FOMC Unanimously Leaves All Policies Unchanged, Launches Forward Guidance

Since the last FOMC Statement on November 5th (right after the election and as the vaccine headlines hit), stocks have screamed higher led by inflation-sensitive small caps...

(Click on image to enlarge)

Source: Bloomberg

But it is Bitcoin that has really screamed higher (up36%) since the November Fed (with Gold, the dollar, and bonds all down around 2-3%)...

(Click on image to enlarge)

Source: Bloomberg

Bond yields spiked in those first few days (Fed, fiscal, vaccines, etc), but have largely trod water since (as the yield curve is at its steepest of the year)...

(Click on image to enlarge)

Source: Bloomberg

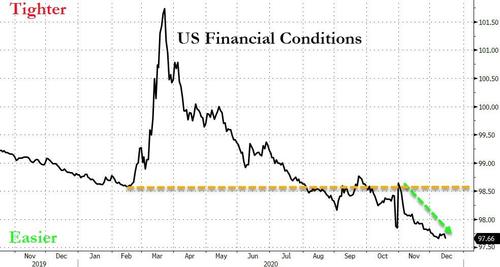

Financial Conditions have dramatically eased in the weeks since the last Fed meeting, smashing financial conditions to their easiest in US history...

(Click on image to enlarge)

Source: Bloomberg

And don't forget that the dollar is suggesting confidence in Powell's magic is waning (as is Bitcoin)...

(Click on image to enlarge)

Source: Bloomberg

Surging COVID-19 case counts, renewed strain in the labor market, and floundering fiscal negotiations - all amid a backdrop of Treasury yields grinding toward the highest levels of the pandemic - are compelling reasons for Fed officials to stand ready to do more., so the big question for today is, will they hedge and enable some easing (extending WAM on purchases) as StanChart suspects, and/or will The Fed hike its IOER, or will The Fed leave well alone at these stratospherically rich levels - merely promising to do something at some point in the unknown future?

The headline is simple - NOTHING CHANGES, EVERYTHING CONTINUES

Central bank officials left rates near-zero at their December meeting and tied bond-buying to their employment and price goals.

“The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time,” Fed officials reiterated in their December policy statement, released Wednesday afternoon.

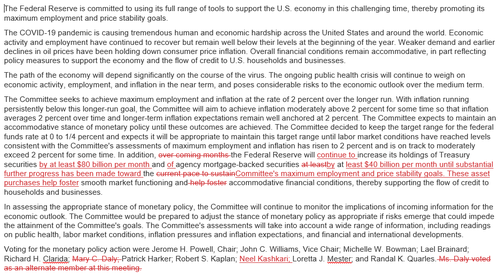

The only major change to the statement is as follows:

In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee's maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

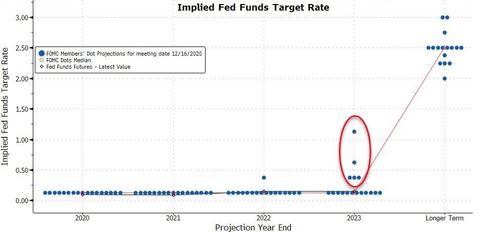

5 of the 17 officials saw rate-hikes during 2023...

(Click on image to enlarge)

Notably, officials did not change their tone with respect to economic conditions, reiterating that the recovery will depend on the course of the virus and that the pandemic will continue to weigh on conditions in the near term. They say it poses “considerable risks” to the outlook in the medium term.

***

Full redline below:

(Click on image to enlarge)

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more