Bitcoin Start Triangle After Massive Uptrend Breaks $40k

The BTC/USD (Bitcoin) has broken above the $40,000 resistance zone after an exceptionally strong move up. Is the trend overstretched? Let’s review the wave and chart patterns.

Price Charts and Technical Analysis

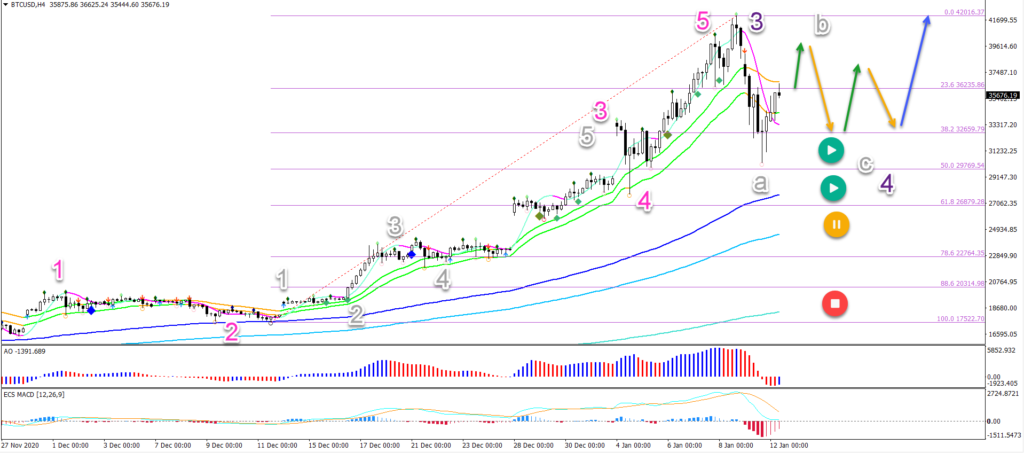

The BTC/USD is not showing any significant signs of a reversal. There is no divergence on the 4-hour chart or higher time frames. Also, the momentum up is very strong.

That said, the counter-trend decline did reach the 50% Fibonacci retracement level. This could indicate a deep or longer retracement via an ABC correction or ABCDE triangle.

As long as the price stays above the 50-61.8% Fibonacci support zone, an uptrend has the best chance of continuing higher (blue arrow) for a new high. Only a break below the deep Fibonacci levels would change and invalidate that view.

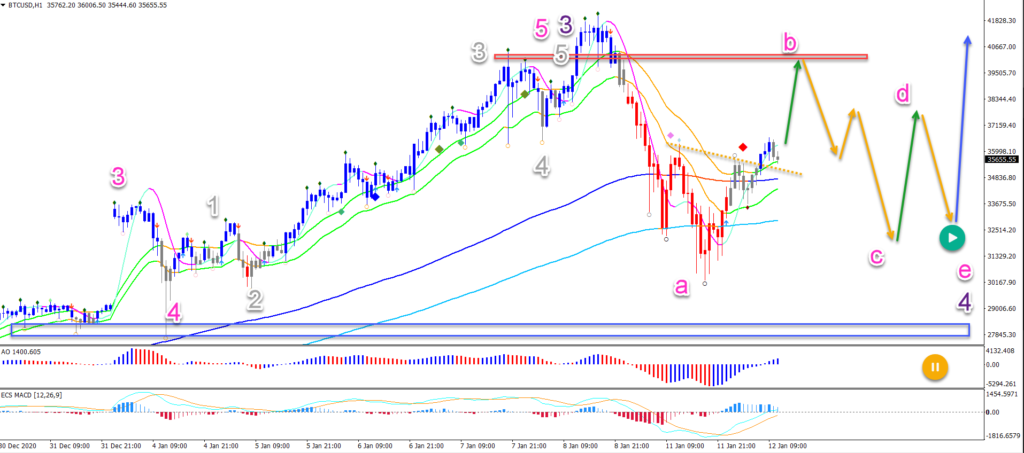

On the 1 hour chart, price action seems to have completed a wave A (pink) of a wave 4 (purple) correction. The wave could become numerous different types of corrections:

- ABC flat

- ABCDE triangle

- ABC zigzag

The first two options are the most likely scenarios. This means that a deeper retracement towards the resistance and then a bounce back down is the most likely pattern.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more