7Y Treasuries Price At Record Low Yield Despite Incoming Supply Flood

Following two spectacular coupon auctions, with a surge in buyside demand for both the 2Y and 5Y Treasury auctions held on Monday, moments ago the Treasury sold $35BN in the week's final coupon issuance in this truncated week, which priced at a yield of 0.525%, tailing the When Issued 0.524% by 0.1bps, if well below last month's 0.68% and the lowest 5Y auction yield on record.

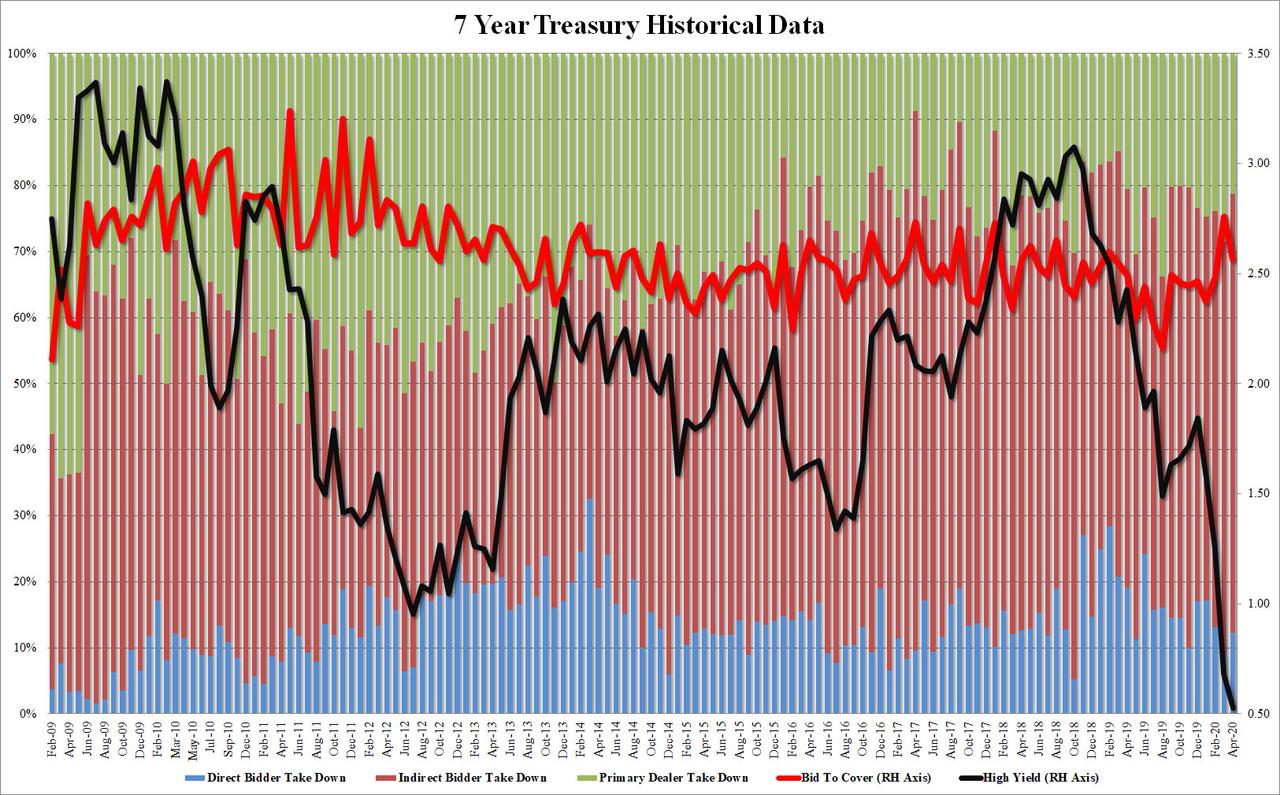

Unlike yesterday's remarkable 2Y auction which saw the Bid to Cover surge to a 6 year high, the internals today were not nearly as pretty, with the BTC dropping to 2.565 from last month's 2.758, although in fairness that was the highest ratio since Jan 2018 so it was hardly concerning. Indeed, the six auction average of 2.50 was below the April bid to cover.

Finally, and once again confounding Lloyd Blankfein, there was no shortage of foreign buyers, with Indirects taking down 66.45%, the most since November, and with the Direct takedown also rising from the 9.1% in March to 12.3%, Dealers were left with 21.3% of the auction, the lowest also since November.

(Click on image to enlarge)

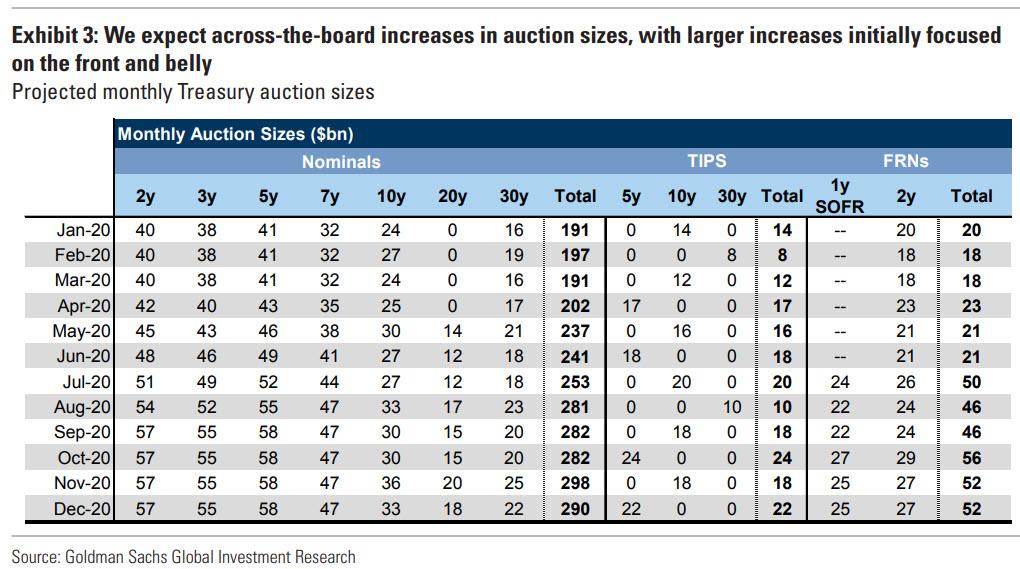

Overall, this was a solid auction especially after today's rally across the curve, and hardly indicative of buyers who are worried about digesting the record Treasury supply tsunami headed for the US as $4 trillion in total debt issuance this year means far higher bond auction sizes arrive as soon as May, according to Goldman.

(Click on image to enlarge)

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more