All Aboard The Reflation Train?

Last week I warned of a tipping point in financial markets but also contrasted it with potential for a return of the reflation trade. Judging by the price action since, investors have opted to step back from the brink. The dollar finally has found some support—aided by PBoC intervention—bond yields have increased and stocks have rebounded modestly. One week does not make a trend, but the path toward a new reflation trade is simple. The dip in U.S. core inflation is temporary and political uncertainty will fade, prompting investors to focus on the bright side. If so, late-comers to the trend of a weaker dollar and lower yields are in for a rude awakening. By Q1, markets could be looking at a White House pushing through tax cuts; hurricane rebuilding will be underway—perhaps boosted by bipartisan support for infrastructure spending—inflation is rising, and the Fed has re-started its hiking cycle. I am not sure that I believe in this version of the world, but the implications are clear if you do. Bonds should be sold aggressively, the dollar is a buy—in particular against the euro and the yen—and domestic U.S. growth stocks, mainly financials, should be added to global equity portfolios.

Believing in reflation?

Bloomberg’s resident macro geek Cameron Crise kept his cool as the hurricanes were battering the U.S. east coast when he said that:

“Last week bore all the hallmarks of a towel-chucking exercise from the few remaining dollar bulls and bond bears that remain alive. (...) if you’re trading [long bonds] on the basis of the hurricane impact staying the Fed’s hand, be very careful, particularly with so little priced for the future.”

Despite the wobble at the end of last week’s trading, I have to concede this round to Cameron.

Looking beyond the potentially exaggerated hit from Harvey and Irma, other indicators also support the idea that it is time to fade the rally in bonds. Most of the positive economic catalysts from Mr. Trump’s presidency arguably has been priced out of the market. COT data show that punters have increased their exposure to U.S. duration to a near-extreme level. Mean reversion usually follows. Sentiment also changed last week with the news that bipartisan support for a growth-friendly tax reform is being forged. Hope is a dangerous strategy, but given how extended positioning on bonds is, it won’t take much for markets to run with this story.

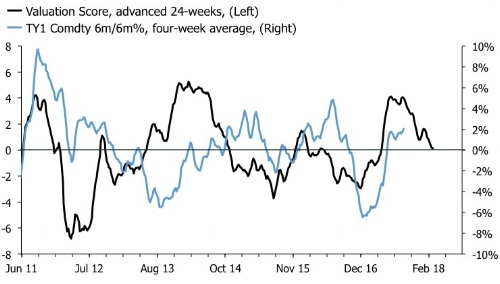

The first chart below shows that my in-house valuation score for the U.S. 10y futures contract also signals downside risk. Trailing returns have increased, but the forward-looking index has rolled over. Bond traders with a large net long position should take note; it might be difficult to squeeze this lemon much further this year.

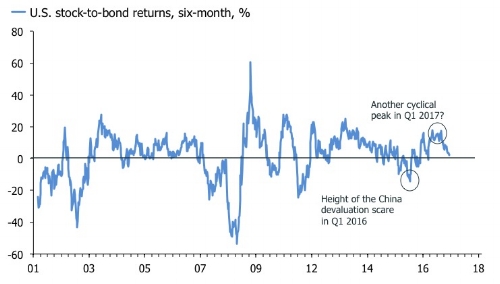

The second chart shows that stock-to-bond returns in the U.S. have rolled over sharply since the start of the year, a story which is corroborated if we plot the same data in Germany. Both of these indicators, however, suffer from a glaring flaw. They tend to get more extreme before they mean-revert. In other words; yes, my valuation score suggests that bond returns will roll over soon, but it usually weakens further before it is time to hit the trigger. This point is even clearer with the stock-to-bond ratio. All it is currently saying is that bond returns now are neutral relative to stocks on a six-month basis. What if they have to outperform for an extended period before returns mean-revert?

