As Consumer Participation Weakens, Debt Market Risk Rises

I am going to take a look at how well US consumers are doing using some common retail measures. I will also look at how much debt consumers have and discuss whether consumers can keep up their spending levels. Consumer spending makes up the majority of US economic transactions, so tracking consumers is important in determining future economic growth patterns.

Consumer Debt – Mortgages

Consumer debt service payments as a percentage of disposable income appears to be favorably balanced against previous economic cycles, when examine thusly.

It appears that consumers are not painting themselves into a corner through rising credit payments as a percentage of income. However, this is not the full story on consumer debt for two reasons.

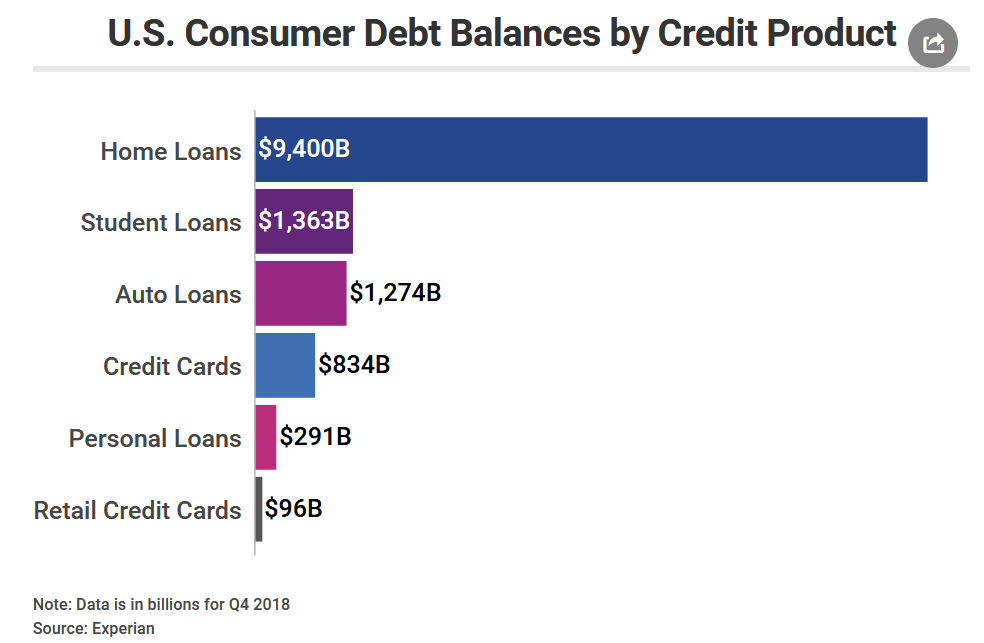

First, the biggest credit payment for most consumers right now is their mortgage, per Experian.

Source: Experian

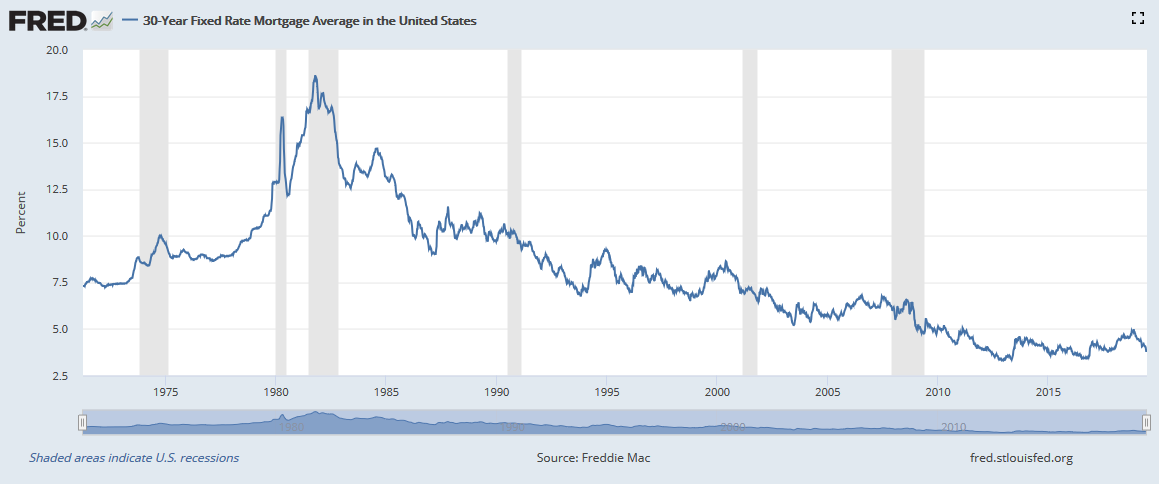

Mortgage interest rates are at 30 year lows and have been there for quite some time. If interest rates rise, consumers will see a significant spike in their mortgage service monthly obligation.

