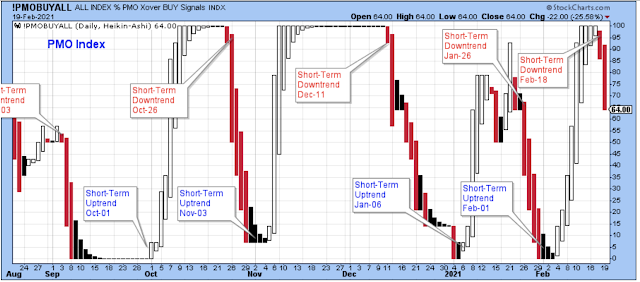

A New Short-Term Downtrend

The Short-Term Trend

It looks like a new short-term downtrend started on Thursday, however my confidence in this new downtrend is low because of the market strength on Friday that occurred despite the big red bar shown below.

The 10-day call/put ratio looks to be confirming the new downtrend. It is not so clear, though, because this is a slower moving 10-day average and can't keep up with a market experiencing volatility. Stocks were very weak on Wednesday and Thursday, but then showed strength on Friday, which is the opposite of what this index shows.

The bullish percents shown below were much more in sync with the market than the 10-day call/put shown above. The bullish percents were aligned with the market when they pointed decisively lower on Wednesday and Thursday and then reversed higher on Friday when there was some buying in the market.

I should point out that one reason to use the bullish percents is that they often reveal the true nature of the broader market, as opposed to the major indexes that can be dominated by a much smaller number of large-cap stocks.

Here is a look at the S&P 500 equal-weighted index. Based on the price bars it doesn't look like a downtrend, but with the stochastic at the top of the range, we at least know that now isn't the time for aggressive buying. I'll be looking for opportunities to reduce equity exposure by a bit in order to be prepared if the market follows through to the downside.

I marked Friday's trading range low as a line in the sand to tell me which way this market is headed in the coming week. I'll raise a bit more cash by selling laggards, if we close below this level.

The transports pushed to new highs on Friday. This serves as more evidence that the market may not be ready to pull back, and also evidence that the economy is doing decently, considering the economic stress of the pandemic.

Fresh new highs for these cyclicals also reveal strength in the economy and stocks. (Also, I suspect there is continued rotation out of high-PE tech stocks.)

This is my favorite group, and they recovered very nicely on Friday with a good AMAT earnings report.

Banks have decisively broken to new highs.

I'm a believer that this market is headed higher (although not in a straight line), and I also continue to believe that we will see a new set of market-leading stocks.

The Longer-Term Outlook

The ECRI index looks like it has finally started to top out. In the weeks ahead, I will be listening carefully to what the people at this economic institute have to say about the future of the economy.

10-year yields were the big story of this past week. I believe that strong bull markets are accompanied by rising long-term rates, so I see this as good news for stocks. But I also believe that it plays a large part in the rotation among industrial sectors as the bull market proceeds.

Early in the cycle, small-caps with highly leveraged balance sheets perform the best, but then they are replaced by the larger-cap stocks that have the capacity to supply the needs of the expanding economy. Then down the road, the stocks that are the least impacted by rising rates and those with the strongest balance sheets will be the leaders.

I'm still a believer in this group, and I think that a powerful base is developing that may be very profitable. I'm not a buyer yet. I'm watching and waiting.

Outlook Summary

- The short-term trend is down for stock prices as of Feb. 18, and we are in a new downtrend.

- Contrarian sentiment is unfavorable for stock prices as of Nov. 14.

- The economy is in expansion as of Sept. 19.

- The medium-term trend for treasury bonds is down as of Oct. 10 (prices lower, yields higher).

Disclaimer: I am not a registered investment adviser. My comments reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, sell, ...

more