February Consumer Confidence Beats Expectations, US Dollar Weaker

The Conference Board’s Consumer Confidence Index for the month of February printed at 91.3 versus a forecast of 90.0, another solid mark for the US economy as the recovery continues. The announcement accompanying the data release noted that the present situation index, based around current business and labor market conditions, had risen. However, consumers were less optimistic about the short-term outlook for the economy, with the expectations index slightly declining.

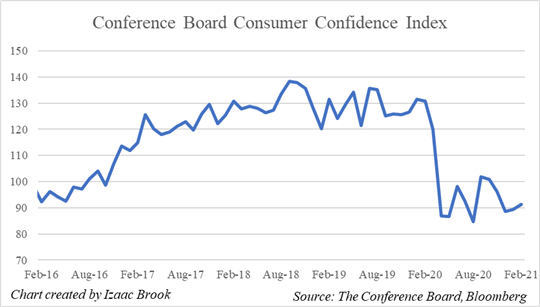

The Consumer Confidence Index fell to a multi-year low at the onset of the pandemic and has remained depressed since whipsawing back and forth from month to month amidst easing lockdowns and resurgences in Covid cases.

After rebounding during the summer and fall as the economy reopened, the index fell below 90 in December and January as Covid cases resurged. While February’s print marks the index’s highest level since November, confidence remains below the pandemic highs spurred on by vaccine announcements and reopenings and remains far below its pre-pandemic levels.

The solid February print in Consumer Confidence reflects the continuation of the economic recovery. Recent struggles in manufacturing have been attributed to seasonal weather and supply chain issues rather than demand weakness, and services activity in February rose to multi-year highs. However, jobless claims remain highly elevated and commentary from FOMC officials suggest that the labor market is in a worse spot than the already-grim headline unemployment numbers show. Employment will continue to be a focus for policymakers as the recovery continues.

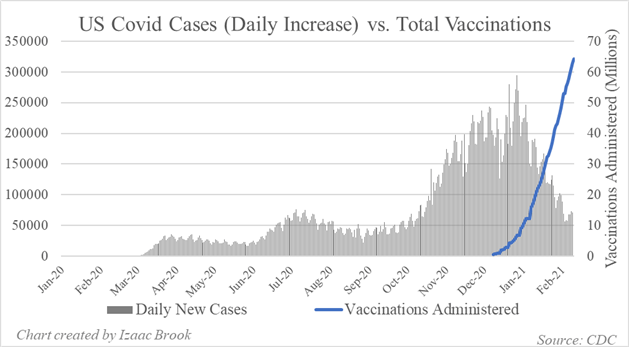

Another driver of consumer confidence are the trends in Covid-19. Daily new cases are far off of their holiday peak and vaccination efforts continue strongly. CDC data suggests that over 13% of the US population has already been vaccinated.

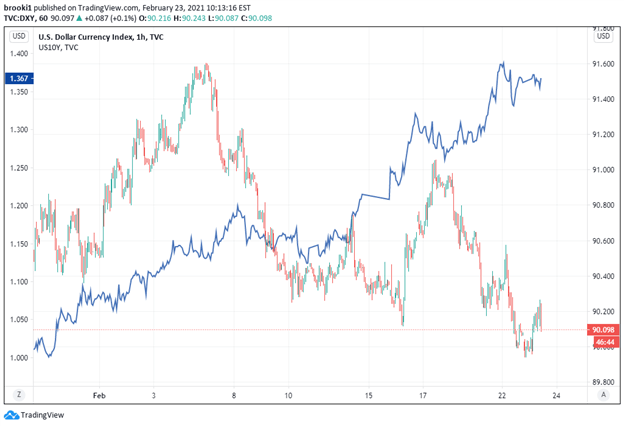

US Treasury yields at the longer end of the curve have sharply risen since the new year began as investors price in more government spending and the potential for higher inflation. While commentary from some FOMC officials suggest that the move is welcomed and not a cause for concern, many expect the Fed will only tolerate a rise in yields for so long before they implement a yield curve control policy.

US 10 YEAR TREASURY YIELD & US DOLLAR INDEX (DXY) (FEBRUARY 2021)

Chart created by Izaac Brook, Source: TradingView

After tracking the rise in longer-term rates into mid-February, the US Dollar has weakened again. The DXY rose to a multi-month high around 91.50 in early February as the 10yr yield moved from around 1.00% to 1.20%. After a move downward, DXY surged to 91.00 mid-month when yields pushed to the 1.30% level.

While this benchmark rate now sits above 1.35%, the DXY has fallen back down to around 90.10. Despite the decent consumer confidence print, the DXY has headed lower as Powell speaks to Congress. Markets will be focused on Fed Chair Powell’s testimony for further hints as to the path of rates, inflation, and the US Dollar.

Disclosure: See the full disclosure for DailyFX here.