2019 Theme Of “Slowing But Growing” Continues

Volatility returned to the markets during the usually calm summer month of August. Fears over an escalation of tariff implementations between the U.S. and China, a potential hard Brexit outcome in late October with new U.K. Prime Minister Boris Johnson at the helm and uncertainty over what the Federal Reserve will do, or will not do, for the remainder of the year led to several bouts of volatility during the month. On the flip side, multiple economic data reports, including, but not limited to, increases in employee compensation and retail sales, reinforced the strength and confidence of the U.S consumer and led to more optimism that consumer spending may drive additional economic growth in the third and fourth quarters of 2019 – recognizing that consumer spending still accounts for approximately 70% of gross domestic product (GDP) in the United States.

Consider that during the first two-quarters of 2019 strength in consumer household spending led to a 2.5% average year-over-year growth in U.S. GDP.

With this said, it is important to remember that our 2019 macro-theme of “Slowing but Growing” continues and investors should not be surprised to see both economic and earnings growth rates slow from the torrid pace they set in 2018 and likely slow down further in 2020, leading to a potential recessionary period in 2021 depending, of course, on the outcome of the 2020 Presidential election and the policies coming out of Washington DC after that point. For now, however, investors should be comforted that the current rates of growth, while slowing, appear to show signs of relative stability.

Given the relative strength of the U.S. economy, one might be surprised to see that the markets are pricing in additional cuts to the Fed Funds Target Rate this year. Given the dual mandate of the Federal Reserve of helping to promote full employment and price stability, one might agree that no additional rate cuts are necessary at this time. We tend to fall in this camp, but recognize we are contrarians in this viewpoint. As of July 31, 2019, the fed funds futures market suggests a 74% chance of at least a quarter-point rate cut at the Fed’s September meeting according to CME FedWatch tool as reported by CNBC. We still would not be entirely surprised to see the Fed Funds Target Rate close out 2019 in its current range of 2.00% – 2.25% but also recognize that if the market does not get the “insurance” rate cut it is expecting that a shorter-term bout of stock market volatility is likely.

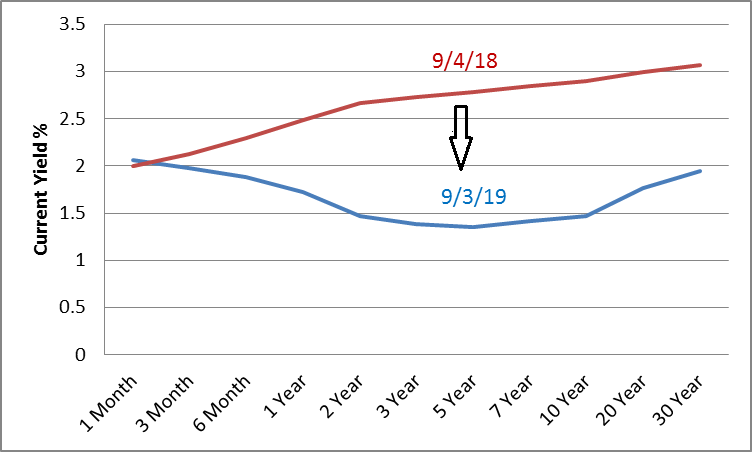

If the Fed does, or does not, cut rates further in 2019, investors will still find it challenging to identify attractive, yield-based investment options for the foreseeable future. The bond market is also pushing fixed income yields lower (see chart below) for a variety of reasons while the rest of Wall Street waits to see what the Federal Reserve does next. As a result, certain other security types (Exs. equities and preferred securities) as well as certain sectors of equities (Exs. utilities and real estate) that are known for historically paying high relative yields are apparently becoming more attractive to certain income-oriented investors. In this regard, it is important to understand that the higher relative yields of some of these other asset classes and sectors may also come with more frequent daily price swings and higher potential risks of principal loss.

Daily Treasury Yield Curve

Source: U.S. Department of the Treasury, as of September 3, 2019.

Looking ahead, the two biggest uncertainties that we see on the near-term horizon are; 1) what the Fed will/will not do with respect to interest rates in their remaining two meetings of 2019 which are followed by press conferences in September and December, and 2) will additional tariffs between the U.S. and China be implemented? The potential outcomes of both of these uncertainties could result in more short-term periods of stock market volatility or additional longer-term growth potential for stocks or even a combination of both. As a result, building in some degree of diversification potential into overall investment portfolio strategies seems worthy of consideration.

Disclosure: Hennion & Walsh Asset Management currently has allocations within its managed money program and Hennion & Walsh currently has allocations within certain SmartTrust® Unit ...

more