BofA: We Are Witnessing The Biggest Asset Bubble Ever Created By A Central Bank

Back in March 2018, when commenting on what was then the 2nd longest central-bank induced bull market of all time (it is now the longest ever) Bank of America's CIO Michael Hartnett pointed out that "bull market leadership has been in assets that provide scarce “growth” & scarce “yield”. Specifically, the "deflation" assets, such as bonds, credit, growth stocks (315%), have massively outperformed inflation assets, e.g., commodities, cash, banks, value stocks (249%) since QE1. At the same time, US equities (269%) have massively outperformed non-US equities (106%) since the launch of QE1."

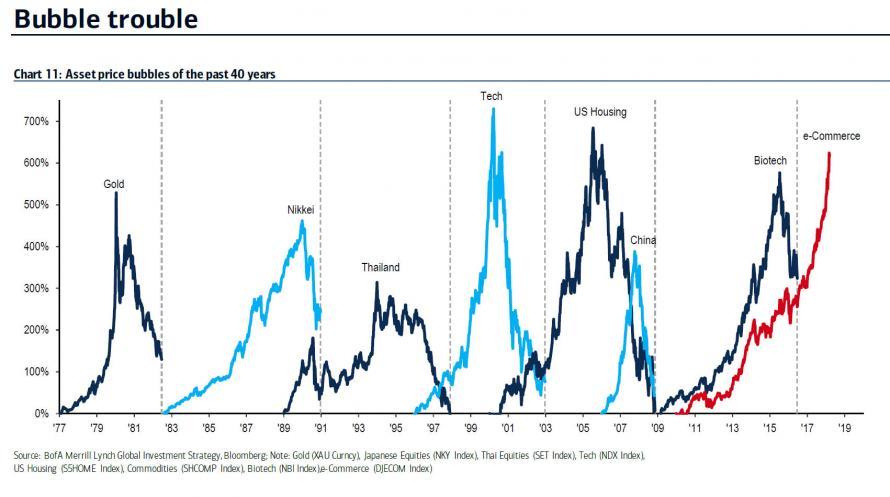

And, as happens every time the Fed tries to manage asset prices, it had blown another bubble: commenting on the hyperinflation in risk assets, Hartnett said that the "lowest interest rates in 5,000 years have guaranteed a melt-up trade in risk assets", which the strategist had called the Icarus Trade since late 2015, noting that the latest, "e-Commerce" bubble, which consists of AMZN, NFLX, GOOG, TWTR, EBAY, FB, is up 617% since the financial crisis, making it the 3rd largest bubble of the past 40 years".

(Click on image to enlarge)

