As ETF Fund Flows Surge, Don’t Fight The Fed’s Passive Investing Philosophy

Investing legend Marty Zweig famously declared, “don’t fight the Fed.” With the Fed now buying fixed-income ETFs and fund flows of index-based ETFs surging, Marty’s advice is proving timely. In this blog post, we review key index-based product performance leading up to the Fed’s intervention and detail the ETF fund flows that followed.

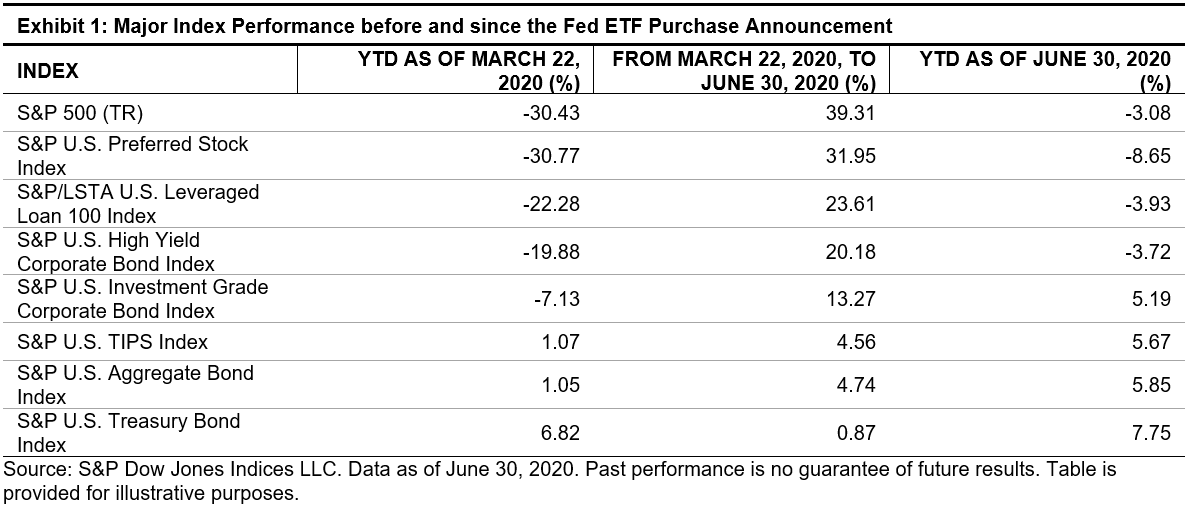

Back in March 2020, we discussed the liquidity impacts on fixed income ETFs.[1] We also recently looked at how the Fed’s intervention changed the structure of the secondary credit markets’ ETF assets and how trade volumes stepped in for declining broker-dealer balance sheets.[2] The Fed outlined several asset purchase schemes to stabilize the market; the fastest one put into action was direct purchases of fixed income ETFs that track major indices. Focusing on corporate bonds, the Fed committed to purchasing first investment-grade bonds, then high-yield bonds that comprised the ETFs. This drew a strong bid from the market, as investment-grade and high-yield bonds had their best quarter since 2009. This is precisely where many investors had taken the late Marty Zweig’s advice and simply followed the same passive approach by not fighting the Fed.

(Click on image to enlarge)

