BofA: "Transitory" Inflation And Supply Chain Imbalances Are Hitting Autos Hardest

The auto industry is already stuck between a rock and a hard place, as dealers struggle to get production up to speed despite an ongoing semiconductor chip shortage that has hamstrung production for some of the world's biggest manufacturers.

At the same time, the U.S. is letting the inflation genie quietly begin to slip out of the bottle. As rising prices take hold amidst supply chain imbalances, focus has turned to automobiles. With new car inventory crunched due to production constraints, used car prices have skyrocketed, as we have noted recently.

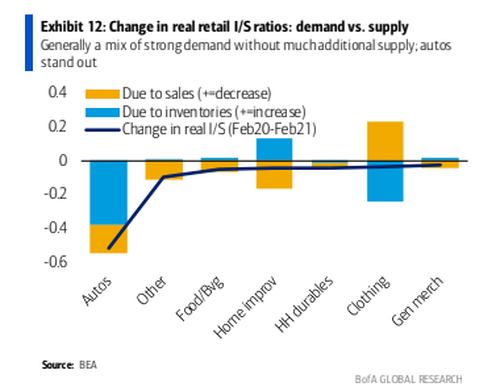

Now, a new note from BofA lays out exactly what type of crunch the industry is in - most recently exemplified in the inability for consumers to even rent cars, let alone purchase one. Detailing "lean inventories" and "price pressures," the note first explains that autos are so far the biggest standout for the country's inventory to sales ratio.

The note also takes a grim tone on when things could return to some semblance of normalcy: "This is a function of both demand and supply: the stimulus and reopening-fueled burst in demand was not matched by a comparable gain in supply. Instead, production has been hampered due to COVID-19-related supply chain issues and labor shortages," it reads.

It also says that the "transitory" period can feel like a long time and that the U.S. economy is still "many months" from feeling more balanced.

Speaking about the supply/demand dynamic of goods causing price spikes, the bank writes:

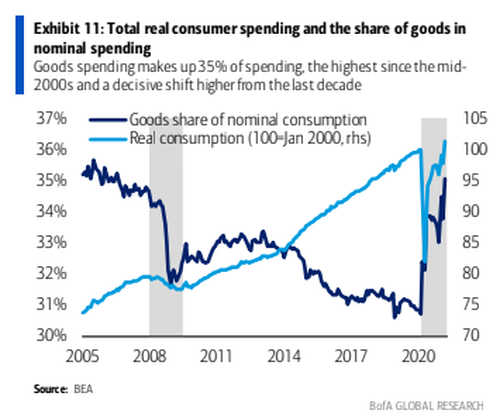

"This highlights the nature of this cycle and the rotation towards goods spending. When producers and companies were first faced with the pandemic, they prepared for a period of weak demand by reducing production and trying to work off inventories. But they were quickly surprised by a dramatic rise in demand for goods, particularly durable goods such as autos, household appliances and electronics. The share of consumer dollars spent on goods has soared to 35.1% as of March 2021, the highest in over 15 years."

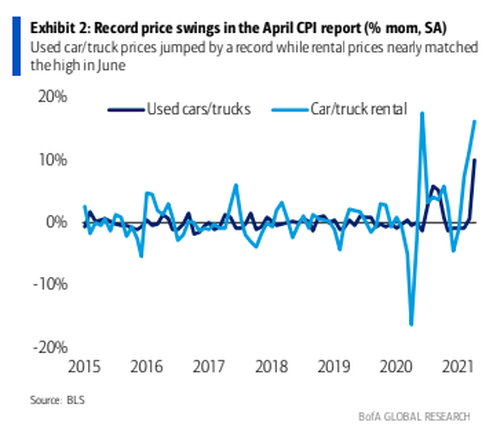

The note also points out how inflation is playing a more pronounced role in the auto sector than other sectors. "We wish you luck if you are trying to rent a car," the note dryly says.

