Bond Yields Tumble As Central Bank Jawboning Begins

It appears the recent surge in rates has finally 'triggered' the central bankers into action.

The first one out of the gate is ECB President Christine Lagarde, who said at an EU Parliament event this morning that The ECB is closely monitoring nominal bond yields to judge whether financing conditions in the euro area are favorable enough to support the economy during the pandemic.

“Within the broad-based set of indicators that we monitor to assess whether financing conditions are still favorable, risk-free overnight indexed swap rates and sovereign yields are particularly important,” Lagarde said.

“Banks use those yields as a reference when setting the price of their loans to households and firms,” she said in a speech on Monday.

“Accordingly, the ECB is closely monitoring the evolution of longer-term nominal bond yields.”

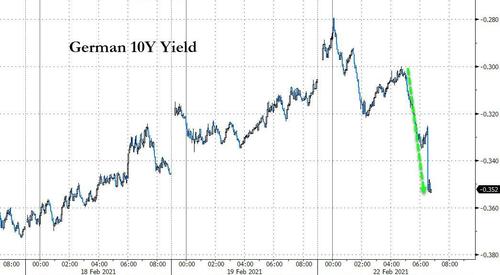

That triggered a plunge in Bund yields...

Source: Bloomberg

And that in turn dragged Treasury yields down (now lower on the day)...

Source: Bloomberg

Ironically, right before this initial jawboning, we asked:

What comes first

— zerohedge (@zerohedge) February 22, 2021

Notably, Treasury yields stalled at a critical resistance level.

Source: Bloomberg

Will Powell and his pals reinforce this "monitoring" narrative?

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more