Don't Worry About The 10-Year: Why Stocks Are Moving Higher From Here

There's been quite a bit of concern about an uptick in interest rates lately. In fact, the recent sharp rises in the 10-year Treasury as well as in other key rates helped push equities into correction territory. So, is this just the beginning? With rates on the rise, will market averages continue to slide? Or, can we expect markets to get accustomed to an "increased rate environment" and proceed higher from here?

There's No Exact Science Here

I sometimes hear market participants say "If the 10-year goes to 2%, how low will gold go, or how about the stock market?" and "What if the 10-year goes to 3%?" Well, there does not appear to be an exact science here. Nevertheless, let's examine several key factors to try to get a clearer image on what is likely going to occur next.

The apparent correlation between higher treasuries and lower prices in areas of the stock market appears to be a short-term phenomenon and is not likely to hold up in the intermediate and longer term.

Rates Just Part of the Image

If we examine the recent declines in the Nasdaq, the SPX, and in other major indexes, we see that the timing appears to coincide with a sharp increase in interest rates.

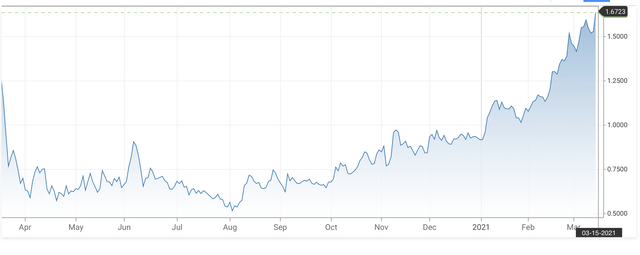

10-Year Treasury

Source: CNBC.com

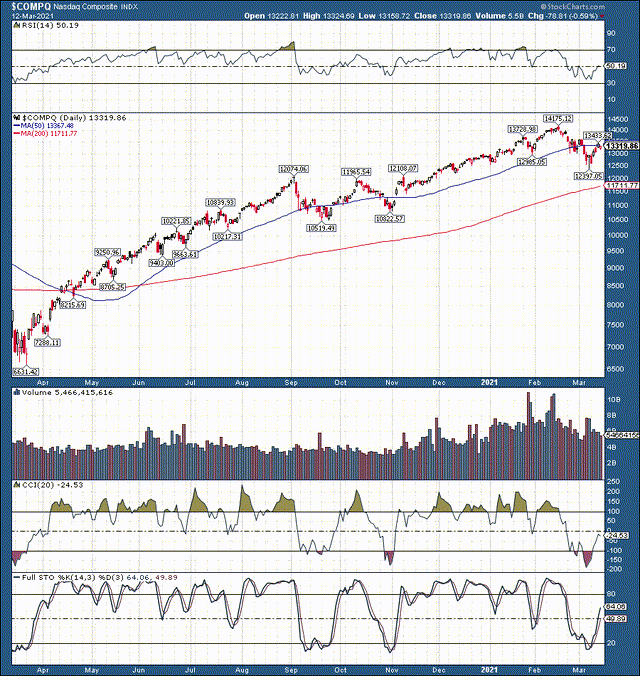

Nasdaq Composite

Source: StockCharts.com

We see that the Nasdaq topped out around mid-February, incidentally around the same time the 10-year and other key rates began to make notable moves. The consensus seems to be that rates should continue to rise. This creates a negative headwind for the economy and the stock market due to higher borrowing costs. Furthermore, there's an additional headwind to the stock market because higher yields on major bonds offer an attractive alternative to owning stocks and other risk assets.

Are Rates Really the Problem?