This will be true for new home buyers as well as existing homeowners with adjustable rate loans. In ARMs as they are known, borrowers often get in for low introductory fixed rates only to have their interest costs rise substantially between year 1 and 2 of the loan. Those who remember the mortgage debacle of the last recession will understand the powerful impact that increases in adjustable rate mortgages can have on the financial liquidity of the economy.

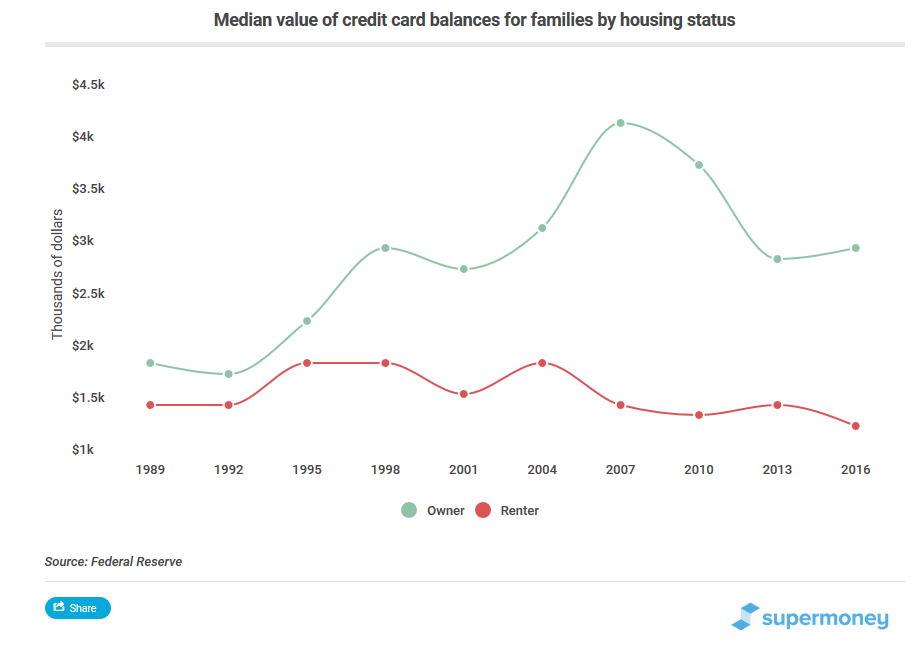

Consumer Credit Card Debt Risk Rising

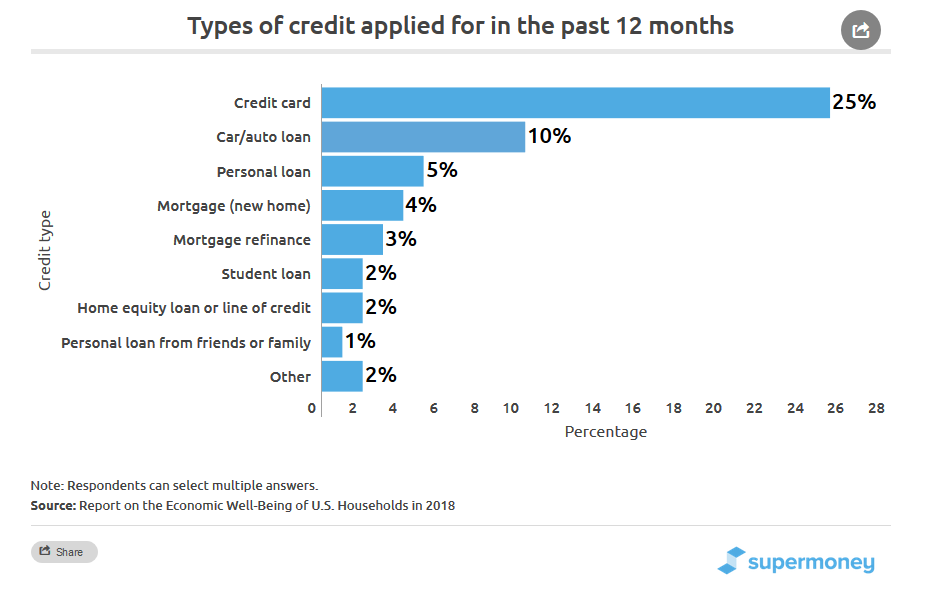

The second aspect of consumer debt that isn’t shown in the disposable income chart above are credit cards. Credit card applications account for the largest increase in credit applications in the past year by a wide margin.

