Bitcoin: Why I Am Buying This Dip

It hurts when you're expecting Bitcoin's (BTC-USD) price to continue to run higher and it melts in front of your eyes. Welcome to the correction of 2021, in which the world's most valuable digital asset just crashed by a staggering 54%. Nevertheless, while selling pressure has been fierce, Bitcoin is likely working its way through an extensive correction. Moreover, this shakeout process may be creating remarkable buying opportunities in Bitcoin and many altcoins. I bought Bitcoin and several altcoins because following this pullback, the bull market in Bitcoin and the broader digital asset segment should stabilize, consolidate, and return to a positive uptrend.

Image Source: Unsplash

What Happened?

Some people believe the meltdown occurred because China recently reiterated its stance on Bitcoin. Other people say it is due to Elon Musk's tweets. Yet, other market participants think that overheated technical conditions are responsible. Clearly, there are numerous moving parts here, and regardless of what you or I think, the digital asset crash probably needed to happen. Bitcoin was up by a whopping 1,800% since its lows just 1-year ago. Many other digital assets were up by 5,000% or more in the same time frame. Coins turned parabolic, the cryptocurrency market got overheated, prices needed to come back down to earth, and they did.

Let's Examine Some Possible Catalysts

China's Communist Party has been against Bitcoin for a while now. In fact, the recent rhetoric essentially reiterates the Chinese government's cryptocurrency bans from 2013 and 2017, but markets are reacting to China's Bitcoin announcement like it is new news. However, from a fundamental standpoint, not much has changed. On the contrary, most of the civilized world remains open to Bitcoin. The digital asset is classified as a commodity, a medium of exchange, a unit of account, or a decentralized convertible virtual currency by numerous nations.

Elon Musk's tweets created a lot of controversy in recent weeks. Yet, evidence implies that Tesla Tesla (TSLA) has not sold its Bitcoin holdings. Moreover, the outspoken Tesla executive mentioned that he supports cryptocurrencies in the battle over fiats. Also, Elon Musk's concerns over Bitcoin's energy consumption appear well-intentioned and seem reasonable. Ultimately, the focus on Bitcoin's carbon footprint should lead to more efficient energy uses in the digital asset industry and may serve as another catalyst for further price appreciation.

Technicals Became a Problem

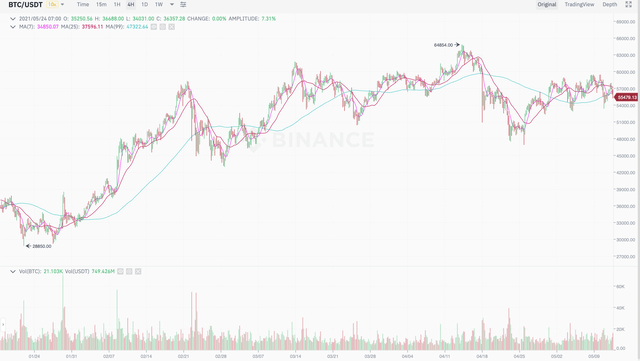

Source: Binance.com

The technical issue became apparent when Bitcoin failed at $60K resistance and fell back down below $54K support. In fact, we discussed the importance of sustaining prices above $54K and warned of a deeper selloff if this technical level got penetrated. The breach of the $54K support line sparked the enormous correction, first to $46K, then to $42K, and ultimately down to $30K support. Also, it is imperative to note that selling was orderly for most of the decline until the crash happened.

This is What Capitulation Looks Like

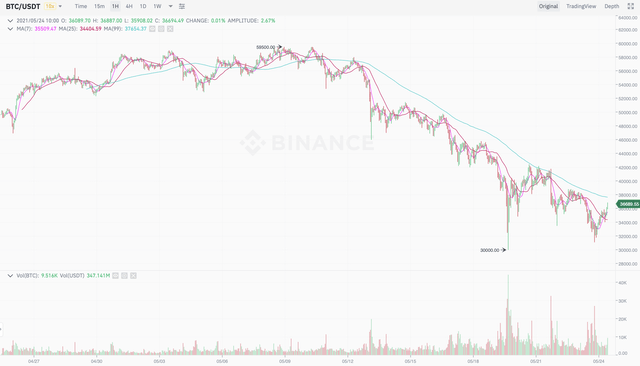

Source: Binance.com

Bitcoin dropped to $30K at one point, as the meltdown shaved more than $500 billion off the digital asset's market cap. The broader cryptocurrency segment's market cap cratered by over a trillion dollars during the height of the selloff. There was enormous volume leading up to and right around $30K, which is what we want to see at the epicenter of the correction process. Next, we see a retest attempt, at around $31K, but volume is notably weaker than during the initial drop. Thus, this looks like a bottoming process here for Bitcoin. A move above $40-42K resistance will be a constructive technical development, while a fall below $30K support could enable more selling pressure to develop. While further declines are plausible, a return to a more positive momentum appears more probable from a technical standpoint now.