It continues:

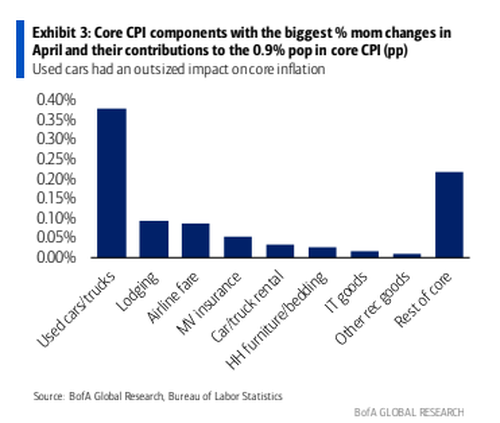

"The CPI report highlighted these challenges, revealing a record 10% mom increase in used car prices and 16.2% spike in rental car prices, which was second only to June last year (Exhibit 2). More broadly, core CPI jumped 0.9% mom SA, the biggest monthly gain since 1981 with record increases in a number of categories. Indeed, 0.7pp of the gain in core CPI owed to just eight categories with used car/truck prices having an outsized contribution of 38bp (Exhibit 3)."

"The auto sector has seen the most severe drawdown in real retail inventories," the report says. The imbalances - further exacerbated by whipsawing travel demand and the semi shortage affecting other goods - including electronics - has the bank predicting that core inflation will continue to be robust heading into the summer:

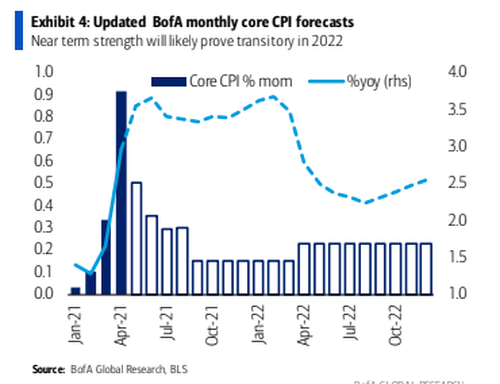

"Considering these dynamics, we think core inflation is likely to be particularly robust through August but ease as we head into year-end, with some risk of a negative payback on a mom basis given the noise. We therefore update our core CPI trajectory as shown in Exhibit 4, which will lead the % yoy rate to surge to a high of 3.7% in June before moderating to 3.5% in December (3.4% 4Q/4Q). We view these price pressures as largely transitory, however, with core CPI cooling down to 2.5% yoy through 2022."

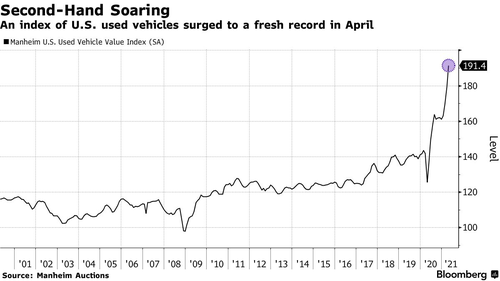

Recall, we noted at the end of April that the Manheim U.S. Used Vehicle Value Index continued to soar, to a new record, as a result of the worsening of a semiconductor shortage, low lot inventories, and a continuing post-COVID-19 "boom." The index was up 6.8% in the first 15 days of April, Bloomberg noted. The index is up an astounding 52% from the same time last year to 191.4.

The data, which is put together by Cox Automotive, "takes into account all U.S. sales through Cox’s Manheim automotive auctions that fall in to one of 20 different market classes." Cox Chief Economist Jonathan Smoke commented about the spike:

“Demand is perfectly stimulated from improving consumer sentiment, recovering jobs, accumulated pandemic savings, tax refund season, and American Rescue Plan cash payments.

"Supply was decimated last year by COVID-19 shutdowns reducing new vehicle production, and used supply was reduced from strong demand last summer.

"Production remains limited as supply chains struggle to overcome issues like the semiconductor shortages.”

Recall, we also pointed out last month that low inventories and chip shortages had prices re-accelerating in 2021 - at a stunning rate - after a brief pause from October to December.

BofA concludes that no changes from a monetary policy standpoint are expected until the back end of summer: "We expect little signal about policy in the June FOMC meeting, but perhaps some additional clarity shortly after." In other words, take it from BofA or from us, but it looks almost certain that things are going to get worse before they get better.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more