EUR/USD Forecast: Euro Looks To Re-Test April Swing Lows, U.S. CPI In Focus

Euro Fundamental Backdrop

Last week’s NFP beat laid the foundation for Monday’s open lower for EUR/USD as markets look forward to U.S. inflation data as the next possible upside risk event for the dollar. Until then, the economic calendar is filled with Fed speeches which can provide some price fluctuation on the pair with an increasingly hawkish tone expected from many contributors.

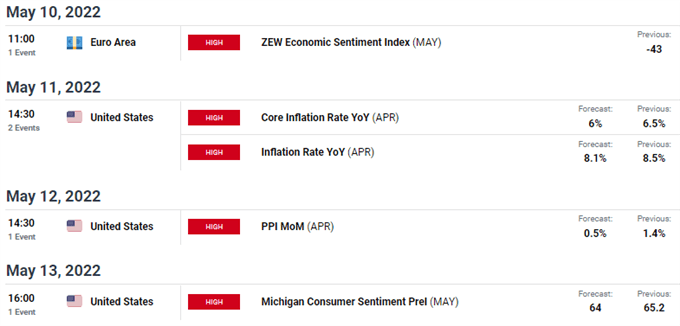

EUR/USD Economic Calendar

Source: DailyFX Economic Calendar

From the European perspective, the Russian oil import ban from the EU is not helping the case for the Euro as growth forecasts continue to fade. Talks around a European recession and decelerating Chinese growth expectations have placed the dollar in the top spot amongst major currencies, in conjunction with strong U.S. labor and inflationary data and an aggressive Federal Reserve, the dollar remains bid at least in the medium-term against the Euro.

Giving added impetus to the dollar upside, the U.S. 10-year Treasury yield extends its climb higher leaving 2018 highs vulnerable.

U.S. 10-Year Treasury Yield

(Click on image to enlarge)

Source: Refinitiv

Technical Analysis

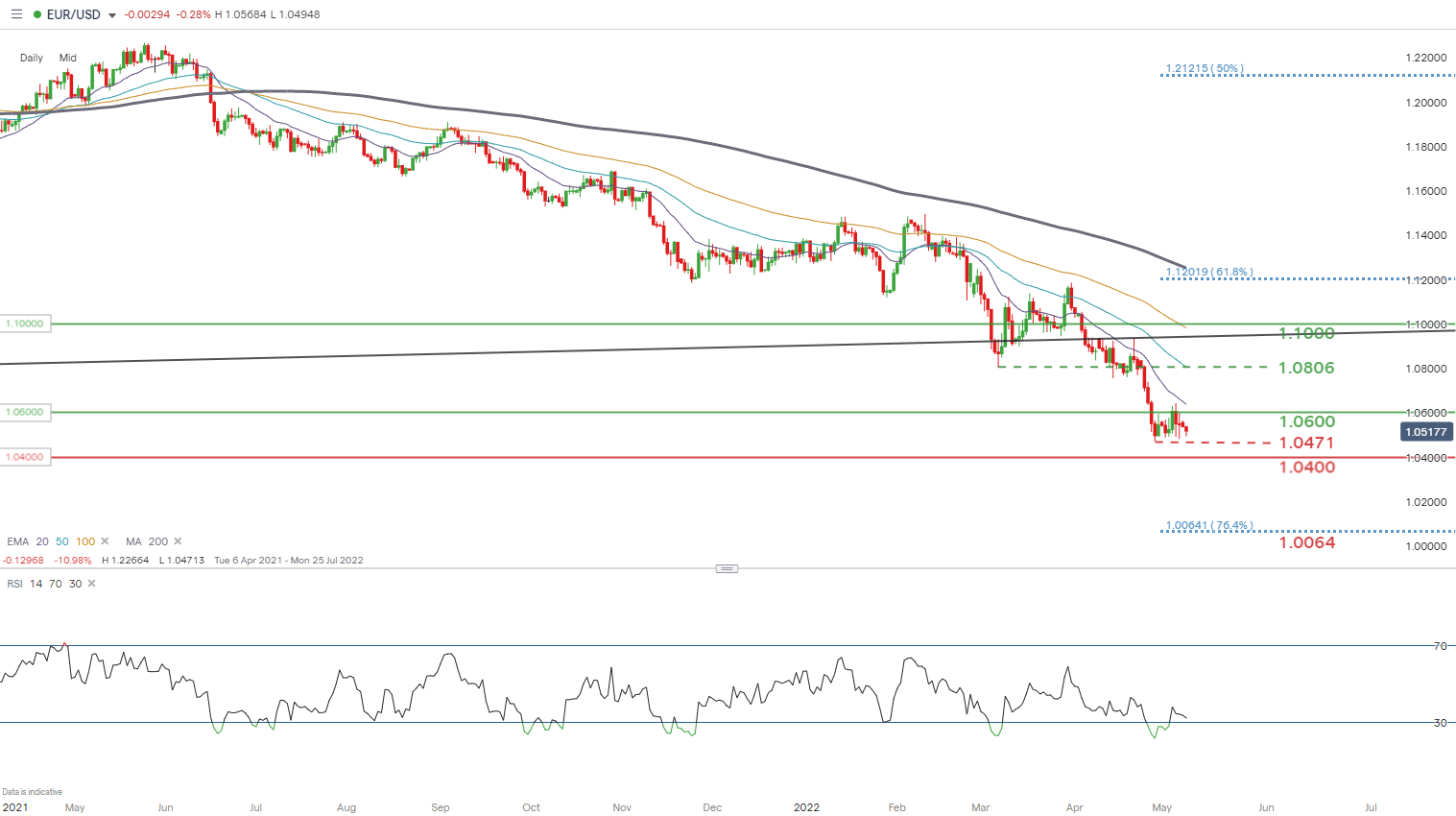

EUR/USD Daily Chart

(Click on image to enlarge)

Chart prepared by Warren Venketas, IG

Technical analysis on the daily EUR/USD chart shows price action consolidating beneath the 1.0600 resistance zone. The catalyst for a break below support is likely to stem from a ‘hot’ U.S. CPI release but with oversold conditions on the Relative Strength Index (RSI) we may see marginal Euro strength to come before a continuation lower.

Resistance levels:

- 1.0806

- 20-day EMA (purple)

- 1.0600

Support levels:

- 1.0471

- 1.0400

- 1.0064 (76.4% Fibonacci)

IG Client Sentiment Data Points To Short-term Hesitancy

IGCS shows retail traders are currently LONG on EUR/USD, with 75% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view of crowd sentiment however, due to recent changes in long and short positioning, we favor a cautious approach.

Disclosure: See the full disclosure for DailyFX here.