Factors That Should Influence Your Investments

If you asked a thousand different people about the key factors that should drive their investment choices, you’re bound to get a thousand different answers.

Some, for example, might be inclined to argue that U.S. stocks have increased for eight consecutive years and there’s no reason to make any portfolio changes because stock prices are still rising.

On the other hand, others may have a completely opposite view, arguing that depressed volatility (VXX) coupled with rising stock prices, spells trouble. As a result, investors with this view may feel motivated to make radical changes inside their investment portfolio, perhaps selling all of their equity positions (DIA) and loading up on cash.

What are the crucial factors that should influence your investment decisions?

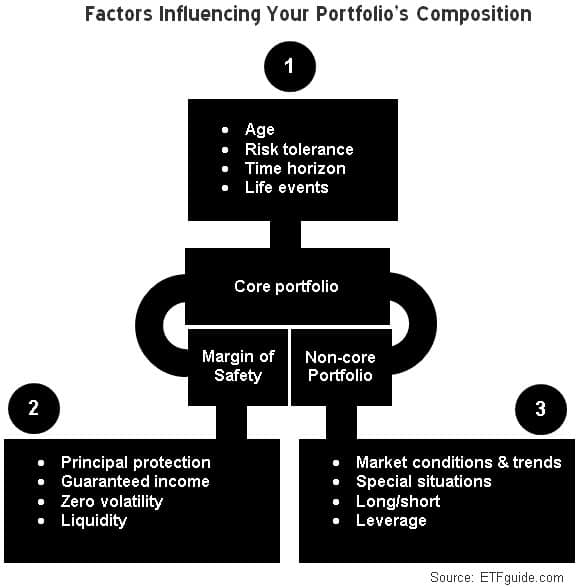

Rather than viewing your investments as one big bucket, I suggest a better approach that I believe reduces risk without hampering growth. My approach is to compartmentalize assets by dividing them into three main buckets: 1) a core, 2) a non-core, and 3) a margin of safety. Before making any asset allocation or diversification decisions, priority number one is to first determine what percentage or dollar value of your money should be put into each of these three buckets.

It’s important to remember that each of these three buckets – the core, non-core, and margin of safety – serves a deliberately different purpose from the next. Also, each bucket is purposely designed to complement the others by eliminating investment strategies that overlap.

Before we can answer the question of what factors should be influencing your investment choices, you must first understand that each of these three buckets – the core, non-core, and margin of safety – has a different set of deciding factors that will impact your portfolio’s overall design.

Your Core

The first bucket within your investment portfolio is your core. And as your core, this bucket is your portfolio’s foundation and should never represent less than 50% of your total assets. Why? Because if you’re allocating anything less than 50% of your total portfolio to your core bucket, you have inadvertently made the other two buckets your core.

Instead of being driven by monetary policy, market conditions, or other outside factors, the mixture of assets inside your core is strictly determined by your age, risk tolerance, and your investment time horizon. (This is labeled #1 in the diagram shown below.) Additionally, “life events” like the birth of a child, death of a spouse, disability, a family inheritance, or upcoming retirement is another key factor influencing the allocation of money inside your core.

What types of assets are held inside your core portfolio? What else, no less, but exposure to all the core asset classes like stocks, bonds (BND) , commodities, real estate (REET) and cash. Moreover, the investment vehicles you use to obtain exposure to these core asset classes should be broadly diversified, tax-friendly, and low-cost. Rather than trying to outperform an index benchmark, the investment vehicles you choose for your core portfolio should be accurate proxies of the asset classes they track.

Your Margin of Safety

The next bucket is your margin of safety. The chief and only goal of this bucket is to preserve capital, guarantee income, and provide liquidity. (This is labeled #2 in the diagram shown above.)

Furthermore, you should not be increasing or decreasing your portfolio’s margin of safety bucket based upon analyst forecasts, market trends, interest rates, or other outside factors. Why? Because your margin of safety bucket is strictly determined by the amount of portfolio cushion you require.

When is the best time to incorporate a margin of safety within your portfolio? Like insurance, your portfolio’s margin of safety should be installed before – not after or during – a crisis event or bear market. Not sure how much money should be allocated to your margin of safety bucket? Just text 33444 and type 4Safety to receive ETFguide’s complimentary margin of safety worksheet.

Your Non-Core

The last bucket inside your portfolio is your non-core. What type of assets can be held inside your non-core portfolio? The obvious answer is exposure to non-core assets like individual securities, hedge funds, venture capital, along with non-core assets like gold (GLD), bitcoin, and volatility. (This is by no means an exhaustive list of non-core assets, but it gives you a general idea of their character.)

Additionally, the proper and only context for leveraged ETFs or margin is within your non-core portfolio. Also, short-selling or using bear ETFs are OK strategies if they're contained within your non-core portfolio.

Remember: Your non-core bucket is the only place within your overall portfolio that is allowed to take concentrated investment risk. (This is labeled #3 in the diagram shown above.) It’s also the only place within your overall portfolio that is influenced by market conditions, monetary policy, economics, politics, and other outside factors.

Summary

What factors should influence your investment decisions? The correct answer is that each of the three buckets within your overall investment portfolio is directly influenced by the unique factors that pertain exclusively to it. (The diagram shown above will help you to remember these unique factors and to which buckets they apply.)

Dividing your money into three sections versus treating it as one big bucket is helpful from many angles. First, it keeps you disciplined. Second, it contains risk. Third, it limits speculative strategies to your non-core bucket, which should reduce the impact of investment bets that don’t work out.

Ultimately, everything I’ve explained here is what I call the “DeLegge Framework.” Although my framework uses elements of the traditional core/satellite investment strategy, it goes a step further by incorporating margin of safety as a third bucket.

The margin of safety concept dates back to the 1930's and was invented by the “father of financial analysis” Benjamin Graham along with his colleague David Dodd. And while Graham’s margin of safety idea has traditionally been applied to the selection of individual stocks, I believe its spirit and intent is equally applicable for building and managing a portfolio of investments with prudence in mind. And that’s why I’ve included it within my framework.

In summary, the chief purpose of the “DeLegge Framework” is to grow and protect capital. Finally, my framework requires no faceless algorithms with zero accountability to tell us what to do. In fact, the Framework is so easy to understand that both financial professionals and do-it-yourself investors alike can implement it. Remember: Dividing your money into three is the key,

Disclosure: None

Disclaimer: Ron DeLegge has analyzed and graded more than $125 million with his Portfolio ...

more