Bank Pulse: Bank Bond Issuance Points To A Change In The Funding Split

Image Source: Pixabay

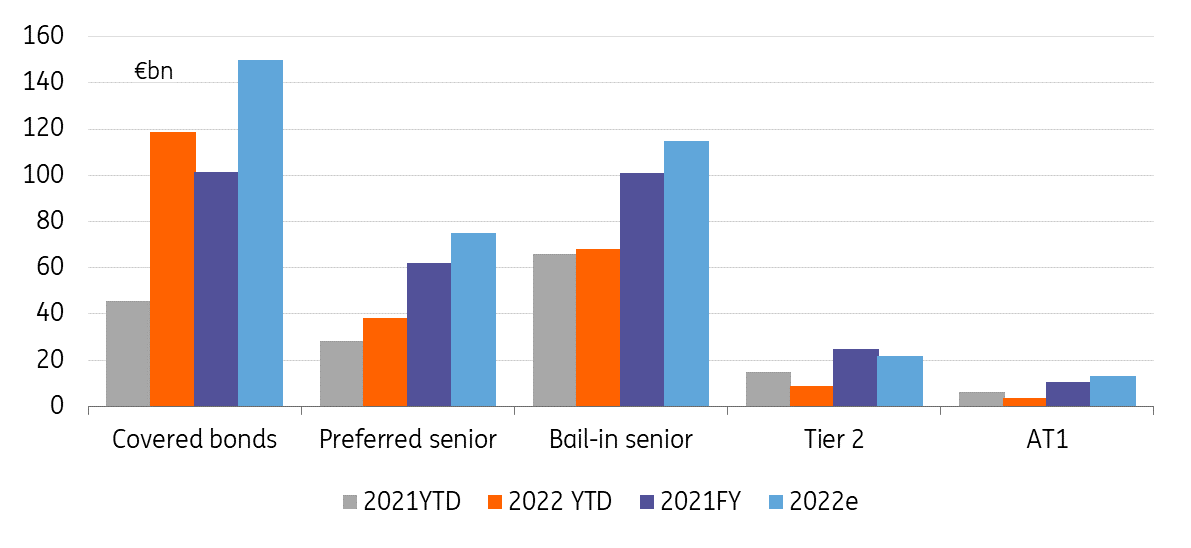

Banks have been active this year in bond markets, concentrating mostly on funding-driven issuance. Covered and preferred senior prints are running ahead of our forecasts, while bail-in senior and subordinated supply somewhat lags with the risk-off mode taking its toll. We are sticking to our forecasts for now.

A change in the bank bond supply composition this year

Banks have been active in bond markets this year with the year-to-date issuance running at €238bn in euro-denominated debt, ahead of the €161bn printed this time last year. That being said, we have seen a clear change in the composition of the debt that is being printed as compared to last year. The bulk of the increase comes in the form of covered debt followed by preferred senior unsecured paper. Bail-in senior runs a touch ahead of last year, while regulatory capital prints are clearly below the levels seen in 2021 YTD.

Banks are reacting to the substantial changes in the operating environment, alongside some regulatory changes in the covered bond side. Persistent inflation has led the central banks to start raising their reference rates faster than had been anticipated, and banks have sought to lock in still attractive longer-term debt levels where they still can. Some have likely also prepared for paying back part of their TLTRO-III funds in the form of early repayments and taken into account that part of the TLTROs mature in 2022. In addition, the risk-off mode has supported issuance in the funding-driven forms such as covered or preferred senior debt, at the expense of regulatory capital including Tier 2 or Additional Tier 1 debt.

Preferred senior and covered debt issuance ahead of last year

The YTD €38bn in preferred senior unsecured issuance is ahead of the €29bn issued in 2021 on a YTD basis. Spanish issuers, in particular, have been more active this year in preferred debt, printing €7bn this year compared with €2.75bn last year. French, Norwegian, and Swedish banks have also issued more preferred senior. In bail-in senior debt, the issuance of €68bn runs just ahead of last year’s level of €66bn. We have seen more deals from French, Canadian, Swiss, and Dutch issuers, while US, German and Spanish banks have been less active here. Covered bond issuance at €120bn is driven mostly by an increase from Canadian, French and German banks.

TLTRO funds remain a part of the bank funding equation for now

We consider that the aggressive increase in expectations for interest rate hikes has changed the early repayment dynamics completely for TLTROs. A combination of the uncertain economic outlook, substantially higher refinancing costs and the potential benefits from a higher deposit rate compared to the TLTRO interest rate make it look more interesting for banks to hold onto their TLTRO funds.

European banks still rely on €2,124bn of funding from the ECB’s funding program TLTRO-III, adjusting for the repayments this June. Of this, €66bn matures in 2022, €1,494bn in 2023, and €564bn in 2024, assuming these funds are kept until maturity. The ECB announced last week that banks will repay €74.1bn across the TLTRO-III tranches 1-10 as of 29 June 2022. Compared to the previous repayment opportunities, the total amount of repayments remain smaller than what banks repaid in September (€79bn) but higher than in March (€2bn) and December (€60bn). Early repayments are driven by a combination of the end of the easing measures (leverage ratio, collateral) and special interest rate periods, as well as refinancing and opportunistic considerations, in our view. The next repayment opportunities are in September and December 2022. Read more on the TLTRO-III dynamics in our report TLTRO-III: To repay or not to repay published on 15 June 2022.

Our base case is that the TLTRO-III program is unlikely to be extended or the terms to be further eased in the near term. Having said that, if market conditions make it more difficult for banks to refinance their TLTRO drawings next year, the ECB may seek to support bank funding conditions by, for example, offering a new LTRO or adding new tranches to the current program. In any case, we would expect that any new program would likely come with fewer attractive conditions attached.

We expect bank bond supply to reach €365bn this year

We are forecasting the full-year bank bond supply to increase to €365bn this year, from €300bn in 2021. So far 64% of the forecast has been realized, while last year at this time 54% of the full year supply had been issued.

Our forecast is split between €150bn in covered, €75bn in preferred senior, €115bn in bail-in senior, and €35bn in subordinated debt. The current supply is running somewhat ahead of our forecast in preferred senior and covered debt, and behind our estimates in bail-in senior and especially in subordinated. This is driven by the change in the composition of the bank bond issuance this year, due to the substantial changes in the operating environment. We revised our covered supply estimate higher earlier this year, but we stick to our estimates for senior debt for now. A realization of our subordinated debt forecast would necessitate the market prospects to improve.

Bank bond supply by category

Image Source: ING, IGM

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more