Bonds Catch A Bid As Stocks Sink

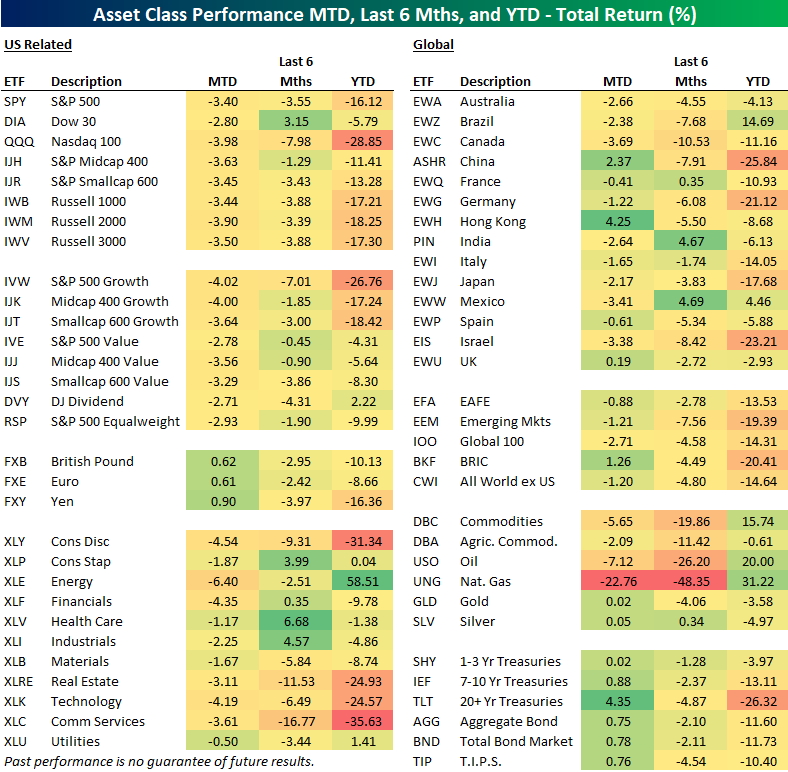

US equity markets have gotten off to a very weak start to December with four consecutive declines to start the month (and futures on Wednesday pointing to a fifth straight day). As shown below, SPY and most other major US index ETFs are already down more than 3% MTD, with growth underperforming value by a bit. Energy (XLE) is down most of the US sector ETFs followed by Consumer Discretionary (XLY) and Financials (XLF). Utilities (XLU) is down the least so far in December at just -0.50%.

International equity markets have held up a little better than the US. The All-World ex-US ETF (CWI) and the Emerging Markets ETF (EEM) are both down just 1.2% MTD, and the All-World ex-US ETF is now outperforming SPY on a YTD basis because of the recent divergence.

For most of the year heading into December, we saw the bond market fall in tandem with stocks, but recently as stocks have dropped, bonds have caught a bid. As shown in the bottom right corner of our ETF matrix below, Treasury ETFs of all durations are up on the month, with the 20+ Year Treasury (TLT) up the most at 4.35%.

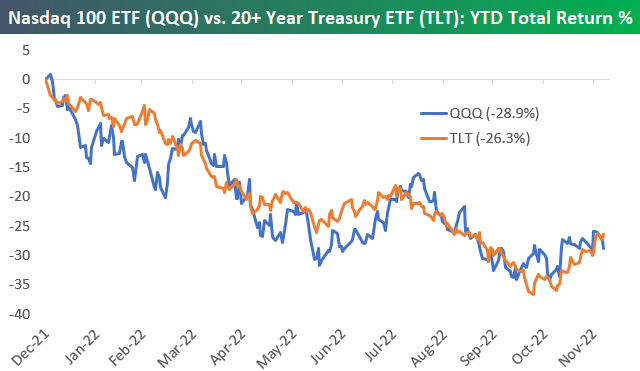

The chart below of the year-to-date percentage change (total return) of the Nasdaq 100 (QQQ) and the 20+ Year Treasury ETF (TLT) is a great way to highlight how closely stocks and bonds have tracked each other this year. So far this month, QQQ is down 3.98%, while TLT is up 4.35%, but this performance divergence over the last four days hardly shows up yet on the chart.

More By This Author:

Lumber Lingering At SupportCountry ETFs Outperforming U.S. Recently

Bears Hibernating

See Disclaimer and Limitations of Liability here