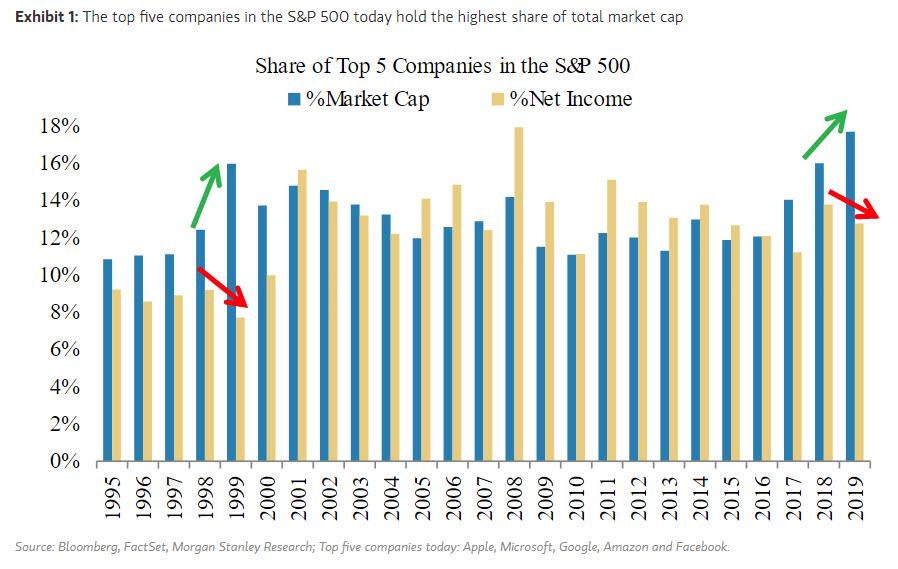

Fast forward two years, one failed attempt at normalizing interest rates, one QE4, and one historic P/E multiple expansion meltup later, when the same bull market leadership in "growth" assets has led to the unprecedented result that the top 5 stocks now account for a greater share of S&P500 market cap than ever before...

(Click on image to enlarge)

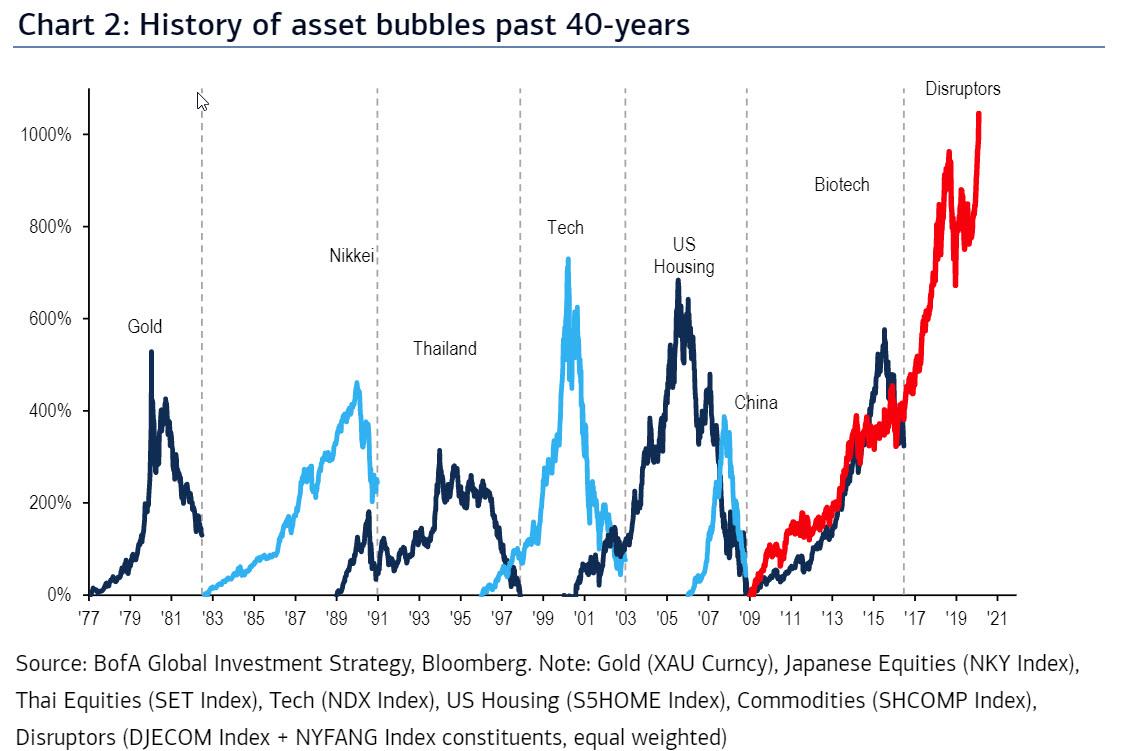

... and when what in 2018 was the third-largest bubble of all time only has - thanks to 800 rate cuts by central banks since the Lehman bankruptcy - now been rebranded to "e-Commerce" by BofA's Hartnett, and which as shown in the chart below has - after rising more than 1,000% from its crisis lows - become the single biggest asset bubble of all time.

