Be Careful What You Wish For

When the ECB was founded, it adopted inflation targeting with the implicit assumption that the purpose of the policy was to hold down inflation. In fact, the policy regime has mostly forced the ECB to try to raise inflation.

In 2020, the Fed adopted an average inflation targeting policy with the implicit assumption that it would be used to push inflation higher when at the zero bound. In fact, the policy may end up forcing the Fed to push inflation lower at the zero bound. One comment suggested that stocks were declining because of the fear that high inflation would lead to tight money. But the evidence doesn’t really support that view:

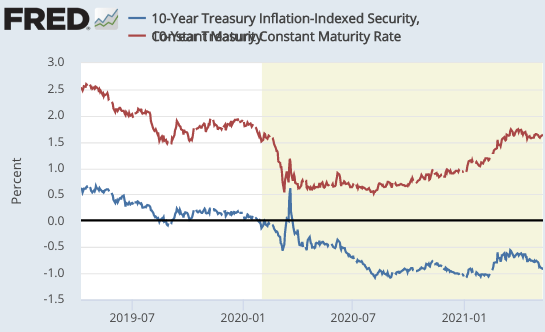

Notice that the rise in 10-year yields this year is all inflation premium, the real yield has not risen and remains deeply negative. Nominal interest rates are rising due to the Fisher effect, not fear of tighter money.

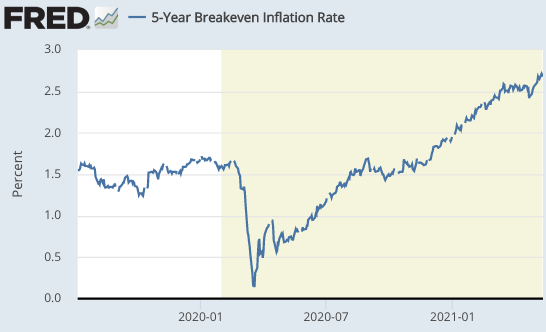

Admittedly, even real yields are not a foolproof indicator of changes in monetary policy (they can reflect growth expectations), but they are less unreliable than nominal yields. Whatever is causing the recent drop in stock prices, it is not a fear of tight money. The real yield on 5-year bonds is even more sensitive to monetary policy than the 10-year yield, and it’s falling even more sharply:

And 5-year TIPS spreads have risen sharply, to 2.72%. That implies about 2.4% PCE inflation over five years, more than enough to make up for the recent shortfall.

Monetary policy is either nearly right or too easy; it’s certainly not too tight. Notice that people investing in 5-year TIPS are guaranteed a negative 2% annual return. But it’s even worse. They have to pays taxes on their nominal return, so the actual after-tax return is even lower. What happened to equalizing tax rates on wage and investment income?