Altcoins on Sale

VeChain (VET-USD)

Source: Binance.com

VeChain, a top 20 coin, dropped by a jawdropping 80% from its recent top just days ago. VeChain, like many other coins, experienced an apparent flash crash during the hottest part of the meltdown. After the initial reversal, VeChian and other altcoins followed Bitcoin to a retest of the correction lows.

Ethereum (ETH-USD)

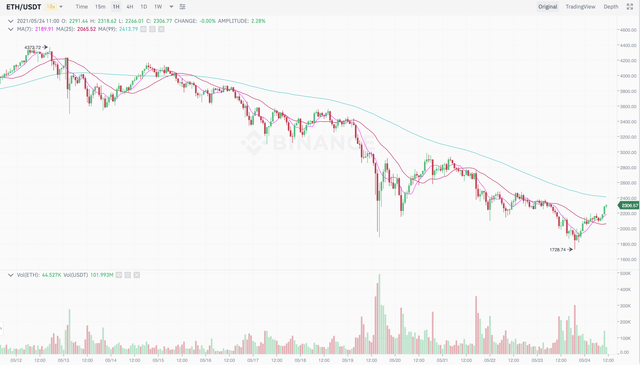

Source: Binance.com

Ethereum, the world's second-largest cryptocurrency by market cap, dropped by around 60% from its recent ATH and was down by over 40% on the day the initial meltdown occurred. Again, look at the massive volume and panic selling that occurred during the height of the correction process. We also see a confirmed retest on lower volume.

Zilliqa (ZIL-USD)

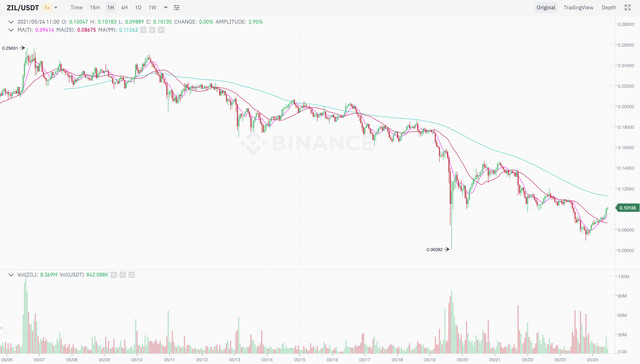

Source: Binance.com

Zilliqa dropped by 76% from its recent ATH, after which we saw a retest of correction lows.

Binance Coin (BNB-USD)

Source: Binance.com

Binance Coin, the number three digital asset by market value, dropped off by 69% from its peak during the cryptocurrency meltdown and the subsequent correction process.

The Bottom Line

Regardless of how many charts we see, a very similar pattern emerges in just about everyone. The digital asset segment went through a sharp correction that culminated in a flash crash on massive volume. Most assets in this sector experienced drops of over 50%, and some went down by 80% or more within days. Also, we see clear evidence of retests in Bitcoin and many other digital assets. Bitcoin's meltdown carries the hallmarks of a massive correction inside of a bull market cycle. Despite the recent headlines, the fundamental image has not changed materially. The Fed continues to balloon the monetary base, and Bitcoin's supply remains limited. I bought this dip as Bitcoin's price should recover and may go on to make new ATHs soon.

Risk Factors

Bitcoin remains a volatile asset and is not suited for everyone. Numerous factors like increased government regulation, hacking, functionality issues (such as speed, cost, and scale), fraudulent activity, and other detrimental elements could impact Bitcoin's popularity and affect its price negatively.

Therefore, for investors with low to mild risk tolerance, a position size of 3-5% of total portfolio holdings may be appropriate. For investors with higher risk tolerance, a position size of 10% of portfolio holdings may be suitable.

It remains unclear exactly how Bitcoin's future will play out. The digital asset could be worth a lot more than it is now several years down the line, or it could be worth a lot less.

Disclosure: I am/we are long BTC-USD, VET-USD, ZIL-USD, ETH-USD.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a ...

more