Source: Supermoney

Analysts of the credit card industry note that the minimum payments on credit cards are below the typical interest rate charges. Meaning, making only the minimum required payments increases total interest charges over time. Even though consumers are able to service their credit cards now, they are falling farther and farther behind their debt balances as shown in the following Consumer Debt Trends graphic from Experian.

You can also see that the credit issuers are happy to increase available credit on existing accounts, to the tune of $4.1 trillion. They are offsetting the increasing risk of higher balances; however, by charging higher interest rates. This is a sign that the credit issuers see higher overall risk in their customer portfolio as the overall debt levels rise.

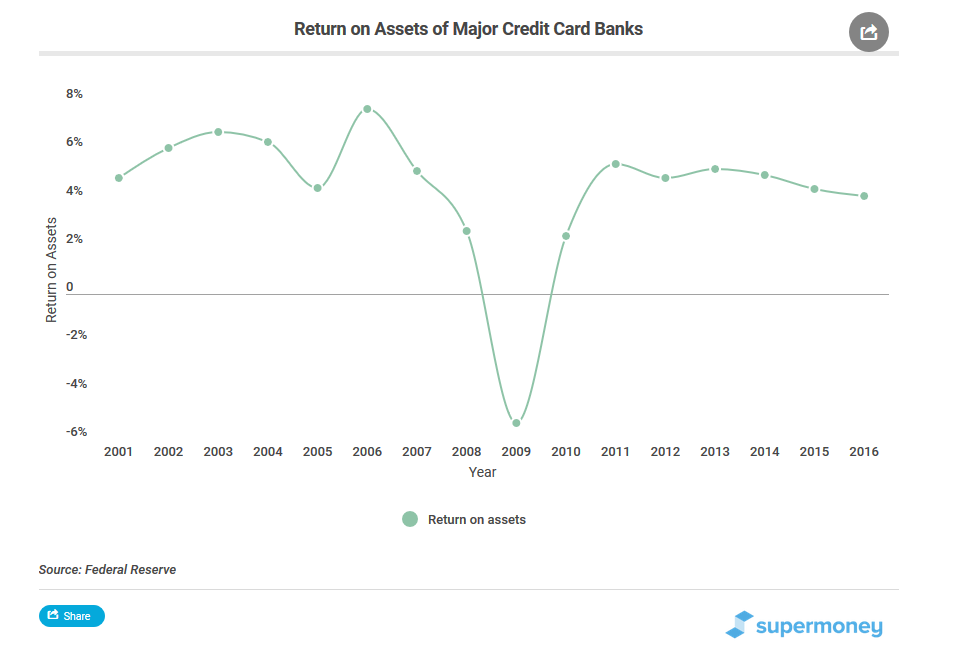

Despite raising their rates, credit card banks are seeing reduced return on asset levels.

When you consider the rising credit balances combined with minimum fees that don’t pay off principal, credit card debt can be a huge ticking time bomb in the consumer economy. Further, record low mortgage have helped cover up for the rising credit balances. In fact, the largest users of credit card debt are home owners with a mortgage.

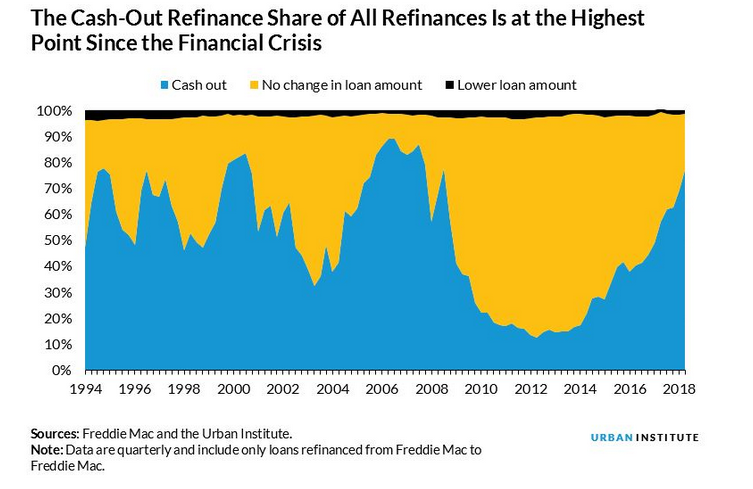

Homeowners with other debts are refinancing their homes to pay it off, which the following two charts illustrate. First, cash-out refinancings are at their highest level since the previous mortgage crisis.

Source: Urban Institute

And second, the biggest reason for refinancing a home is to pay off other debts.

Source: Freddie Mac

Despite the fact that consumers are able to finance their current debt burdens, any change in interest rates or a general economic slowdown leading to job loss could change the current debt picture dramatically. That is why it is important to consider how the picture of consumer debt health may change in the near future.

Consumer Spending

Consumer spending trends paint a much clearer picture of consumers ability to participate in the economy going forward. Let’s start with 1st quarter retail sales.

