Can An Inverted Yield Curve Cause A Recession?

from the St Louis Fed

-- this post authored by David Wheelock, Group Vice President and Deputy Director of Research

An inverted yield curve - or a situation in which market yields on shorter-term U.S. Treasury securities exceed those on longer-term securities - has been a remarkably consistent predictor of economic recessions. However, simply because inversions forecast recessions does not necessarily mean that inversions cause recessions. Why might a yield curve inversion cause economic activity to slow?

Banking and Yield Curve Inversions

One possible channel is through the banking system. Banks engage in maturity transformation. That is, on average, the loans in a typical bank’s portfolio have a longer term to maturity than the deposits and other funds they use to finance those loans. In essence, banks transform their short-term liabilities (such as deposits) into longer-term assets (such as business and consumer loans).

Normally, banks can profit on the spread between the yields on longer-term assets and the interest they pay on deposits and other short-term liabilities. However, bank profits get squeezed when short-term interest rates rise relative to the yields on long-term assets. This can lead banks to cut back on their lending, which, in turn, can put the brakes on economic activity.

Tightening Lending Standards

Recently, the Federal Reserve asked banks how their lending policies might change in response to a hypothetical moderate inversion of the yield curve.1 Many of those surveyed indicated that they would tighten lending standards or price terms on every major loan category.

When asked why they would do so, several potential reasons were given:

- An inversion could cause loans to be less profitable relative to the bank’s cost of funds.

- An inversion would cause their banks to be less risk tolerant.

- An inversion may signal a less favorable or more uncertain economic outlook.

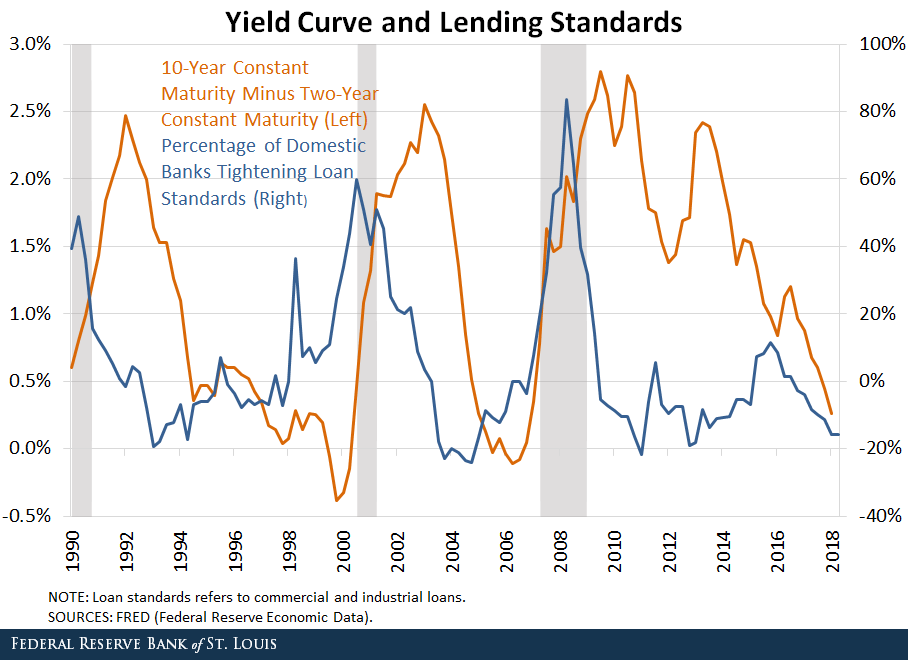

The figure below illustrates the tendency of banks to tighten lending terms when the yield curve inverts. It plots the yield on 10-year Treasury securities minus the yield on two-year securities.

Normally, the yield on 10-year securities exceeds the yield on two-year securities, reflecting the fact that the yield curve is usually upward sloping. The yield curve is downward sloping (or inverted) when the yields on shorter-term securities are higher than those on longer-term securities, as in 2000 and 2006. Both of those inversions were followed by the start of a recession within a few months.

The Fed has surveyed banks on their lending terms continuously since 1990.2 The chart shows that the net percentage of banks tightening their lending standards on commercial and industrial loans began to rise around the time that the yield curve inverted in 2000 and 2006.

Why is this important? Researchers have found that the economy tends to slow after banks tighten their lending standards, suggesting that an inversion of the yield curve could cause economic activity to slow by leading banks to reduce the supply of loans.3 Thus, an inverted yield curve might do more than predict a recession: It might actually cause one.

Notes and References

1 October 2018 Senior Loan Officer Opinion Survey on Bank Lending Practices.

2 The Fed also surveyed banks on their lending terms from 1967 to 1983.

3 Lown, Cara S.; Morgan, Donald P.; and Rohatgi, Sonali. “Listening to Loan Officers: The Impact of Commercial Credit Standards on Lending and Output." Federal Reserve Bank of New YorkEconomic Policy Review, July 2000. Also, Bassett, William F.; Chosak, Mary Beth; Driscoll, John C.; and Zakrajsek, Egon. “Changes in Bank Lending Standards and the Macroeconomy." Journal of Monetary Economics 2014, Vol. 62, pp. 23-40.

Additional Resources

- Dialogue with the Fed: Staying Ahead of the Yield Curve

- Regional Economist: The Risk of Yield Curve Inversion - and How to Avoid It

- On the Economy: The Yield Curve vs. Unemployment Rate in Predicting Recessions

Disclaimer: Views expressed are not necessarily those of the Federal Reserve Bank of St. Louis or of the Federal Reserve System.

No content is to be construed as investment advise and all ...

more