Fed History Suggests Rate Cut Coming

“Davidson” submits:

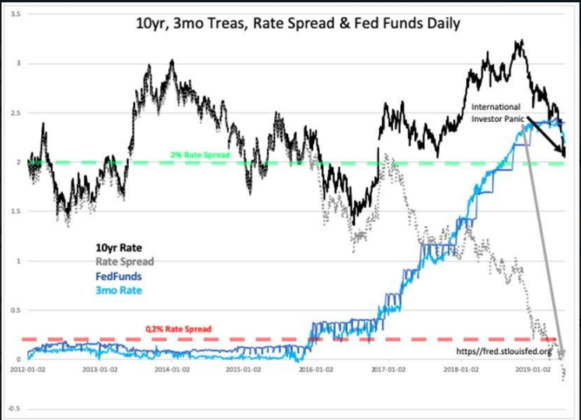

Panic has driven the 3mo/10yr Treasury spread to -0.18% (negative 18bps). The talk is about the Fed cutting rates, when and how much. Despite this becoming the dominant topic history indicates that the Fed follows 3mo Treasury rates(T-Bill rates) by lagging shifts in FFunds rates up to 30dys vs 3mo Treasury market rates.

Current market psychology has 3mo rates at 2.14% v FFunds at 2.4%. Based on recent Fed actions, we could see the Fed adjust FFunds lower by 0.25% shortly.

While a host of positive economic activity indicate continued expansion, i.e. no global slowdown as repeated daily in the media, the Fed, following its historical pattern, is likely to cut.

(Click on image to enlarge)

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more