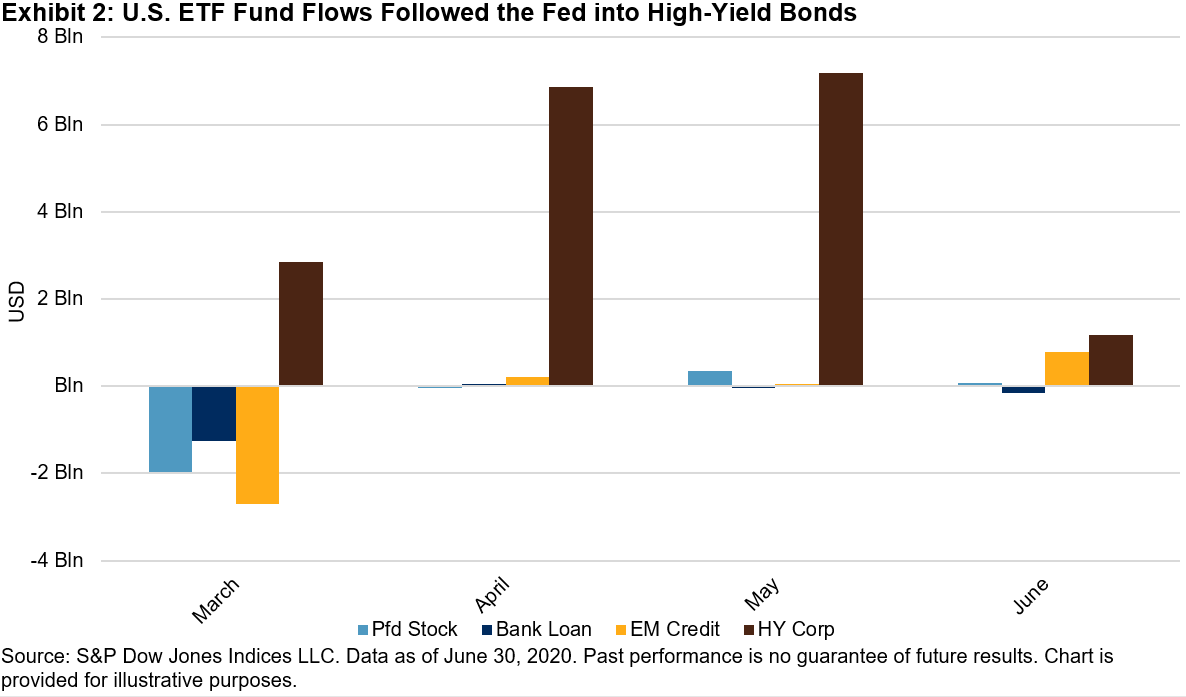

Asset flows surged in the markets where the Fed committed to buying, while other areas fared much more poorly. While the riskiest fixed income sectors saw steep outflows, only a few returned. Every core-plus sector saw steep outflows in March 2020. As the Fed committed to purchasing investment-grade bonds, enough demand was created to stop outflows and finish positive in March. Since then, investment-grade and high-yield bonds have subsequently attracted assets with the backing of the Fed, while emerging market debt experienced the deepest outflows.

(Click on image to enlarge)

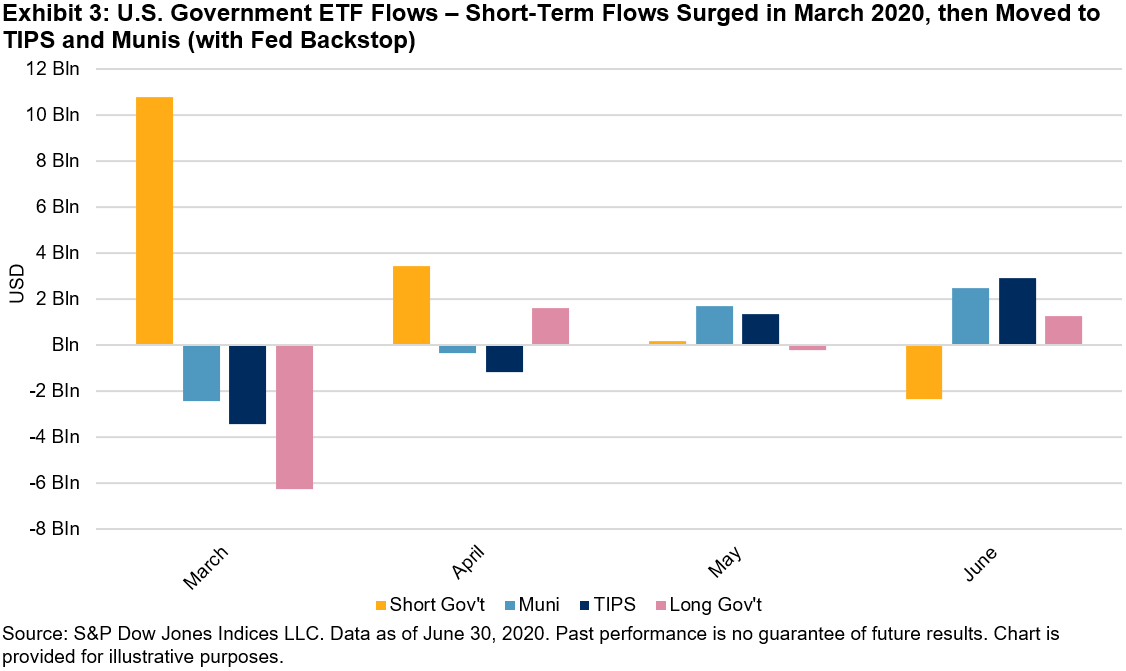

In less credit-sensitive sectors, fund flows also highlighted contrasts as the asset recovery took shape. March 2020 showed investors flocking to short-term government bonds, while long-term bonds bore the brunt of the sell-off. That trend maintained through April. Not until May did we see investors looking to other safe havens like municipals, as conditions eased (with the Fed’s backing this time through the Municipal Liquidity Facility), and inflation concerns took hold as federal government deficits ballooned.

(Click on image to enlarge)

With the Fed stepping in, the performance of key market indices reflected the benefit of these extraordinary actions. However, fund flows have shown that the Fed’s rising tide did not lift all boats. Investor behavior has shifted toward short-term and high-yield bonds and away from long-term bonds and other riskier asset classes like emerging market debt. As market volatility has subsided from the depths of the March lows, investors have also increasingly looked at munis and TIPS (inflation-linked) bonds as alternative sources of security. As the fund flows bear out, the trend of index-based investing in fixed income seems to be here to stay. If Marty were alive today, perhaps he’d be following this trend instead of the ticker tape he so often cited.

[1] Brian Luke: Liquidity Impacts on Fixed Income ETFs and Passive Investing. March 18, 2020

[2] Evan Gunter, Brian Luke: Credit Trends: How ETFs Contributed To Liquidity And Price Discovery In The Recent Market Dislocation. July 8, 2020

Disclaimer: For more information on the risk-adjusted performance of actively managed funds compared with their benchmarks in 2018, read our latest more