5Y Auction Treasury Prices At Lowest Yield Ever Despite Sharp Foreign Buyer Pullback

If yesterday's tailing 2Y auction was more of a shot in the dark, with an avalanche of new issuance coming down the pipe and was hardly indicative of what future demand will look like, the same can be said for today's 5Y auction, even though unlike the 2Y, there was little one can say to criticize today's sale of $41 billion in 5Y paper.

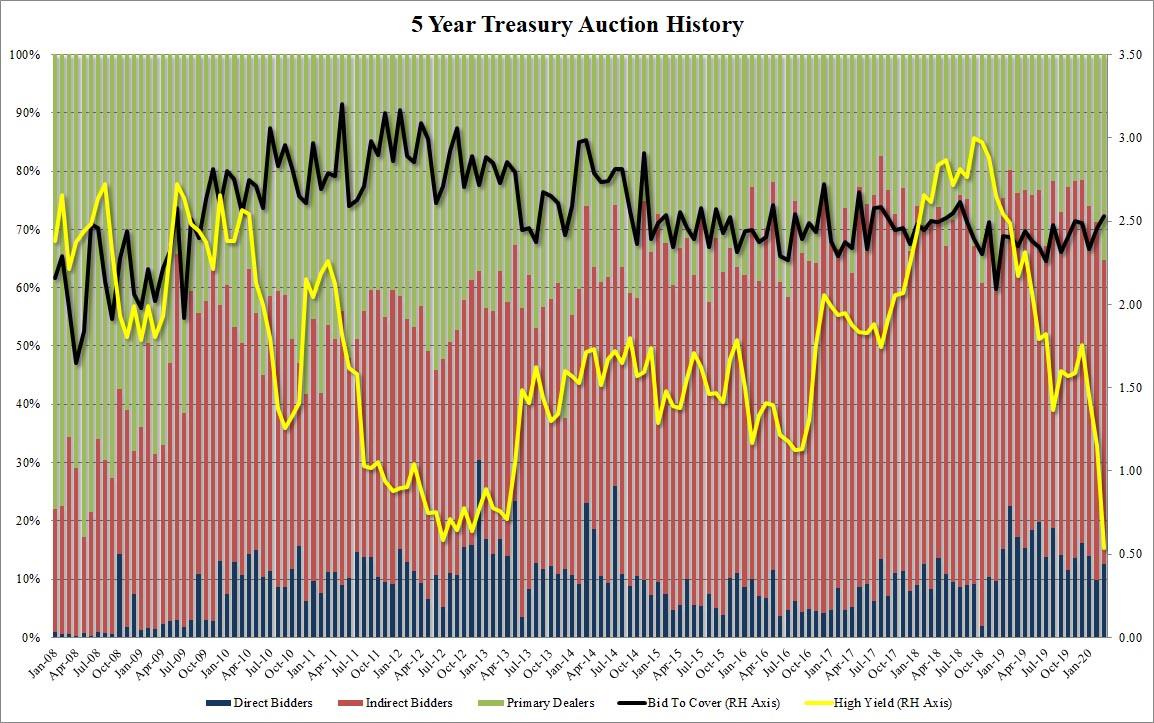

Let's start at the top: the yield on today's auction, which was 0.535%, was not only sharply below the February 1.15%, but was also below the lowest on record, which was recorded in July 2012 when it hit 0.58%. The auction also stopped through the When Issued by 1.5bps, showing demand coming into the auction was quite high despite today's torrid risk rally.

The bid to cover was also impressive, jumping from 2.46 to 2.53, the highest since July 2018.

That said, the internals left a bit to be desired, with the Indirect takedown down from 61.5% to 52.1%, which was the lowest since August of 2015. And with foreign buyers stepping away, and Directs taking down 12.6%, slightly above last month's 9.8% if below the 6-auction average of 13.2%, it meant that Primary Dealers had to jump, and took down 35.3%, the most since Dec 2018.

Yet even despite the reshuffling in the buyer composition, the auction was clearly very strong and helped push the yield curve in parallel notably lower even as today's risk rally continues without missing a beat.

(Click on image to enlarge)

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more