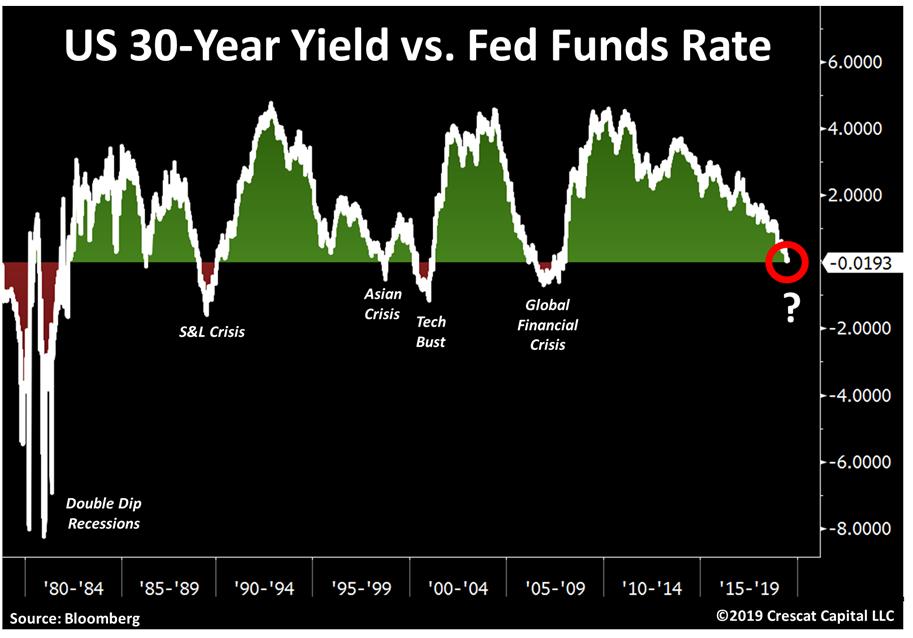

Charts That Matter - Wednesday, July 3

It’s official. US 30-year yield just inverted vs. the Fed funds rate! Same warning ahead of the GFC, tech bust, the Asian crisis, S&L crisis, and 1980’s double-dip recessions. The only false signal, 1986. (Tavi Costa)

We now have the entire US Treasury curve below the Fed overnight rate.

(Click on image to enlarge)

As world trade goes, so goes EM…( Variant Perception)

(Click on image to enlarge)

Challenger Job Cuts Add a Support Pillar to Gold Foundation — Steadily increasing Challenger job-cut announcements support expectations for Federal Reserve easing, pressuring the dollar and adding support to appreciating gold prices.

(Click on image to enlarge)

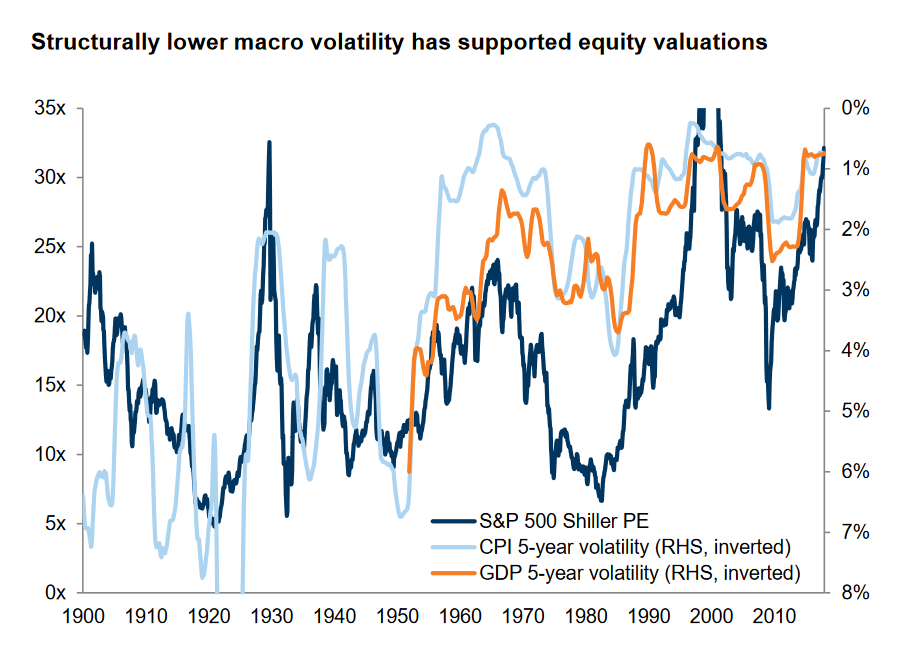

Lowflation has given a boost to valuations across assets

(Click on image to enlarge)