Biotech Stocks Getting Ready To Explode

Biotech Pulse

Biotech shares are up this year, as represented by the Nasdaq Biotechnology Index (IBB), which is the industry benchmark, and the S&P Select Biotechnology Index (XBI), after a sharp decline in 2018. This is a welcome respite for biotech investors.

However, it has not been easy being a pure biotech investor and the performance of the benchmark this year is masking the struggle that biotech investing has been facing for quite some time now. The industry valuations have been tracking sideways for the last 4 years, and the Nasdaq Biotechnology Index has not yet eclipsed the last high set back in 2015. This range-bound consolidation is evident in the chart below as the index has continued to trade between the two blue lines.

Nasdaq Biotechnology Index - IBB

Source: PrudentBiotech.com (click for a clearer image)

The small and mid-cap weighted S&P Biotech Select index has done relatively better than the larger cap weighted Nasdaq Biotech index, but still shows the range-bound consolidation that has made meaningfully positive and consistent returns an uphill task for biotech investors.

S&P Biotechnology Index - XBI

(click for a clearer image)

One dollar invested in the industry benchmark Nasdaq Biotechnology Index at the beginning of 2015 would still be around $1 in mid-2019. This listless performance is not expected from a high-risk segment in a lengthy bull market.

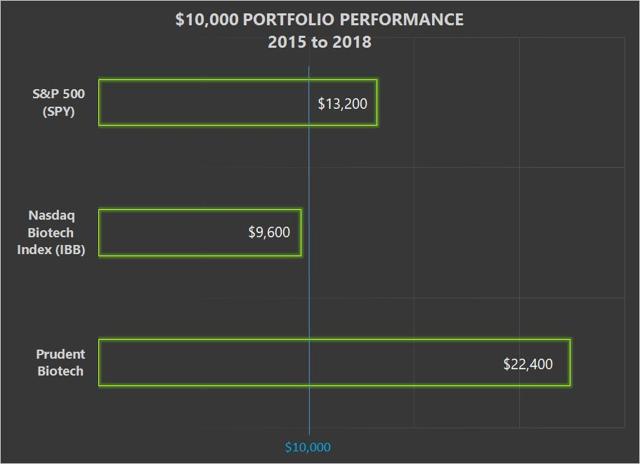

However, the difficult investing environment for the sector doesn't mean that biotechs have not been rewarding to investors. There have been selective opportunities for meaningful gains in biotechs during this period, as shown by our Prudent Biotech model portfolio.

(click for a clearer image)

Why Has Biotech Been Under Pressure For 4 Years?

Going sideways is not a bad performance if the broader market is relatively worse. But it sure is an underwhelming performance if the broader market has been consistently making new highs over that period.

The biotech industry represents one of the riskier segments of the investing market. Since risk is highly sensitive to interest rates, biotechs are also quite sensitive to the monetary policy outcomes.

In our opinion, the biotech industry group has been range-bound and going sideways due to two overarching risks - one, an unfavorable monetary policy, which can adversely affect risk-appetite, and second, the perennial risk of drug price legislation which has continued to dampen enthusiasm for the broader biopharma group.

Interest Rates And Biotech Performance

The best recent period for biotechs was the ~6-year period from 2010 to 2015 when the Nasdaq Biotech Index soared nearly 400%. This was a period of a downward bias in interest rate policy.

The biotech benchmark rose in a steady long-term uptrend from 2010 to 2015 and recording an all-time high in July 2015...

Nasdaq Biotech 2010 to 2015

(click for a clearer image)

...When the monetary policy controlled Fed Funds rate was flat with a downward bias

Federal Funds Rate (2010-2015)

Source: St. Louis Fed; edits by PrudentBiotech.com (click for a clearer image)

The biotech benchmarks have become range bound for the last 4 years...

Nasdaq Biotech 2015 to 2019

...As the monetary policy drove the Fed Funds rate higher and maintained an upward bias

Federal Funds Rate 2015 to 2019

St. Louis Fed; edits by PrudentBiotech.com (click for a clearer image)

When Does The Pressure On The Biotechs Lift?

