Five Year Inflation Breakeven, S&P500 And The Dollar

The S&P 500 dropped 1.3% on Friday; many accounts attributed the drop to Fed statements indicating a faster accelerated pace of rate hikes (especially Bullard’s comment), presumably in response to prospects for higher than previously anticipated inflation. Interestingly, market indicators on Friday are not supportive of that interpretation.

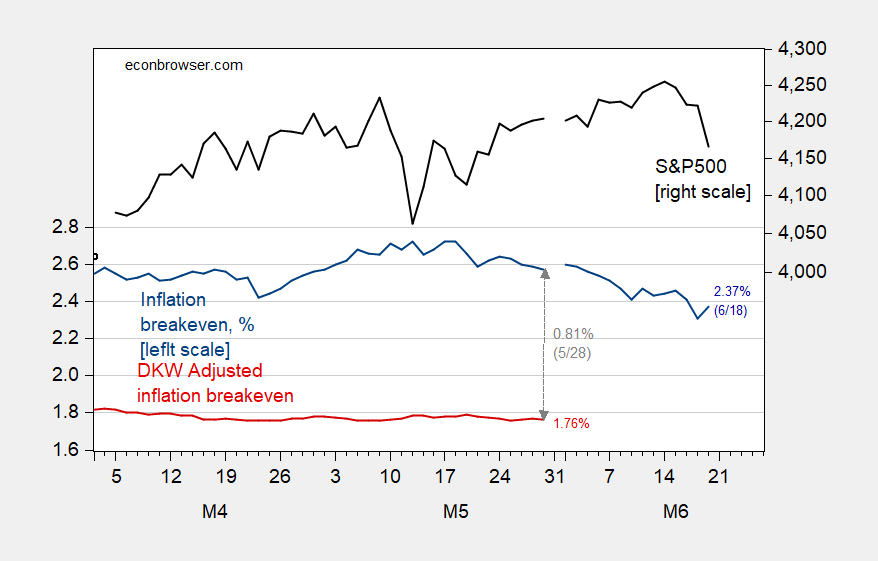

Figure 1: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue, left scale), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red, left scale), both in %; and S&P 500 index (black, right log scale). Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 6/4, and author’s calculations.

From 6/15 to 6/18, the five year breakeven drops from 2.46% to 2.37%, However, we know that changes in the inflation risk premium and the TIPS liquidity premium can lead to measurement error in expected inflation derived from the simple breakeven calculation.

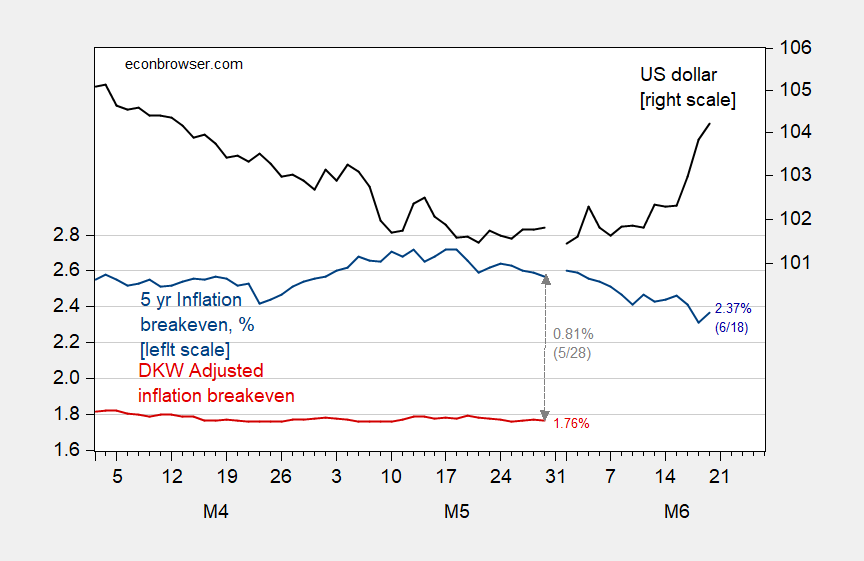

Interestingly, the US dollar appreciates, suggesting that the forex market takes seriously a monetary tightening (regardless of inflation expectations) that increases the real interest rate.

Figure 2: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue, left scale), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red, left scale), both in %; and Fed nominal value of dollar index against advanced economy currencies, 2006M01=100 (black, right log scale); spliced to DXY index 6/11-6/18. Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 6/4, and author’s calculations.

Hence, the news appears not to be indications of higher inflation (which for previous CPI releases seems to have a relatively small effect), but rather FOMC member inclinations toward raising rates earlier rather than later (it’s also possible the market believes the Fed has inside information regarding inflation).

Disclosure: None.