis Gartman, who last year ended his daily newsletter after three decades, who appears to be right in his retirement.

Equities are “egregiously” over-valued relative to measures such as sales, profits and the size of the economy. The spread of the coronavirus is threatening global growth, and investors should buy safety assets such as gold and government bonds, he said.

“I’m afraid rallies are to be sold into, not weakness to be bought,” Gartman said in an interview on Bloomberg Radio with John Tucker.

“I’m amused or dismayed at how many people are still willing to buy the dip, and this dip is far more serious than people want to anticipate at this point.”

Gartman's view echoes that of Mohamed El-Erian, who wrote on Tuesday that the virus-induced sell-off “isn’t a buy-the-dip opportunity” because there’s little evidence right now supporting the notion of a V-shaped recovery.

Dr.Doom, Nouriel Roubini, is also a skeptic, calling hopes for a quick rebound in China’s economy “delusional.”

It would appear that bond yields agree...

(Click on image to enlarge)

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more