Source: Census

Total retail sales increased only 2 percent from the same 1st quarter period a year ago. Notice in the slowing trend in growth in the bottom-right quarter for the previous 5 quarters, from 5.5% YoY in 1st quarter 2018 to 2% YoY in Q1 2019. It is clear that consumer spending is slowing down.

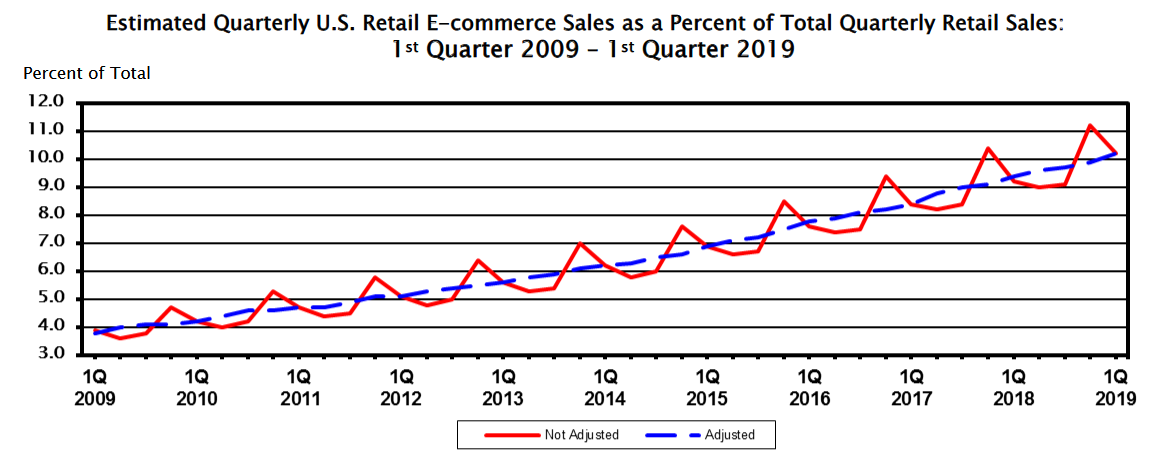

Now let’s consider e-commerce growth for a moment from the same census report.

Net sales for e-commerce (versus brick and mortar) have risen, as a percent of overall quarterly sales, since 2009. This phenomenon has often been credited with the failures of retail outlets over the last several years. But the census data, when both artifacts presented above are taken together, really show that the rise in e-commerce has not been enough to offset the overall retail sales rates declines in the US.

Putting debt and spending together, it seems clear that the American consumer is spending less while dealing with higher debts. Debt payments as a percentage of disposable income has not crossed an historic Rubicon yet. But this metric ignores the impact on overall debt growth supported by historically low interest rates and increasingly minimalist credit repayment terms.

Worker Pay Trends

Lurking behind the typical discussion on consumer debt and spending is how much of the productive economy are workers earning. If consumers are expected to support the economy moving forward, their wages need to grow in parallel with expectations on their spending growth.

The chart above shows that the share consumers are making from the gross domestic income has fallen for over 40 years. When it comes to projecting future consumer participation in the economy, it would make sense to reduce the percentage that consumers spend and therefore contribute to economic production.

It would seem an economist would not project increases in consumer spending given the protracted trend we see in the chart from FRED above, unless interest rates were expected to continue to fall further. Or a debt jubilee policy is expected to be enacted the government. While the former could happen, it is somewhat unlikely given the record debt levels across the public and private sectors of the economy.

The latter is highly unlikely to happen in the near future unless some sort of debt-based economic collapse becomes imminent and there are no other choices left on the policy-makers table. In other words, last resort only.

Conclusions

What I expect to happen moving forward is this. Consumers will reach a breaking point when their falling percentage of take home pay meets some equilibrium point with their rising debt levels. Here is why that will must happen eventually.

Mortgage interest levels cannot go much lower, they are already near the lower bound. There is much more room for interest rates to go up, especially given debt saturation levels across all areas of the economy: corporate, national, and personal.

Belief in the solvency of the US government, for example, is clearly being challenged by the yield curve inversion currently going on in most treasury yield pairs. Such an inversion has almost always predicted an economic recession in the US. One would expect a recession to cause an increase in loan defaults, unemployment levels, and therefore eventually also interest rates as economic risk increases.

Rising interest rates would cascade the problems of consumers participating in the economy as well as paying off past debts already incurred.

The credit card companies don’t really have any room to move monthly payments much lower without sacrificing interest incomes needed to sufficiently pay their bills. And any such move would surely damage consumer’s ability to ever move out of debt to their creditors.

The likely coming consumer debt defaults don’t bode well for banks and mortgage lenders.