For Bonds, This Is Now The Second Worst Bear Market In 40 Years

Last December, we predicted that the US was heading for a "titanic taper tantrum" in 2021, to an extent as a result of a sharp drop in bond demand as a result of reduced bond purchases by the Fed but also due to a spike in inflation which would lead to a sharp drop in demand for duration.

So fast forward to this week when the crash in US Treasurys, and especially the belly of the curve led by a plunge in 5Y prices...

(Click on image to enlarge)

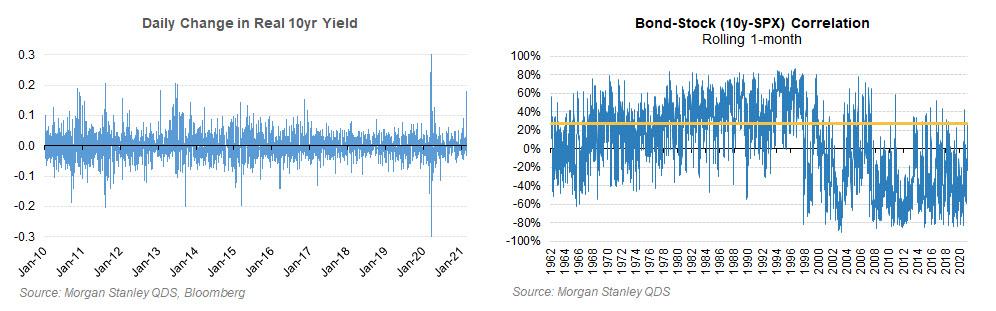

... led to a historic vol shock as the real 10Y yield soared and which crushed both bond and equity bulls, but especially risk parity and balanced funds, who suffered tremendous losses as the conventional hedging role that bonds play was reversed as the bond stock correlation reversed from deeply negative to positive...

(Click on image to enlarge)

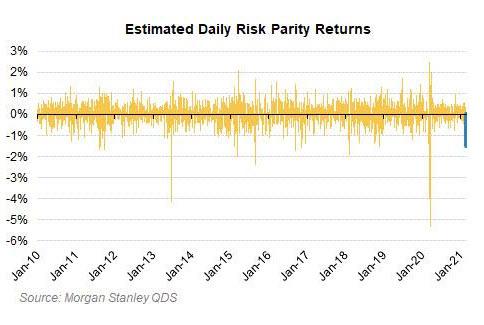

... resulting in a crushing blow to risk parity returns.

(Click on image to enlarge)

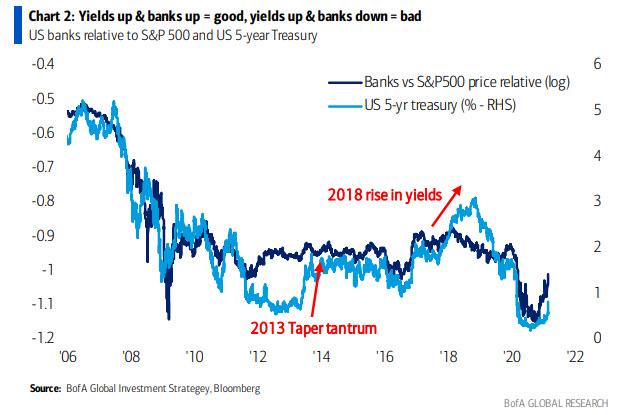

What is more remarkable is that while this week was terrible for bond bulls, the past year has been just as painful. As Bank of America's Michael Hartnett writes today, the past 12 months have been great for equity investors with the GOAT rally since March, coupled with a GOAT V-shape macro recovery... yet on the other side, we have had a bond bear market which is now also one of greatest-of-all-time. Consider that since Aug 4th annualized price return from +10-year US govt bonds = -29%, Australia -19% (they do YCC!), UK -16%, Canada -10%. Hartnett's advice is to watch bank stocks for the “tell” on how badly the bond rout is hurting liquidity & growth expectations.

(Click on image to enlarge)

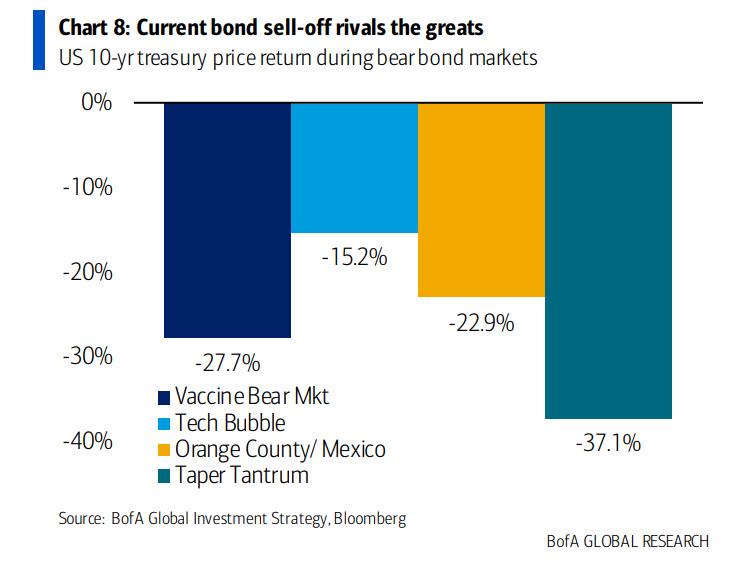

But going back to our original warning from December about a "titanic taper tantrum", what we find stunning is that while Thursday may well have been the culmination of growing concerns about runaway inflation (and, to Michael Burry, hyperinflation), even if more pain is certainly coming if the US is set to suffer through a period of 4%, 5%, 6% or more inflation, the pain for bonds over the past year is absolutely staggering, and as Michael Hartnett notes, the "Vaccine Bear Market" in bonds is now the second-worst bear market in history...

(Click on image to enlarge)

... and warns that the monetary impotence or fiscal impotence inducing bond sell-off that exceeds on annualized basis 1994, 1999, but not quite taper tantrum of 2013, may "lead to contagion, illiquidity, busts, and bankruptcies" ... which is why volatility & hedges against inflation & currency debasement set to outperform in 2021.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more