Erosion Beneath Euphoria

Treasury yields rose initially on news that Fed Chair Powell has the nod for a second term. Apparently, Powell–who’s endlessly sought to boost animal spirits and his portfolio at every market yip–is now a hawk that will raise rates through a global downturn and tanking risk markets in 2022. LOL indeed.

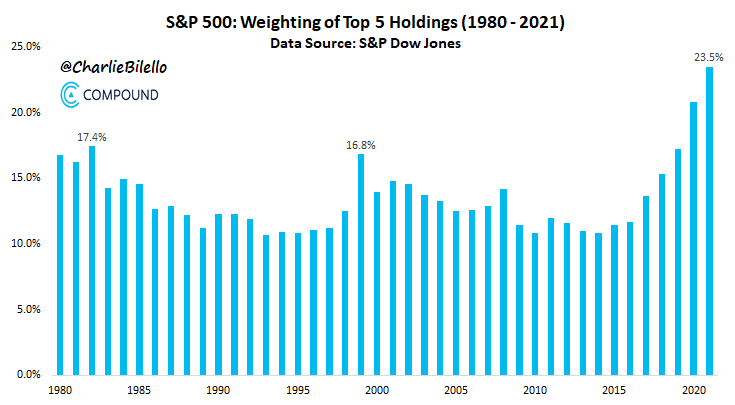

With the five most expensive S&P companies now accounting for 23.5% of its market cap (shown below since 1980, courtesy of Ridgehaven Capital), a world of FOMO surfers are more risk-concentrated and vulnerable to capital implosion than at any time in the past 41 years; even well beyond the 2000 tech top.

(Click on image to enlarge)

Breadth is brutal beneath the euphoric surface, with many former retail darlings tumbling into well-deserved repricing cycles. The list below highlights 32 standouts, camouflaged by a NASDAQ 100 Index still within 3% of its all-time high. As in 2000, the magnitude of these drops is par for the math-less buying, which has dominated since 2020.

The U.S. dollar has been rising against the basket of global currencies again since June. As shown below from my partner Cory Venable, since 2007, the greenback’s advance against the commodity-centric-CAD is another warning sign for risk markets. And, lest we forget, rising greenbacks ramp carrying costs for foreign borrowers who remain heavy in dollar-denominated debt.

(Click on image to enlarge)

Bond yields have backed up since August, but as shown in Cory’s chart below of U.S. 10-year yields since 1987, the bounce purchased by trillions in monetary and fiscal stimulants looks suspiciously quick. Like the 2007 and 2000 recessions, yields are likely to move lower for at least a couple more years, while the economy and financial markets finish the downcycle that began in 2019. Interrupted but not yet completed.

(Click on image to enlarge)

Disclosure: None.