CARES Act: Why Quality Screening Is Now More Important Than Ever

The U.S. stimulus bill (the CARES Act) enacted on March 27, 2020, received significant attention for its support payments to individuals. However, it also has a significant impact on large corporations (see Exhibit 1).

(Click on image to enlarge)

This blog will take a closer look at two lending programs and their market impact within their respective segments.

CARES Act: Liquidity Where It’s Needed

The first program[i] is for loans and guarantees made through the U.S. Treasury or Federal Reserve for up to five years, at prevailing market rates prior to the outbreak. While this is welcome liquidity, it comes with a few restrictive covenants.

- Companies must maintain 90% of their pre-virus employment and may not pay dividends or repurchase stock until 12 months after the loan terminates.

- Only companies with “significant operations” and a “majority of employees” in the U.S. are eligible.

This means that companies that change their finance policies to access these loans may signal they have no other funding options available.

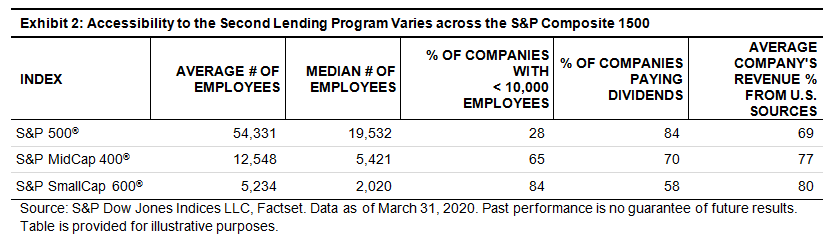

The U.S. Treasury will also provide financing[ii] to lenders to make direct loans at rates of 2% or less to businesses with 500-10,000 employees. Furthermore, for the first six months (or longer, at the Treasury’s discretion), no principal or interest shall be payable, though restrictions like those mentioned above remain in place here too. However, the distinction here is that the second program could significantly enhance the borrowing capacity of high-quality mid-sized companies, without needing to change their financing policies or signaling distress (given its accessibility through lenders or intermediaries).

This leads us to the following considerations.

- First, below-market rates are welcome from a liquidity perspective.

- Second, as we go down the market-cap scale, companies are more likely to have more than 50% of their employees based in the U.S., which would qualify them for this program.

- Lastly, most of these qualifying companies with 500-10,000 employees are well represented across the core U.S. size indices.

(Click on image to enlarge)

Quality Matters in Times of Stress

The S&P Quality Indices consider ROE, accruals ratio (operating asset efficiency), and financial leverage to select higher-quality constituents. Our quality indices broadly outperformed during the recent sell-offs, while remaining competitive in the subsequent rebound and the previous 12-month run.

(Click on image to enlarge)

Similarly in small caps, the S&P SmallCap 600’s historical benefits over the Russell 2000 show that the index can provide small-cap exposure but with better quality through the profitability screens utilized in the S&P SmallCap 600 methodology.

Fixed Income

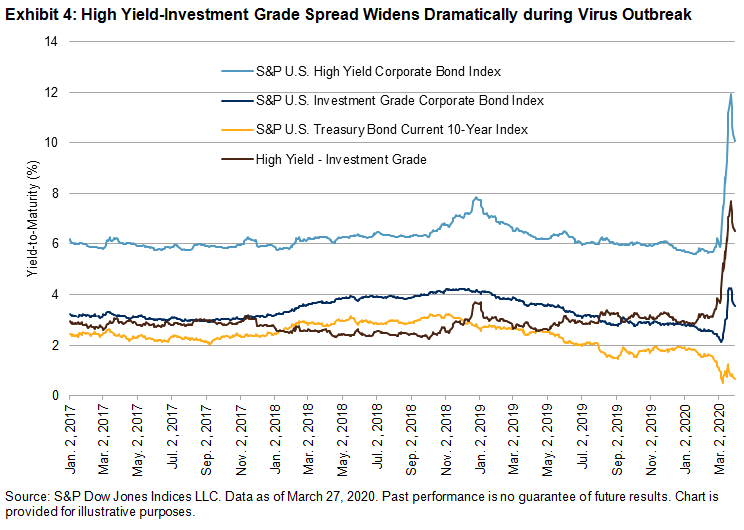

The bond market has long included its own proxy for quality, dividing assets into investment grade and high yield. The spread between the two has blown out recently, even with rates on Treasuries dropping. The Fed’s Primary and Secondary Market Corporate Credit Facilities (PMCCF and SMCCF), which are buying investment-grade bonds directly from issuers and in the market, has aided this flight to quality. The moves in yields and spread neatly illustrate the market’s updated expectations of enhanced survivability odds for investment-grade (quality) firms.

(Click on image to enlarge)

Perhaps, now it’s equities’ turn to focus their attention to where it’s needed most, i.e., quality!

[i] H.R. 116-748, Title IV, Sec 4003, (c)(2)

[ii] H.R. 116-748, Title IV, Sec 4003, (c)(3)(D)

The information provided is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Graphs and ...

more