A Cheap Bet On Inflation

“If I seem unduly clear to you, you must have misunderstood what I said” was Fed chair Alan Greenspan’s response during testimony to the Senate in 1987. Transparent communication has come a long way since then. Greenspan continued the policy of obfuscating responses, reflecting a belief that it improved the Fed’s operating flexibility by disguising mistakes. This inspired Secrets of the Temple: How the Federal Reserve Runs the Country, William Greider’s 1989 scripture describing faith-based monetary policy.

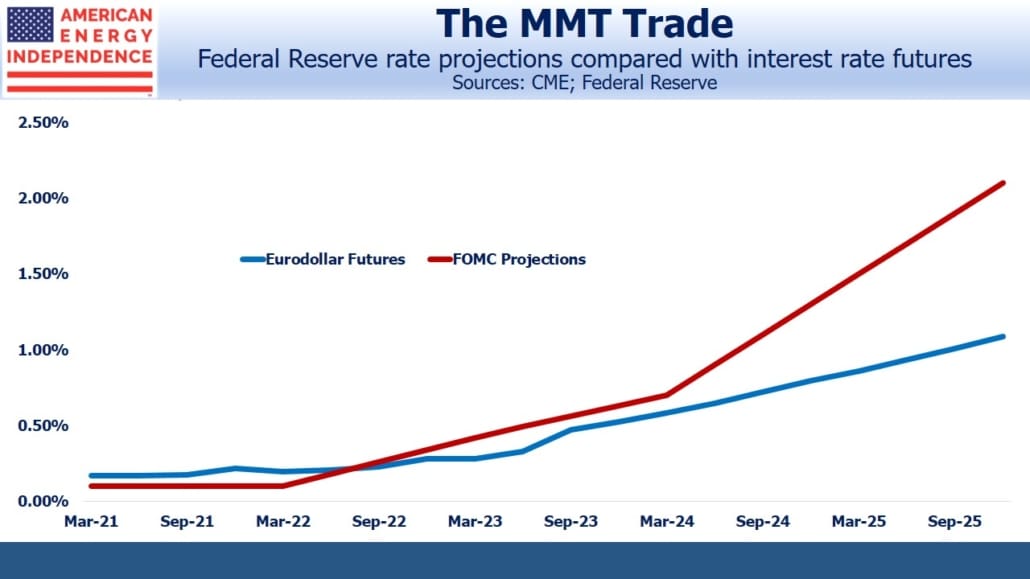

Today, the Fed’s projections are public. Their meeting minutes are published. The mystery has gone, although they still are the most important market participant. Transparency allows for comparison between market forecasts of interest rates and the Fed’s. Of course, the latter has the advantage of being able to make their forecasts correct through their actions, should they be so moved. Fortunately, the Federal Open Market Committee (FOMC) is not burdened with excess vanity, so serially inaccurate interest rate projections do not bother them.

In recent years it’s been mildly amusing, in a nerdy sort of way, to show how the FOMC’s long term forecasts for inflation and the Fed Funds rate have followed bond yields lower, conceding the market’s prescience. Fixed income investors have been ahead of this for years, exhibiting greater accuracy about Fed policy than the FOMC itself (see Bond Market Looks Past Fed). Covid made such games irrelevant, but as markets look beyond the pandemic, revisiting FOMC Projection Materials is becoming worthwhile again.

In August, Fed chair Powell gave a speech where he addressed persistently low inflation and how this had caused FOMC members to continually lower their rate forecasts. He explained how 2% inflation remained their definition of price stability, but since recessions typically cause it to undershoot, the FOMC would henceforth be more tolerant of greater than 2% during a strong economy. The inference, reflected in subsequent FOMC projection materials, is that short term rates will remain low for a long time, at least long enough for inflation to exceed 2%.

The chart compares the futures market with the FOMC’s forecasts. There is some judgment involved – the FOMC provides annual estimates through 2023 followed by a long-term assumption. The chart assumes that the long run is five years away. The market, as has been the case for years, is assuming lower rates than the FOMC.

Rates probably will stay low. Betting on higher inflation has been a fool’s game for longer than the average investor’s career. But these are unusual times. M2 money supply growth is 24%, higher even than when we were trying to whip inflation in the 70s and 80s. The fiscal outlook is as bad as ever, with debt projected to exceed the wartime highs of 1945, and stay there.

Modern Monetary Theory (MMT) as explained by Stephanie Kelton in The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy, holds that deficits don’t matter until they cause inflation. MMT has been widely panned by mainstream economists and isn’t regarded as a serious framework for fiscal policy. But the reality is that deficit hawks win few votes nowadays. We are, in truth, already pursuing the unlimited government spending that MMT advocates. Higher inflation is the only remaining obstacle, as we noted on Sunday in Deficit Spending May Yet Cause Inflation.

Low inflation remains likely, so betting against this is unbelievably cheap. The eurodollar futures curve offers precise forecasts of short-term interest rates, which in 2022 are expected to rise only 0.06%; that is, the spread between the December ‘21 and December ‘22 futures contracts is 0.06%.

Suppose that the economy emerges from Covid by the spring, as the vaccines allow a return to our previous lives. Consider whether a desire to live for the present promotes a vigorous economic rebound, as people catch up on experiences, trips and visits long delayed. The Roaring 20s followed the 1918 Great Influenza, although the still fresh horrors of World War I also played a significant role in the zeitgeist.

If inflation does pop above 2% next year, markets will start looking more carefully at near-zero Fed Funds and its longevity. No rate hike until 2023 will look to some like an awfully long time. The 0.06% spread between the December ‘21 and December ‘22 futures contracts could easily move to 0.25%, still representing only a single rate hike over that year.

The question is whether the odds offered by the market are sufficiently different from the odds of such happening, the minimum criteria to justify a trade. The money market curve is unlikely to invert, so the loss if nothing happens is a few basis points. The risk/return on this trade is a long way from 50/50, but the odds of an inflation jump are low too. Call it the MMT trade.

Some investors are already contemplating higher inflation. Bitcoin buyers are among them. There are cheaper ways, with well-defined downside, to express such a view. The eurodollar futures curve is one of the best. Your blogger has already initiated this trade.

Disclosure: We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track ...

more