10Y Auction Prices "On The Screws" As Yield Creeps Higher For 3rd Month

Unlike yesterday's record large 3Y auction, today's auction of benchmark 10Y paper sold "only" $35BN in new paper, the same as last month and down from the all time high of $38BN in August.

(Click on image to enlarge)

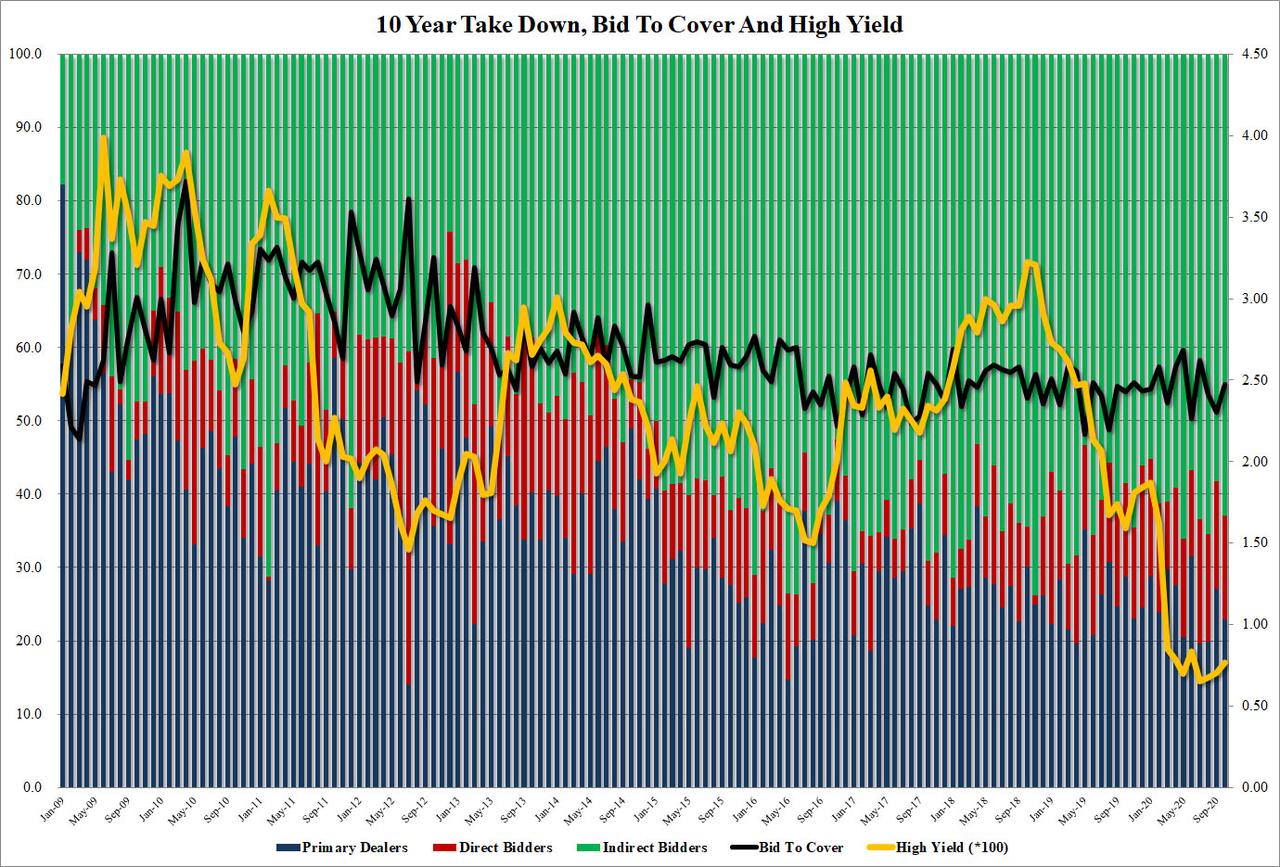

However, like yesterday's 3Y auction, today's sale of 10Y paper also stopped at a higher yield than last month, printing at 0.765%, on the screws with the When Issued, and up 6.1bps from last month's 0.7040%. With today's auction, the trend of rising auction yields continued for a fourth month after hitting an all-time low of 0.653% in July.

Perhaps due to the higher yield, and modest supply, the Bid to Cover rose from 2.30 last month to 2.47, the highest since July and just below the 2.48 six-auction average.

The internals also improved, with Indirects taking down 62.9%, up from 58.3%, and above the 61.5 recent average. And with Directs flat from last month at 14.2%, Dealers were left holding 22.9%, down from 27.1% last auction.

(Click on image to enlarge)

Overall, this was a solid - if hardly stellar - auction, one which took advantage of the recent concession and sets the stage for a peaceful 30Y auction to close out the coupon week tomorrow.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more