Best Metal Stocks To Buy Now

Image Source: Pixabay

Investing in metals, like gold or silver, is a good choice not only because it will always be considered valuable, but because it also helps to protect your other investments. Metal stocks are shares in companies that explore for, mine, and refine metals such as copper, nickel, and zinc. Some metal stocks are unique because they are represented in a couple of industries: mining and energy.

The metals industry is a subsector of basic materials. It includes companies that:

- Mine, process, or invest in the extraction of precious metals such as gold, silver, platinum, and palladium.

- Mine and process industrial metals such as copper, iron ore, and aluminum ore (bauxite).

- Convert raw metal materials such as iron ore into more valuable metal products such as steel.

List of Best Metal Stocks

Here is the list of the best Metal stocks to buy now:

| Sr | Company Name | Symbol | Market Cap | Price (As of 16th Dec 2022) |

| 1 | Rio Tinto Group | NYSE: RIO | $ 114.2 billion | $ 70.45 |

| 2 | Southern Copper | NYSE: SCCO | $ 46.3 billion | $ 59.89 |

| 3 | Nucor Corporation | NYSE: NUE | $ 34.4 billion | $ 134.1 |

| 4 | ArcelorMittal | NYSE: MT | $ 21.7 billion | $ 25.92 |

| 5 | Steel Dynamics, Inc. | Nasdaq: STLD | $ 17.9 billion | $ 101.92 |

| 6 | Wheaton Precious Metals Corp. | NYSE: WPM | $ 17.4 billion | $ 38.43 |

| 7 | Commercial Metals Company | NYSE: CMC | $ 5.6 billion | $ 47.46 |

| 8 | MP Materials Corp. | NYSE: MP | $ 5.2 billion | $ 29.27 |

| 9 | Hecla Mining | NYSE: HL | $ 3.2 billion | $ 5.26 |

| 10 | Lithium Americas | NYSE: LAC | $ 3.08 billion | $ 22.85 |

Rio Tinto Group

Rio Tinto is among the largest and most significant companies in the iron ore mining industry. Iron ore is the company’s core product. This is a highly important natural resource for the green energy transition.

Rio Tinto has very recently completed its acquisition of Turquoise Hill Resources which has significantly strengthened Rio Tinto’s copper portfolio. This acquisition will further support the company’s strategy to grow in materials the world needs for achieving net zero and delivering long-term value for its shareholders.

The company’s financials for the FY 2021 are as follows:

- Total Sales Revenue was reported at $ 63.5 billion

- Net Earnings were reported at $ 21.1 billion

RIO Tinto has a market cap of $ 114.2 billion. Its shares are trading at $ 70.45.