This is obviously a tricky question to answer as the last few years have been littered with incorrect breakout predictions for biotechs.

But part of the answer should be clear.

If the above correlation of monetary policy and biotechs is true in terms of a cause-and-effect relationship, then to the extent monetary policy has been pressuring biotech valuations, that pressure will begin to ease as we enter the second-half of 2019. This projection is underpinned by the critical assumption that the backdrop of a weaker economy persists, thus forcing the Federal Reserve to begin cutting the Fed Funds rate in the second-half.

If markets begin to see a clear path to an interest cut in the second half of this year, and perhaps as soon as the third quarter itself, biotech valuations will particularly benefit as the lengthy consolidation and declining interest rates can combine to finally push the Nasdaq Biotechnology Index above the confines of its 4-year range and into an industry uptrend.

In other words, the biotech investing playbook can dramatically change in the second half due to a shift in monetary policy, an outcome which can be highly favorable for biotech investors.

Biotech Stocks At A Near-term Critical Point

Typically, after a lengthy period of sideways consolidation when an index breaks out on the upside, the uptrend is forceful and expected to continue much further, technically speaking.

While we anticipate that will occur in the second half, the biotech group has to first avoid a forceful breach to the downside, as it sits at a key support level.

The Nasdaq biotech index is once again resting at its weekly 200 days moving average (DMA). As can be seen in the chart above, that level has been breached decisively only once in the past 4 years, only to be retaken quickly.

Barring any Federal Reserve induced panic instigated by the Committee's uncompromising commentary or a systemic risk event, the biotech group most likely should continue to find strong support at the present level. Consequently, the next meaningful move in the group, apart from the long-term breakout projection discussed above, should be a drift up as the benchmark index zigzags within its range.

Conclusion

Assuming that we are now rapidly approaching a change in the direction of the interest rate cycle, the biotech group could be very well positioned to finally capitalize on its lengthy consolidation. Even if the gains are not as heady as the last 2010 to 2015 cycle, due to resistance from the overarching drug price regulation risk, this new phase can make an investor's job easier compared to the grinding phase of highly selective biotech stock picking since 2016. A lot can happen when a favorable and steady tailwind finally begins to assist the fortunes of biotechs in the stock market.

Investors should not ignore the biotech sector at this time, but be aware of a potential opportunity building up. It's not upon us yet, but can knock on our doors soon if the Fed reveals its hands on an interest rate cut. Be aware of near-term volatility if the Federal Reserve appears to be maintaining its patient posture in its FOMC meeting comments and speeches, rather than a recognition of the growing risks to the economy and a shift towards a potential easing.

Fundamentally, the biopharma field is already undergoing a period of very promising scientific innovation. Now it is highly likely that the macroeconomic environment is shifting towards one when biotech stocks historically do best.

There are many promising biotech companies which can benefit further in an improving investing climate. A few of them, which may be now or in the past be part of the Prudent Biotech model portfolio or the Graycell Small Cap portfolio, include Biohaven Pharmaceutical (BHVN), Sage Therapeutics (SAGE), Amarin (AMRN), GW Pharmaceuticals (GWPH), Iovance Biotherapeutics (IOVA), Array Pharmaceuticals (ARRY), Blueprint Medicines (BPMC), Mirati Therapeutics (MRTX), Acadia Pharmaceuticals (ACAD), Arena Pharmaceuticals (ARNA), Ascendis Pharma (ASND), China Biologics (CBPO), Uniqure (QURE), Voyager Therapeutics (VYGR), Audentes Therapeutics (BOLD), Meiragtx Holdings (MGTX), Tricida (TCDA), Crispr Therapeutics (CRSP), Axsome Therapeutics (AXSM), Medicine Company (MDCO), Coherus Biosciences (CHRS), Zynerba Pharmaceuticals (ZYNE), Ziopharm Oncology (ZIOP), and Arrowhead Pharmaceuticals (ARWR).

As always, use a portfolio approach to invest in this volatile segment to overcome the inevitable errors.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.