10-Year Auction Prices Below 2.5% For The First Time Since 2017

Following yesterday's subpar 3Y auction, today's 10Y, $24 billion reopening of Cusip 6B1 was nothing short of stellar.

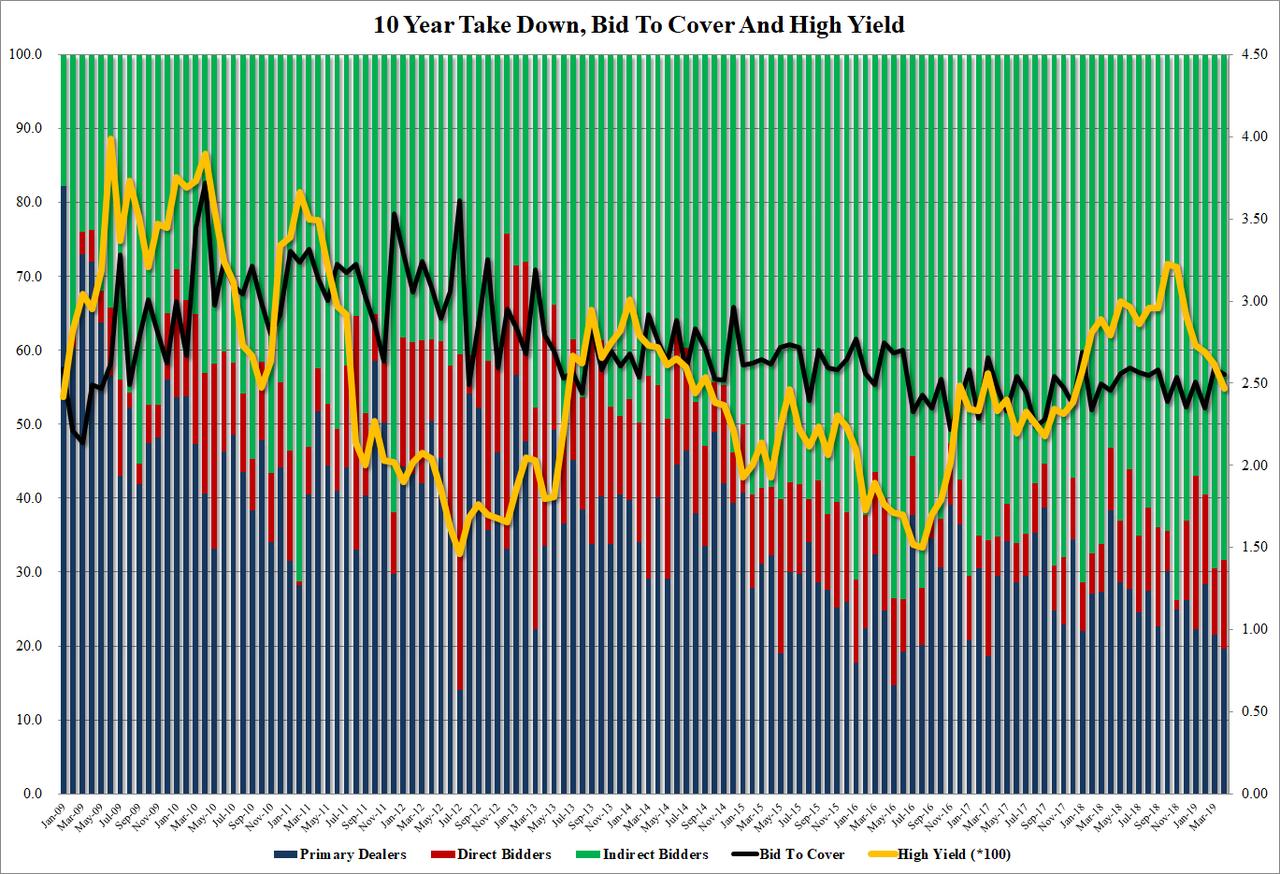

Pricing at a high yield of 2.466%, well below last month's 2.615%, this was the first bond auction to price below 2.50% since December 2017, and also stopped through the 2.476% When Issued by 0.1 basis point.

The internals were impressive as well: the Bid to Cover of 2.55 dropped from 2.59 last month but was still above the 2.45 six auction average. Notably, amid concerns that foreigners are stepping away from US paper, Indirects took down a healthy 68.4%, well above the 64.5% recent average, if modestly below last month's 69.4%. More importantly, this was toward the high end of the historical range, with just a few auctions pricing in the 70%+ Indirect range. And with Directs taking down 12.0%, modestly above the six auction average, Dealers were left with 19.6% of the auction, the lowest since March 2017.

Overall, a very strong auction and certainly refuting any speculation that at least in April, foreigners had any particular desire not to participate in US Treasury auctions.

(Click on image to enlarge)