Fed Raising Rates Foretelling The Next Major Financial Crisis

This may sound like a slightly over the top idea for some, but its important that investors pay attention: there could be major financial crisis looming. This time around, it could be worse than the last one.

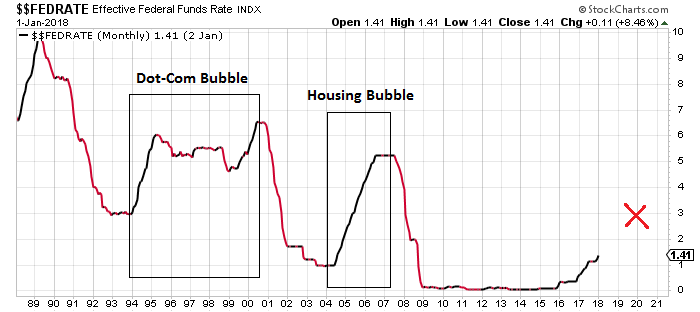

What will cause this financial crisis? It’s important to pay attention to the chart below. It plots the federal funds rate–interest rates set by the Federal Reserve.

Chart Courtesy of StockCharts.com

Look at the rectangles drawn on the chart. Whenever the Federal Reserve has raised rates after keeping them low for a while, a major bubble has formed. Eventually, these bubbles burst and end up as full-on economic or financial crises.

In 1994, the Fed starting to raise rates, and didn’t really stop till 2000. In the midst of all his, we had the dotcom bubble forming. Those who were invested in the markets know very well how it ended. The Federal Reserve raised the federal funds rate from three percent to six percent.

Then, in 2004, the Federal Reserve decided to raise interest rates again, stopping in early 2007. Rates went from around one percent to four percent. During this time, we had the housing bubble getting bigger. It was followed by one of the biggest financial crises. If you recall, when a housing bubble bursts, the entire financial system was one verge of collapse.

So, What’s Next?

In case you didn’t know, the Federal Reserve is raising interest rates after keeping them at zero for about six years. By 2020, the federal fund rate is expected to be around three percent. The “X” on the chart above represents this.

Do we have any bubbles forming? Yes.

As it stands, we have the stock market trading at extremely high valuations. For instance, look at the CAPE ratio; it’s the price-to-earnings (P/E) ratio adjusted for cyclicality and inflation. The ratio stands at the highest level since the dotcom bubble. It has to be questioned if there could be a stock market crash and if it could lead to a financial crisis.

The bond market has had a solid run to the upside over the past few years as well. As rates go up, bond prices decline, so the bond market could be in deep trouble. Will this cause the next financial crisis? It’s possible.

Lastly, look at the notional value of the derivatives held by banks in the U.S. The top 25 banks have notional derivatives worth $141.2 trillion that are backed by interest rates. Just a small percentage of these derivatives going out of hand could cause severe damage. (Source: “Quarterly Report on Bank Trading and Derivatives Activities,” Office of the Comptroller of the Currency, last accessed February 15, 2018.)

What Could Happen in the Next Financial Crisis?

With low interest rates, there’s usually a lot of money sitting around. When interest rates start to go higher, a lot of capital misallocation happens. We have seen this over and over again.

With this, it isn’t outrageous to look out for the next financial crisis already.

I also truly believe that the next financial crisis will be a big one, and that it’s going to require extraordinary measures. My reasoning for this is very simple: there’s a lot of money out there, thanks to low interest rates from the past six or so years. So the bubbles that are forming now could be much bigger than the previous ones. With this, the financial crisis following could be much more severe.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more