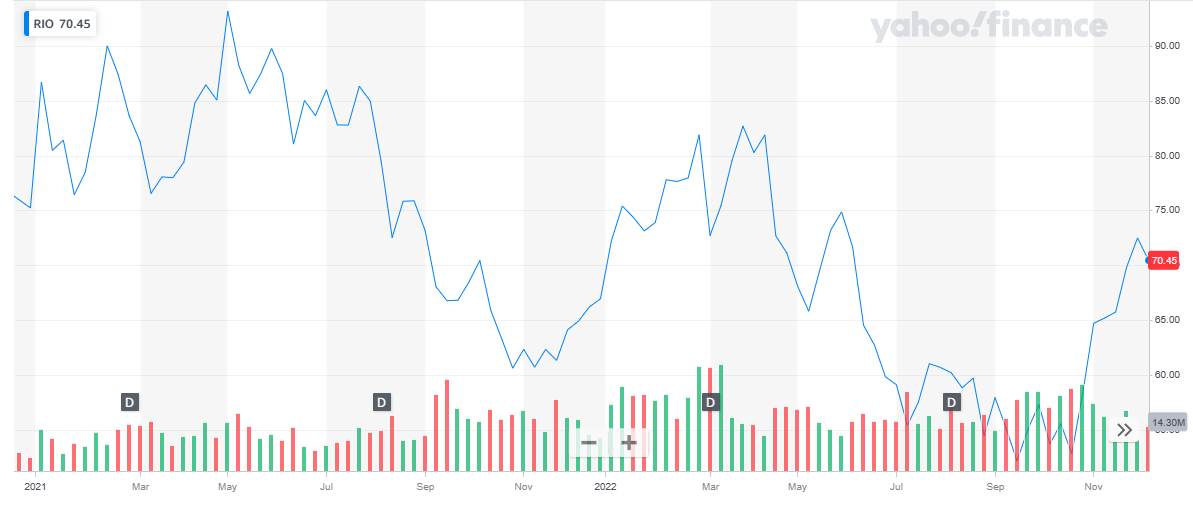

The share of the company has been quite volatile in the past two years. It started the year 2021 at $ 75.22. During the year, the stock dropped to a low of $ 60.62 and eventually closed at $ 66.94. Overall, the stock declined by 11 % in 2021.

In 2022, they continued with the volatile behavior. The stock started at $ 66.94, rose to $ 82.68, dropped to a low of $ 52.16, and recently closed at $ 69.26. To date, the stock appreciated by 3.5 %.

(Click on image to enlarge)

Southern Copper

Southern Copper Corporation (SCC) is one of the largest integrated copper producers in the world. It is engaged in mining, exploring, smelting, and refining copper and other minerals

The below table shows the financials of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 2.16 billion | $ 2.3 billion | $ 2.7 billion |

| Net Income | $ 520.9 million | $ 434.4 million | $ 787.8 million |

| Earnings per share | $ 0.67 | $ 0.56 | $ 1.02 |

Investors who are looking to benefit from the rising technology by earning profits should consider drone stocks for investment.

Southern Copper has a market cap of $ 46.2 billion. Its shares are trading at $ 59.76. If you are seeking a steady stream of income, you should invest in REIT stocks.

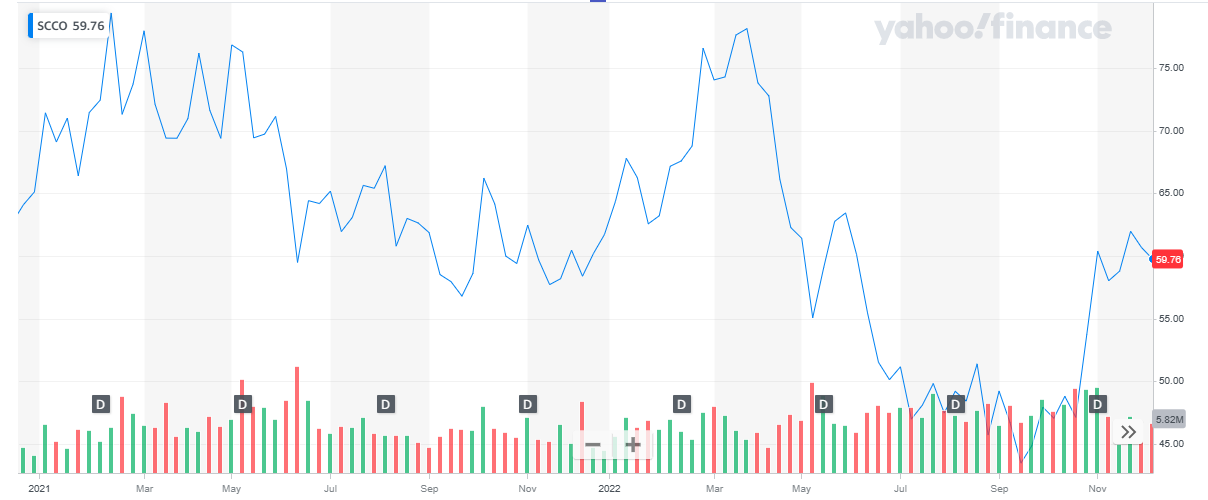

The stock of the company has been extremely volatile in the past two years. It started the year 2021 at $ 65.12 and closed the year at $ 59.76. During the year the stock declined by 8.2 %.

