Basics: Bonds Versus Stocks

“If you want to get rich, buy stocks. If you want to stay rich, buy bonds.”--Anonymous

The late Barton Biggs’s Wealth, War and Wisdom asked if any investment at the start of the 20th century would still be there—worldwide and in any economic conditions—at the end. In searching for what is called a permanent “store of value,” he found not gold, real estate, stocks, bonds or Beanie Babies, but only land with water and animals. Except your neighbors will always have more guns.

Given Biggs’s findings, we have to accept some risk, but we can improve our odds by evaluating available information and lowering the chance of being wiped out. We know something about stock risk. What about bonds?

Companies and governments who need money can issue bonds, which are promises to pay interest until an expiration date. At that date, called the bond’s maturity, the bond ceases to exist and the issuer repays principal and remaining interest. Bonds come with short times to maturity or longer times, just as people do. For example, Tom’s Tomatoes issues bonds paying 4% and maturing in 2025. Bond Buyer buys $1,000 worth—bonds are typically bought and sold in $1,000 units—earning the right to $40 a year in interest payments until maturity, when the issuer will pay back the $1,000 and any remaining interest.

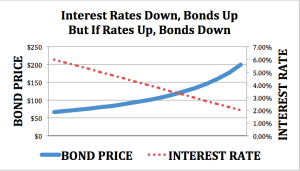

Once the bonds are sold for the first time, investors may buy and sell them on the bond market. They are subject to gain or loss due to interest rate changes and the financial health of the buyer. This chart shows the inverse relationship between bonds and interest rates:

If a bond at issuance pays 4% or $40 on $1,000, and interest rates fall (dotted line and right axis), the bond price rises (solid line, left axis). If rates fall to 2%, the bond should double to $200. Nice. But if rates rise, bond prices fall. If they jump to 6%, the bond drops 33% to $67. If the issuer’s financial health worsens, investors may fear possible default on the interest and principal payments. Sellers will outnumber buyers, and the bond price will decline until $40 is a high enough percentage to balance buyers and sellers. An existing owner who wants to sell takes a loss.

Yet despite these two risks, bonds hold two distinct advantages over stocks. First, if a company enters bankruptcy, bondholders are paid before anyone else—maybe not much, but more than the stockholder, who is almost always wiped out. Second, municipal issuers, as opposed to corporations, very rarely default. An expert tells me that even in the Great Depression, fewer than 3% of all municipal bond issuers defaulted on their interest payments.

There is no completely safe place for our money. Stocks and bonds, like crossing the street or choosing a spouse, both require analysis of risk and reward. The longer the investing runway, the better the odds for wisely chosen stocks. The shorter the time, the odds favor carefully selected bonds. Along the way, as in life, it’s all about balance.

Tom Jacobs is an Investment Advisor for separately managed accounts with Dallas’s Echelon Investment Management. You may reach him at more

Finance 101 at it's finest, thanks.

Nouriel Roubini may have a rodent proof safe which is about as safe as you can get. www.talkmarkets.com/.../summers-and-roubini-talk-negative-interest-rates-sound-logic-but-uncharted-waters But, seriously, bonds will help people sleep easier at night, IMO.