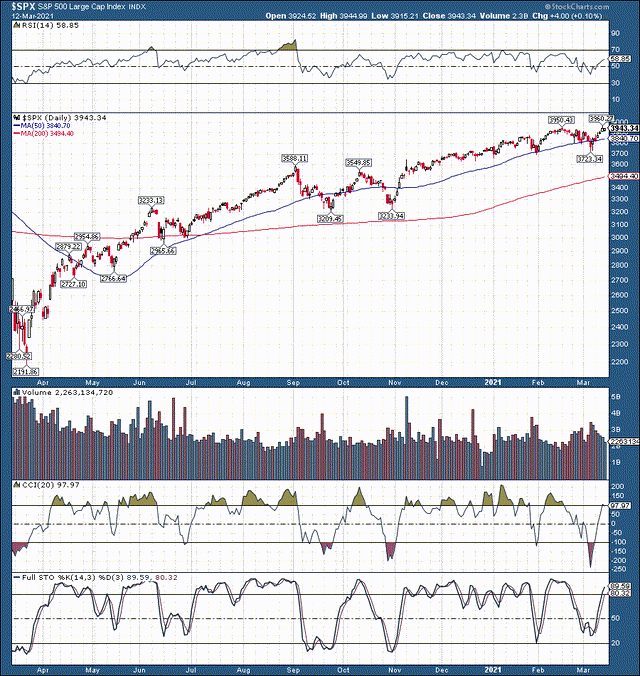

S&P 500

If we move away from the Nasdaq for a minute, we see that the SPX is back up near all-time highs ("ATHs") once again. This is despite the 10-year roughly tripling in yield since its low in August 2020. Also, if we look back on the recent correction, stocks likely declined due to several coinciding factors, not just a rise in interest rates. Along with a rise in rates, equities were confronted with frothy valuations in certain sectors, sell the news type events (end to earnings season, passing of fiscal stimulus), profit-taking, as well as other factors.

Therefore, we likely went through a healthy correction, with some rotation away from extremely high multiple names. In turn, capital rotated towards more value-oriented sectors. That is why we see the SPX back up around its ATHs, while the Nasdaq is still lagging, for now.

So, Why Are Interest Rates Rising?

The Fed is committed to keeping rates lower for longer, yet rates are moving higher anyways. While the market is placing the probability of a 0.25% hike at around 4% by the end of this year, the Fed's benchmark rate is likely to stay at zero for quite some time. The Fed Chair has mentioned that the central bank won't be raising rates "any time soon." Not any time soon means not until sometime in 2023 or possibly later, even in my view. The current situation concerning rates is not a product of the Fed, but is rather a product of the market, as yields appear to be rising due to higher inflation and higher growth expectations.

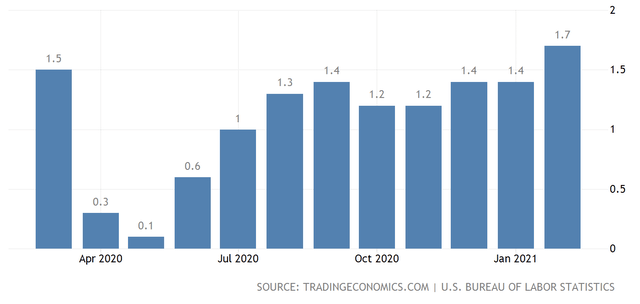

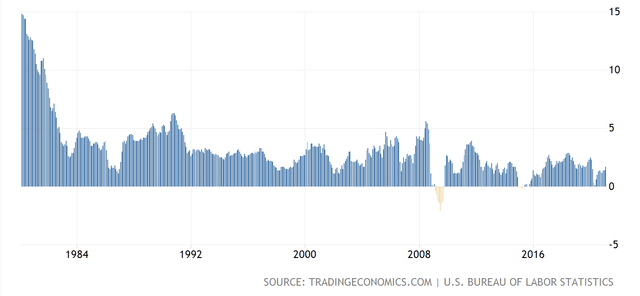

CPI Inflation

Source: TradingEconomics.com

In fact, we can see that CPI Inflation is at its highest point in over a year and it's likely going to get much hotter from here. With all the loose money in the system, the zero benchmark rate, trillions of dollars in cheap loans and backstops, perpetual QE, and enormous fiscal stimulus, the bounce back from COVID should be full of growth and inflation at the same time.

The recent increase in interest rates is simply the market's way of preparing for a wave of growth that is about to flood the economy. However, this does not mean that moderately higher interest rates will reflect poorly on economic growth or the stock market for that matter.

I believe that we are seeing a knee-jerk reaction. Market participants see higher rates and some transitory short-term selling occurs in the market. However, there's very likely a limit to how high rates can go without the Fed's intervention, and inflation growth should outpace rate growth going forward.

For instance, inflation could hit 2%, 2.5%, or higher throughout this year. Yet, the 10-year is likely to trail the rate of inflation. We've seen the 10-year trail the rate of inflation by quite a bit since the Fed began easing in late 2018, and this trend is likely to last going forward. Therefore, with inflation at 2% we may see the 10-year at about 1.8%, if inflation hits 2.5% the 10-year may move up to around 2-2.2%, etc.