In 2022, the stock started with a huge spike in price. From $ 61.71, at the start of the year, the stock rose to $ 78.17. After that, the stock declined to a low of $ 43.45 and last closed at $ 59.76. To date, the stock closed by 3.2 %.

(Click on image to enlarge)

Nucor Corporation

Nucor and its affiliates are manufacturers of steel and steel products, with operating facilities in the United States, Canada, and Mexico. Products produced include carbon and alloy steel — in bars, beams, sheet, and plate; hollow structural section tubing; electrical conduit; steel racking; steel piling; steel joists and joist girders; steel deck; fabricated concrete reinforcing steel; cold finished steel; precision castings; steel fasteners; metal building systems; insulated metal panels; overhead doors; steel grating; and wire and wire mesh.

The below table shows the financials of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 10.5 billion | $ 11.8 billion | $ 10.5 billion |

| Net Income | $ 2.2 billion | $ 3.3 billion | $ 2.8 billion |

Nucor Corp has a market cap of $ 34.3 billion. Its shares are trading at $ 133.6.

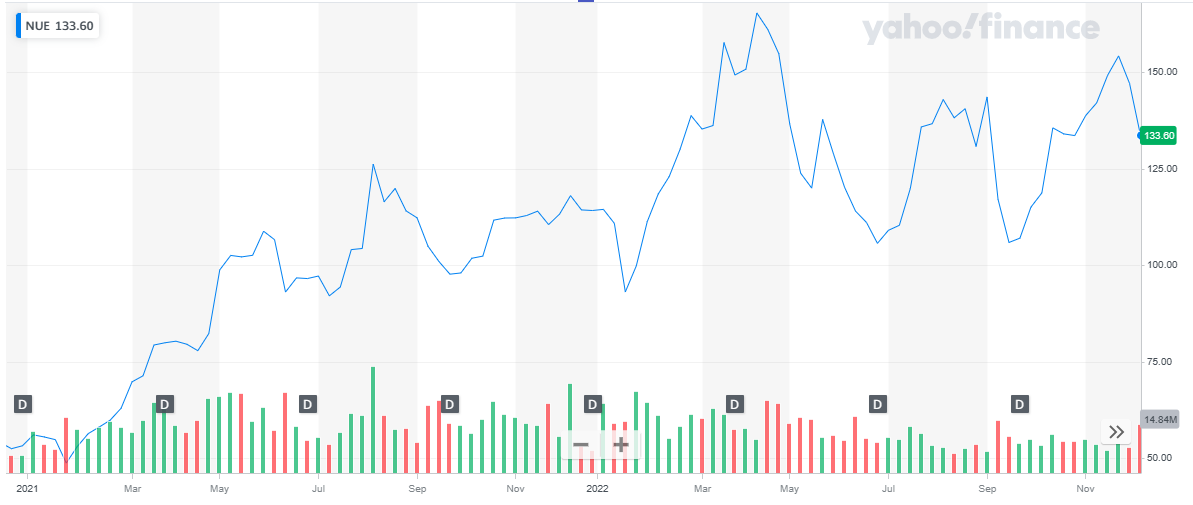

The stock of the company has been on an upward trend for the past two years. From $ 53.19, at the start of the year, the stock closed off at $ 114.15. Overall, the stock appreciated by 114.6 % in 2021.

In 2022, the stock of the company exhibited volatility in the current year. The stock rose as high as $ 165.32 during the year. After multiple dips and hikes, the stock last closed at $ 133.6 representing a 17 % appreciation to date.

(Click on image to enlarge)

ArcelorMittal

ArcelorMittal including its subsidiaries (“ArcelorMittal” or the “Company”) is one of the world’s leading integrated steel and mining companies, with steel-making operations in 16 countries on four continents.

