Bitcoin (BTC/USD) Breaks To New Highs As Twitter, Uber Follow Tesla

Bitcoin’s recent price action continues to demonstrate the powerful nature of crowd psychology and, more specifically, the role that influencers such as Elon Musk play in the market. Despite breaching the $48,000 mark, BTC/USD gave back a portion of Monday’s gains following Tesla’s announcement of a $1.5 billion investment into the digital currency. However, it appears as if major market players are following in Tesla’s footsteps after Twitter, Mastercard and Uber have all announced their interest in adopting Bitcoin as an additional payment method.

A combination of USD weakness and speculative popularity continue to weigh on major cryptocurrencies, igniting the volatility regime that initially fueled the bullish reprisal of the ‘Bitcoin bubble’.

BITCOIN (BTC/USD) TECHNICAL ANALYSIS

After breaking above $48,000 on Monday, price action retraced off of the key psychological level, falling to the 14.4% Fibonacci retracement level of the Jan – Feb move, currently providing support around $45,277. For now, sentiment remains bullish, with the Moving Average Convergence Divergence (MACD) crossing above the zero line, indicating that the short-term momentum continues to favor the bulls as major market players contribute to the rising demand for cryptocurrencies.

Bitcoin (BTC/USD) 4 Hour Chart

Chart prepared by Tammy Da Costa, IG

If bulls are able to push through resistance, a test of $50,000 may be in the cards, however, if bears break below current support, which may happen if regulators continue to seek more stringent laws regarding the holding and trading of virtual currency; then they may be able to drive prices back towards the 38.2% retracement level of $40,435.

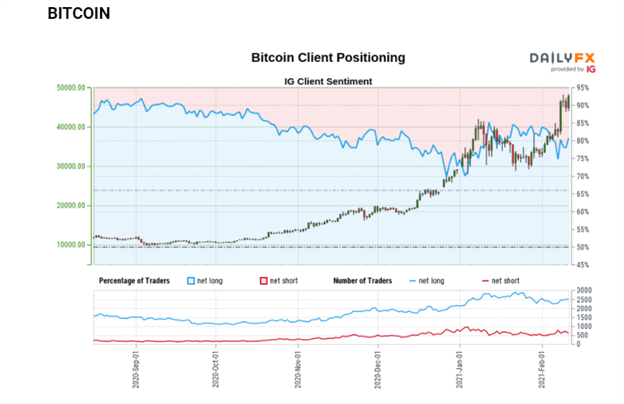

BITCOIN (BTC/USD) SENTIMENT

At the time of writing, retail trader data shows 79.47% of traders are net-long with the ratio of traders long to short at 3.87 to 1. The number of traders net-long is 0.83% lower than yesterday and 10.69% higher from last week, while the number of traders net-short is 8.25% lower than yesterday and 8.77% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Bitcoin prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Bitcoin-bearish contrarian trading bias.

Disclosure: See the full disclosure for DailyFX here.

Interesting! But I choose to abstain from the rush.

And I certainly hope that the others are following that very old and very good advice, of "Do not gamble (invest) more than you can afford to lose."

I think that I see a bubble hiding here.