Bitcoin Soars Above $50,000 For First Time Ever

A little over a month ago - when JPMorgan and every so-called financial expert was bashing bitcoin and saying a crash is imminent - we said that $50,000 is only a matter of weeks if not days (on its way to $100,000). Well, that prediction came true at exactly 7:29am ET this morning when bitcoin soared by some $2,000 in minutes, rising above $50,000 for the first time ever and hitting $50,547.70...

(Click on image to enlarge)

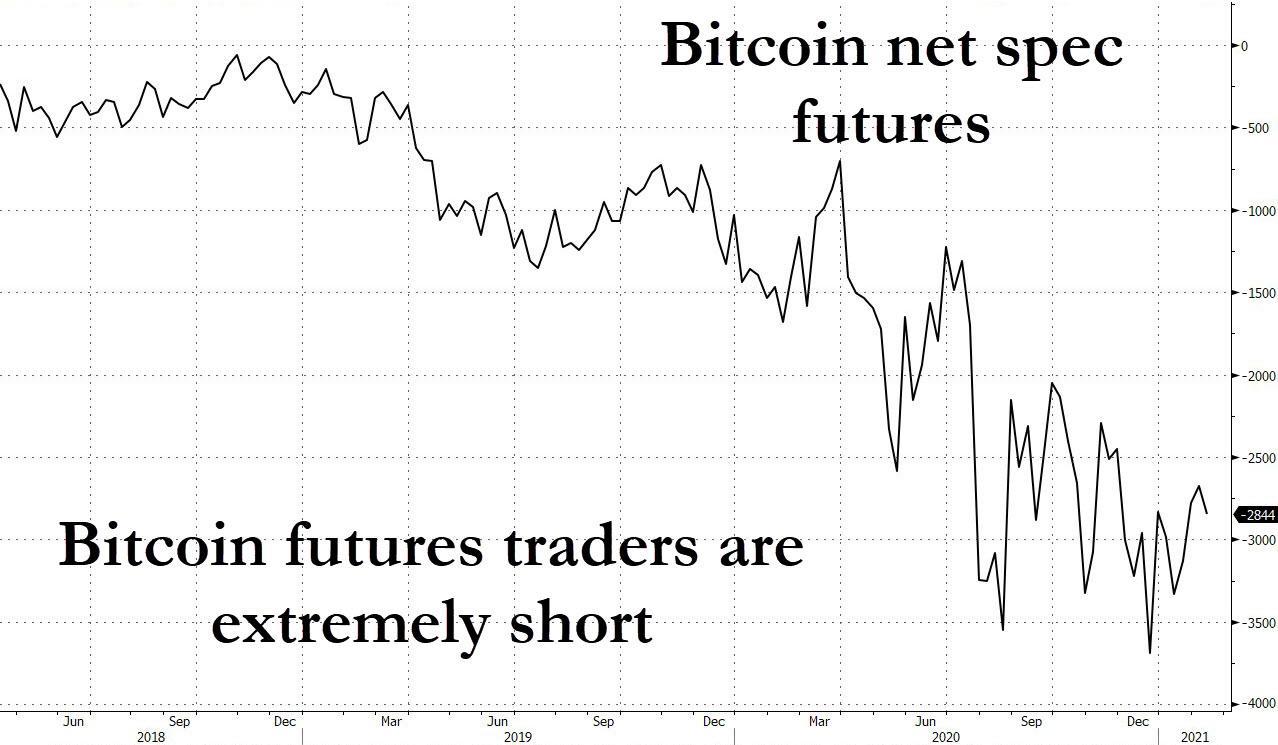

... although it was quickly smacked down by large futures shorts who face huge losses if the momentum accelerates north of $50,000, and they are squeezed and forced to cover a la GME.

(Click on image to enlarge)