ArcelorMittal’s steel-making operations include 37 integrated and mini-mill steel-making facilities. ArcelorMittal is the largest steel producer in Europe and among the largest in the Americas, the second largest in Africa, the sixth largest steel producer in the CIS region, and has a smaller but growing presence in Asia.

ArcelorMittal sells its products primarily in local markets and to a diverse range of customers in approximately 155 countries, including the automotive, appliance, engineering, construction, and machinery industries. ArcelorMittal has a global portfolio of 12 operating units with mines in operation and development and is among the largest iron ore producers in the world.

Arcelor Mittal reports financials half-yearly and annually. The below table shows the past and recent financials of the company:

| HY 2022 | The full Year 2021 | |

| Sales | $ 43.9 billion | $ 76.6 billion |

| Operating Income | $ 8.9 billion | $ 17 billion |

| Net Income | $ 8.3 billion | $ 15.6 billion |

| Earnings per share | $ 8.53 | $ 13.53 |

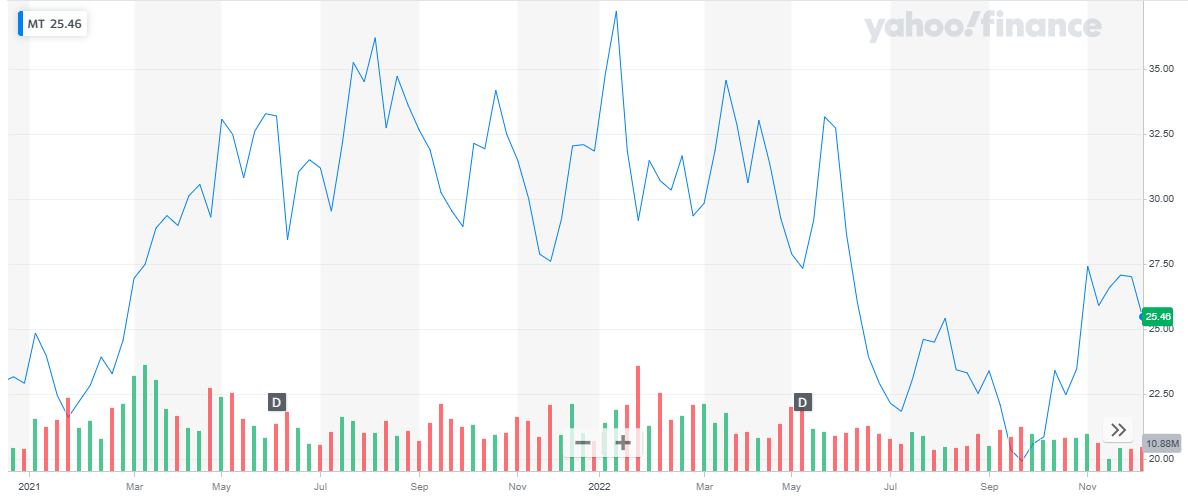

Arcelor Mittal has a market cap of $ 21.7 billion. Its shares are trading at $ 25.46.

The stock of the company has been extremely volatile in the past two years. Starting from $ 22.9, at the start of 2021, the stock went through multiple dips and peaks throughout the year and closed at $ 31.83. During 2021, the stock appreciated by 40 %.

In 2022, the stock continued its volatile behavior. From $ 31.93, the stock went as high as $ 37.22 and as low as $ 19.91 and last closed at $ 25.4. To date, the stock has declined by 20.45 %.

(Click on image to enlarge)

Steel Dynamics Inc.

Steel Dynamics is one of the largest domestic steel producers and metals recyclers in the United States, based on estimated annual steelmaking and metals recycling capability, with facilities located throughout the United States, and in Mexico. Steel Dynamics produces steel products, including hot roll, cold roll, and coated sheet steel, structural steel beams and shapes, rail, engineered special-bar-quality steel, cold finished steel, merchant bar products, specialty steel sections, and steel joists and decks. In addition, the company produces liquid pig iron and processes and sells ferrous and nonferrous scrap.