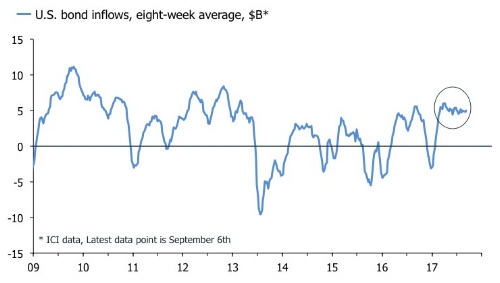

I am tempted to offer a similar interpretation of the ICI flow data. My third chart shows that U.S. bond inflows have been stable since the beginning of the year when they rebounded as markets priced out the Trumpflation story. It’s possible that momentum slowed last week—we won’t know until we get the update next week—but this chart doesn’t exactly provide evidence to suggest that investors are souring on the long bond.

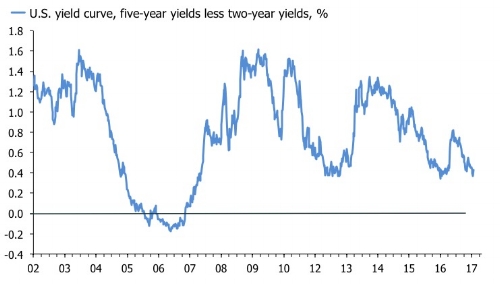

Show me the steepener

A bet on reflation—and a stronger dollar—also mean that investors will have to tackle another conundrum. What happens if the Fed is back in business? Up until this point, higher short-term rates in the U.S. have been associated with a flatter yield curve. This is not exactly how a reflation trade is supposed to look, which leaves reflation-chasing investors with a challenging story-telling exercise. They need come up with a version of the world in which the curve steepens as the Fed moves. Assuming the FOMC continues to move slowly and Washington delivers on tax reform and infrastructure stimulus, this should be possible. But it is also a story that requires a lot of faith. If Washington unleashes fiscal stimulus, the Fed risks getting caught behind the curve. It usually does not end well, if the Federales have to scramble to catch up.

A controversial alternative is that the Fed kicks back from the table and reverts to the strategy of letting the economy “run hot.” I would have discounted this notion a few weeks ago, but with the uncertainty over key FOMC positions at the moment, nothing can be ruled out. Another notion is that rate hikes and reduced QE outside the U.S. will do the heavy lifting. But that also requires us to tell a story in which curves steepen as central banks tighten the screws. A world where the U.S. 10-year yields rise as the Fed hikes, but the curve remains flat—a parallel shift—probably is the best bet at this point. But is that a reflation-story? I am not so sure.

Just give me some ideas

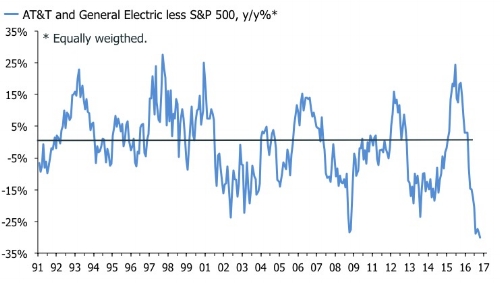

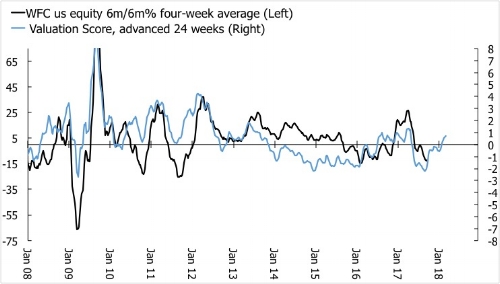

In the portfolio, performance remained lackluster in the first two weeks of September, extending the poor run since May. Last week’s big news was that star manager Hugh Hendry is throwing in the towel on his Eclectica fund. I can’t afford to do the same, but I agree with Mr. Hendry that it has been a harrowing summer. My two final charts show one idea that is currently being implemented—but not working—and one which I am contemplating. Mean-reversion is one of the most powerful rules in finance and economics. But I wonder whether it applies to GE and AT&T. Both are cheap outright and versus the market, but once passive fund vehicles start dumping underperforming stocks, things quickly go from silly to insane. Finally, I offer a treat for the reflation-trade hunters in the form of a buy-signal on Wells Fargo. It was a good horse for me earlier in the year, and I am thinking about a smash and grab for a rebound. But that begs the question I started with; is now really the time to jump aboard the reflation train?

Disclosure: None