(Click on image to enlarge)

Commenting on this biggest ever asset bubble in his latest Flow Show report, Hartnett explains it as follows:

... the US dollar off to best start to year since 2015, DXY threatening to breakup toward 104 post-GFC high… bullishly driven by positioning (consensus bearish US$), politics (probability of Trump or Bloomberg victory in US presidential election at fresh high of 77% according to poll aggregator Oddschecker.com), and bubble with global capital flowing to US tech disruption bubble.

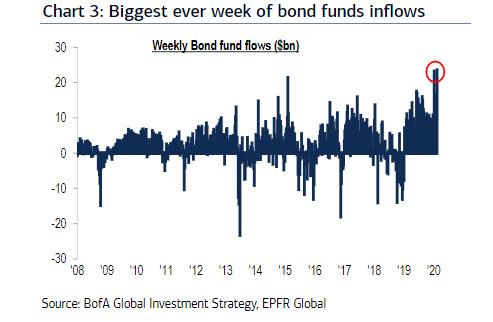

Ironically, and confirming the barbell strategy pursued by investors, even as global capital floods into the "growth" sector, a "twin bubble" continues to grow, with inflows into bonds seemingly neverending, and just this week investors poured the most money ever into IG corporate bonds ($13.4BN)...

(Click on image to enlarge)

... in addition to a $1.2BN inflow into tech funds, despite broader FTC "Big Tech" antitrust action into what is now America's least regulated sector:

(Click on image to enlarge)

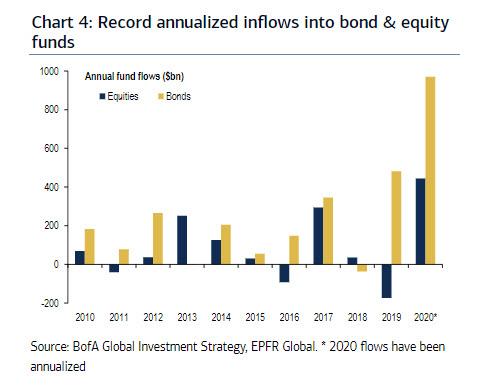

Meanwhile, easing COVID-19 fears have lent a strong weekly bid to HY corporate bonds ($3.4bn), EM equity ($2.7bn), & EM debt ($2.1bn). In short, investors appear to be buying anything that is not nailed down, resulting in record annualized inflows into bond and equity funds.

(Click on image to enlarge)

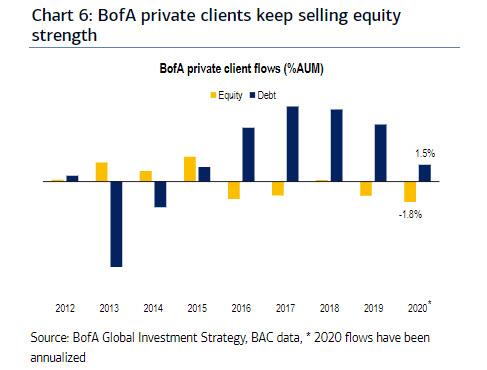

Of course, the bubble may be the biggest ever, but the action observed now is hardly new, and there is a familiar word to describe what is going on: distribution... as the smartest and richest money in the room - private clients - continue to quietly sell stocks to retail investors even as they buy more and more and more bonds.

(Click on image to enlarge)

Putting it all together, what does Hartnett - who like Morgan Stanley's Michael Wilson - has been reluctantly bullish into this meltup, think happens next, and when will he finally sell? His answer below:

We stay "irrationally bullish" in Q1: positioning not yet "euphoric" & Fed caught in "liquidity trap"; we expect rising probability of a "Minsky moment" to coincide with peak positioning & peak liquidity in Q2 triggering "big top" in risk assets; sell S&P500 when PE >20X, go short credit & stocks when new lows in bond yields & US$ appreciation becomes disorderly bearish signaling tighter Fed liquidity & sparking recession/default fears.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more