Fed Kills The Bear…For Now

It’s 4:40 a.m. on Friday morning and I am sitting in the airport waiting for my flight to Vancouver, B.C.One thing about being at the airport this early…there is no line…for anything. Anyway, I am on my way to present at the annual MoneyTalk Conference where I am honored to be the keynote speaker this year.

But here is my problem. I had to prepare my presentation and send it to my hosts a couple of weeks ago. The topic was simple enough…“how to navigate a market that has changed trend.”

The problem, for my presentation on Saturday anyway, is that narrative may have been postponed. Which is what I want to discuss with you this week – “How the Fed sent the bears back into hibernation…for now.”

(When I get back next week I will post the entire presentation deck for you.)

First, let’s start with what happened last week as we discussed in a post for our RIA PRO subscribers:

“The statement and press conference following the January 30th Federal Reserve policy meeting was, with little doubt, a further pivot to a dovish stance. The statement below is from the prior December meeting and marked up in red to highlight changes in the current January 30th statement. The big clue about future interest rate policy is in the following addition:‘the Fed will be patient as it determines what future adjustments to the target range…’ ‘Patient’ tells us that the Fed’s plans to raise rates two or three times in 2019 are now on hold. It also leads the reader to believe the next move could just as easily be a reduction in rates.”

“The next important takeaway came in regards to the Feds balance sheet. In the press conference Jerome Powell, as he has done recently, alluded to the idea that QT is not on ‘autopilot’ anymore. In other words, it is likely the Fed will not continue to reduce the pace at which they are shrinking their balance sheet without considering the economy and financial markets. We stress the word ‘autopilot’ because that was how Jerome Powell to described the pace of balance sheet reductions at the December 19, 2018 FOMC meeting press conference. The ensuing market mayhem in the days following the press conference appears to have rattled the Fed into modifying that take quite substantially. In fact, they have done a 180-degree reversal in only six weeks.”

And just like that, the ‘Fed Put” was back.

2018 was a year where the markets had begun to adjust for tighter monetary policy. Jerome Powell was believed to be different from his predecessors by focusing more on economic stability and the avoidance of asset bubbles rather than being driven by the whims of the financial markets.

It only took a 4.4% decline in the S&P 500 last year, combined with strong comments from the White House and no doubt strong pressure from the Fed’s member banks, to make Mr. Powell the “market’s b*tch”.

But what is most important was the release of the supplementary statement entitled “Monetary Implementation and Balance Sheet Normalization” in conjunction with the FOMC statement. The bullet point below from the statement makes it clear that increases to the balance sheet, also known as QE, will be a part of their tool kit going forward.

As Mike Lebowitz noted last week:

“This is curious as Powell was adamant that QE two and three should not have been executed after the financial crisis abated. Now, without much reason, the specter of QE is being raised.”

“In our opinion, the Fed’s new warm and cuddly tone is all about supporting the stock market. The market fell nearly 20% from record highs in the fourth quarter and fear set in. There is no doubt President Trump’s tweets along with strong advisement from the shareholders of the Fed, the large banks, certainly played an influential role in persuading Powell to pivot.”

As our headline this week denotes – the shift in policy has temporarily put the bulls back into hibernation. As the chart below shows, the market not only broke out of its recent consolidation and successful retests of the 50-dma but also broke the downtrend line from the 2018 highs.

Currently, the next major resistance level will be the 200-dma which is just ahead along with the cluster of tops of the consolidation range in October and November of last year.

But, with the Fed now back to providing plenty of “accommodation” to the markets, even if it is only verbal at the moment, there is a bias to the upside for the markets currently. As shown below, the last time we got a short-term “buy” signal, like the one triggered just one week ago, it led to the rally that the markets to new all-time highs.

As I noted two weeks ago in this missive, these were all of the ingredients necessary to bring the bear market that began in 2018 to its end.

For now.

The Fed Is Limited

While the Fed certainly gave the markets what it wanted in the near-term,in the longer-term there is actually very little the Fed will be able to do to stem the next recessionary bear market.

The chart below shows why.

In 2008, when the Fed launched into their “accommodative policy” emergency strategy to bail out the financial markets, the Fed’s balance sheet was only about $915 Billion. The Fed Funds rate was at 4.2%.

If the market fell into a recession tomorrow, the Fed would be starting with roughly a $4 Trillion dollar balance sheet with interest rates 2% lower than they were in 2009. In other words, the ability of the Fed to “bail out” the markets today, is much more limited than it was in 2008.

“So what? There are plenty of bonds to buy.”

True, but there are other factors at play which will also dramatically limit the effectiveness of further rounds of accommodation.

When the Fed launched QE in 2009, market valuations had been reverted to below the long-term average and investor sentiment had been completely washed out. The massive selling that occurred as the markets collapsed left a huge amount of “pent up” demand for equities.

Today, that is no longer the case.

Valuations are no longer cheap by historical standards, but instead are expensive by virtually every measure.

As Goldman Sachs pointed out recently, the market is pushing the 89% percentile or higher in 6 out of 7 valuation metrics.

There is no longer a “pent up” demand for equity ownership as households now have more equity exposure than at any other point in history.

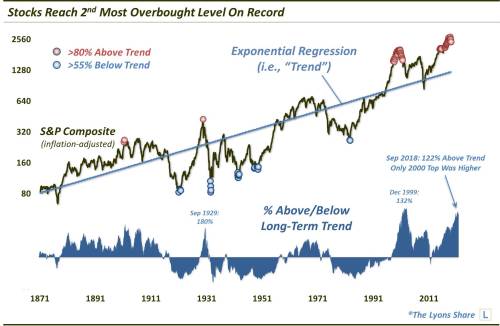

Furthermore, the market is not grossly oversold and deviated well below long-term trends as it was in 2008. As Dana Lyons recently penned:

“We used exponential regression smoothing to find the ‘best fit’ trend line on the [Shiller data] series from 1871 (h/t to Doug Short for the concept.)

After finding the best fit trend line for the composite, we can measure how far above or below prices are at a given time. As it turns out, this past September saw the composite reach 122% above the trend line, i.e., it was 122% “overbought”. In nearly 150 years, the only months that saw prices more overbought than that were those encompassing the 1999-2000 market top — the most excessive, bubbly top in U.S. market history.”

While markets can certainly remain extended for much longer than logic would predict, they can not, and ultimately will not, stay overly extended indefinitely.

The important point here is simply this. While the Fed may have curtailed the 2018 bear market temporarily, the environment today is vastly different than it was in 2008-2009. Here are a few more differences:

- Unemployment is 4%, not 10+%

- Jobless claims are at historic lows, rather than historic highs.

- Consumer confidence is optimistic, not pessimistic.

- Corporate debt is a record levels and the quality of that debt has deteriorated.

- The government is already running a $1 trillion deficit in an expansion not half that rate as prior to the last recession.

- The economy is extremely long is a growth cycle, not emerging from a recession.

- Pent up demand for houses, cars, and other durables has been absorbed

- Production and Services measures recently peaked, not bottomed.

In other words, the world is exactly the opposite of what it was when the Fed launched “monetary accommodation” previously. Logic suggests that such an environment will make further interventions by the Fed less effective.

The only question is how long will it take the markets to figure it out?

Bull In A Bear’s Den

Michael Lebowitz and I recently discussed the market in a broader sense for our subscribers at RIA PRO.

Disclosure: The information contained in this article should not be construed as financial or investment advice on any subject matter. Real Investment Advice is expressly disclaims all liability ...

more