The important factor is that inflation should remain well above the 10-year and most other key "safe-haven" yields. Since investors will likely be earning negative real interest holding many of the safest bonds, stocks and other risk assets look quite attractive in such an environment. Furthermore, the higher cost of borrowing should also be offset by the rise in inflation going forward. This market dynamic should be very bullish for stocks, commodities, and other risk assets in the intermediate and longer term. Rising yields in the 10-year and in other Treasuries alone is not enough to derail the stock market. It will very likely require the Fed's active involvement and a much tighter monetary stance to cool off the economy and the stock market in the future.

How High Can Rates Go?

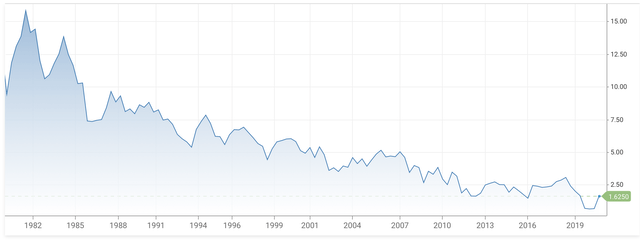

10-Year Long-term

This is a very key image here, and it clearly illustrates that the 10-year's long-term trajectory is lower and lower.

Inflation Longer-term

Inflation too has a trend of heading lower but it is nowhere as steep as the 10-year's decline. (I'm using the 10-year as a proxy here, but other key treasuries have a very similar longer-term trajectory.) So, we see the 10-year well above the rate of CPI Inflation in numerous instances in recent history, but not so much lately.

Why not lately?

In one word, it's - Debt

This is a crucial piece of the puzzle we cannot forget to discuss.

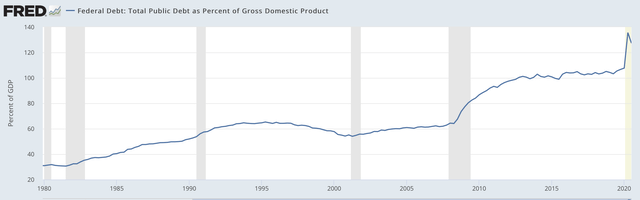

U.S. Debt to GDP %

With over $28 trillion in national debt, the U.S. is now one of the most heavily indebted nations in the world.

Let's run through some key statistics here:

In 1980 the U.S.'s federal debt to GDP ratio was just under 35%. By 2000 this ratio ran up to about 59%, and right now it sits at a staggering 130%. This is significant because the higher the debt ratio the more difficult it is to service the debt. While the economy may have been able to function effectively with the 10-year at around 5% in 2000, it simply is not realistic in today's market.

The national debt is largely comprised of Treasuries, thus we can use the 10-year as a proxy to gauge debt servicing payments. With the 10-year at 5%, the current servicing payment would be around $1.4 trillion, not very realistic in my view. Even at 3% the debt servicing sum would be a staggering $840 billion (far more than 2021's $636 billion defense budget). In fact, the U.S.'s total federal revenue is around $3.47 trillion, making a 3% debt servicing payment roughly 25% of the entire federal budget. At around its current 1.6% the U.S. will pay out about $450 billion in servicing payments. This is still an astoundingly large number, and we also need to consider that the debt is perpetually increasing due to the continuous budget deficit.

Furthermore, it's not just the federal debt. Total personal debt is at over $21 trillion, which is about $64,000 per citizen, vs. just about $25,600 in savings per family. It's pretty clear that the U.S. has a significant debt problem. This is why we're seeing a perpetual intermediate and long-term decline in the 10-year as well as in other key rates. The U.S. consumer, the government, and the corporation are all swamped in an unprecedented amount of debt, and the only way that this debt can be serviced effectively is through increasingly lower rates. The economy will not be able to grow or function effectively with moderately higher interest rates in my view. In fact, we saw this scenario play out towards the end of 2018 when the Fed was forced to pull a 180 on its monetary policy after trying to elevate the benchmark rate modestly.

The Bottom Line

There's likely a ceiling to how high-interest rates can go, and it's probably not too much higher form here. Moreover, if the market is not able to control interest rates, the Fed will very likely introduce further measures such as more easing, zero or even negative rate targets to suppress interest rates further. At the same time, inflation could go notably higher. Especially considering that the Fed may have limited resources outside of higher rates to combat the threat of inflation. In fact, if the Fed is forced to keep interest rates subdued due to enormous debt loads, inflation could run quite hot in future years. This creates a very favorable environment to own stocks, commodities, and other risk assets in. Therefore, we're very likely on the brink of another major move higher here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: This article expresses solely my opinions, is ...

more