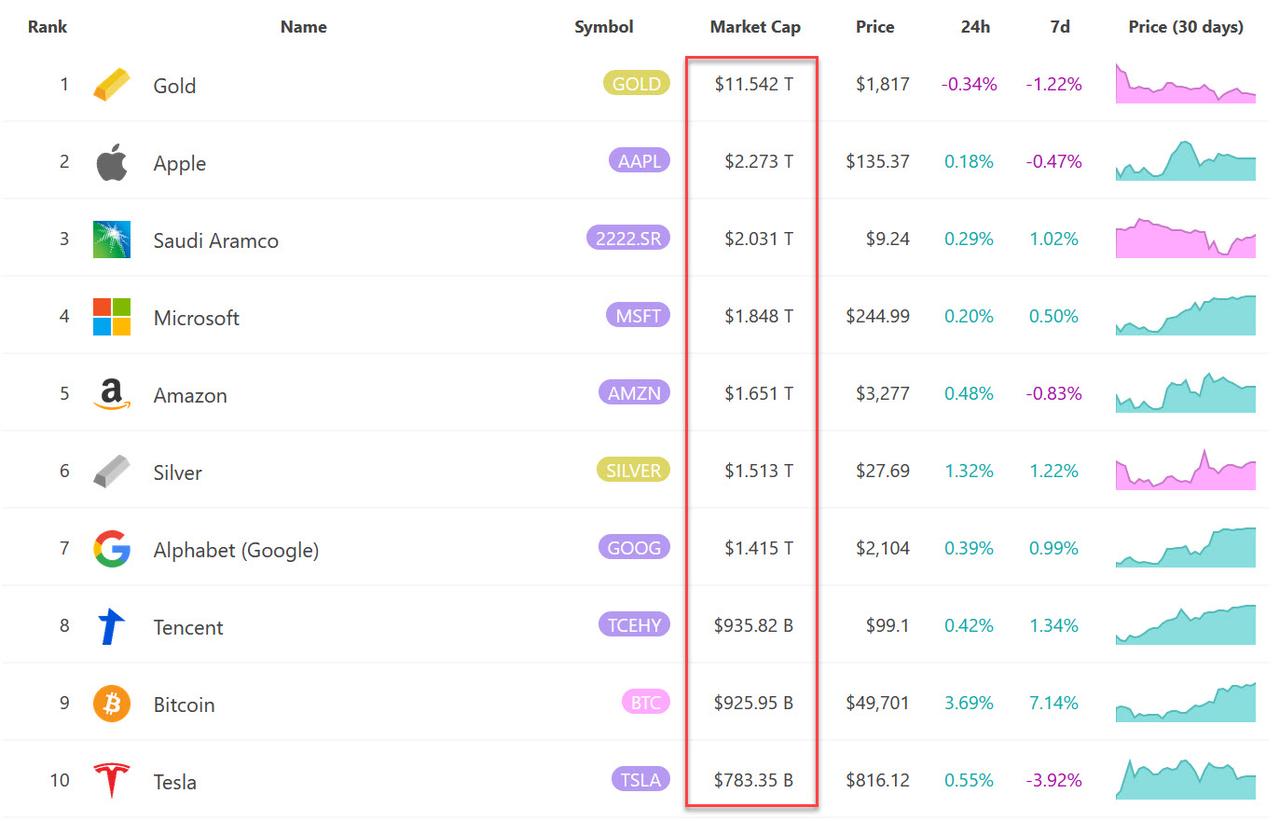

The world’s largest cryptocurrency is now up about 73% so far this year, its total value surpassing the market cap of TSLA and rapidly approaching the $1 trillion level. Ethereum hit a record on Friday and is up about 140% year-to-date.

(Click on image to enlarge)

After ending last year with a fourth-quarter surge of 170% to around $29,000, Bitcoin token jumped to $40,000 seven days later. It took just nearly six weeks to breach the latest threshold, buoyed by endorsements from the likes of Paul Tudor Jones, Stan Druckenmiller and Elon Musk. And speaking of, it means that Elon Musk's purchase of $1.5 billion in bitcoin is now profitable to the tune of about $500-$750MM in just weeks.

“Whether it’s Musk, Mastercard or Morgan Stanley, the mood, music and momentum is impossible to ignore,” said Antoni Trenchev, managing partner and co-founder of Nexo in London, one of the biggest crypto lenders. “To the annoyance of many, the Bitcoin express has left the station.”

Trenchev cautioned that investors should be prepared for a wild ride after the latest milestone, pointing to last month’s 30% pullback as evidence. “Short-term volatility is very much a feature of this bull market and investors.

Maybe, but maybe not: every pullback in recent months has been furiously bought back almost as if bitcoin has a central bank protecting it, like for example they do with stocks. The fact that bitcoin is hated by central banks and is still blowing stock returns out of the water is the most impressive observation here. The 400% rally over the past year comes amid a backdrop of near zero borrowing rates from central banks and unprecedented stimulus from governments in the wake of the coronavirus pandemic. Bitcoin advocates have criticized the moves as money printing even though inflation remains subdued.

Mastercard, in a blog post late Wednesday, singled out so-called “stablecoins,” which often peg their value to that of another asset, such as the U.S. dollar. Mastercard has already partnered with crypto card providers such as Wirex and BitPay, but has required digital currencies to be converted into fiat before processing payments for transactions on its network.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more