The below table shows the financials of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 5.6 billion | $ 6.2 billion | $ 5.6 billion |

| Operating Income | $ 1.21 billion | $ 1.6 billion | $ 1.5 billion |

| Net Income | $ 918 million | $ 1.2 billion | $ 1.1 billion |

| Earnings per share | $ 5.07 | $ 6.49 | $ 5.74 |

Steel Dynamics has a market cap of $ 17.7 billion. Its shares are trading at $ 101.2.

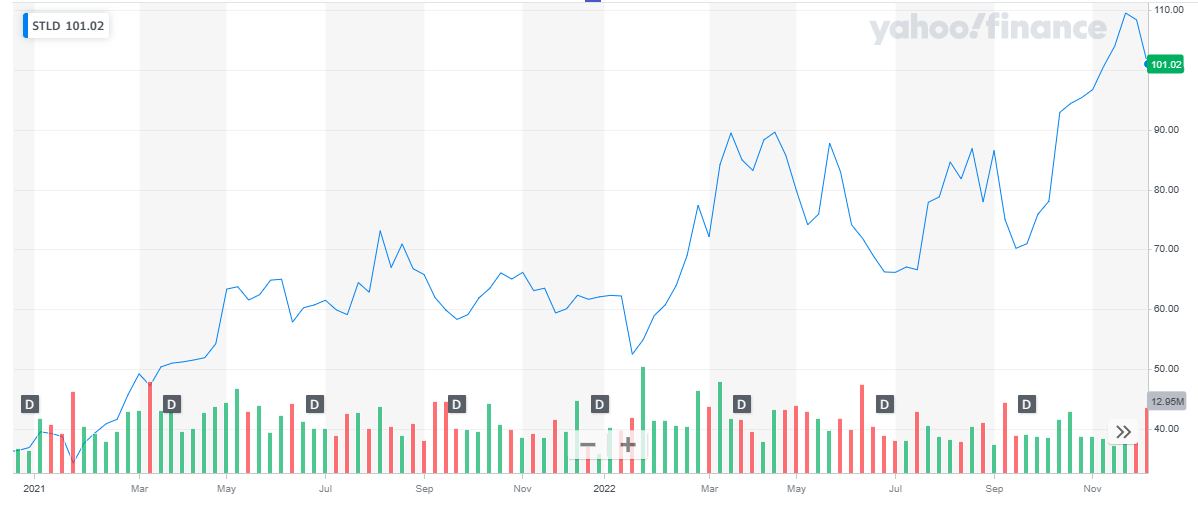

The stock of the company has been on an upward for the past two years. From $ 36.87, at the start of the year, the stock closed at $ 62.07. Overall, the stock appreciated by 68 % during the year.

In 2022, the stock continued its bullish trend. From $ 62.07 the stock last closed at $ 101.02 representing a 63 % appreciation to date.

(Click on image to enlarge)

Wheaton Precious Metals Corp.

Wheaton Precious Metals Corp. is a precious metal streaming company that generates its revenue primarily from the sale of precious metals (gold, silver, and palladium) and cobalt.

As of March 31, 2022, the Company has entered into 31 long-term purchase agreements (three of which are early deposit agreements), with 24 different mining companies, for the purchase of precious metals and cobalt (“precious metal purchase agreements” or “PMPA”) relating to 23 mining assets which are currently operating.

The below table shows the financials of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 218.9 million | $ 302.9 million | $ 307 million |

| Operating Income | $ 102.6 million | $ 149.8 million | $ 159.7 million |

| Net Income | $ 196.5 million | $ 149 million | $ 157.5 million |

| Earnings per share | $ 0.435 | $ 0.331 | $ 0.35 |

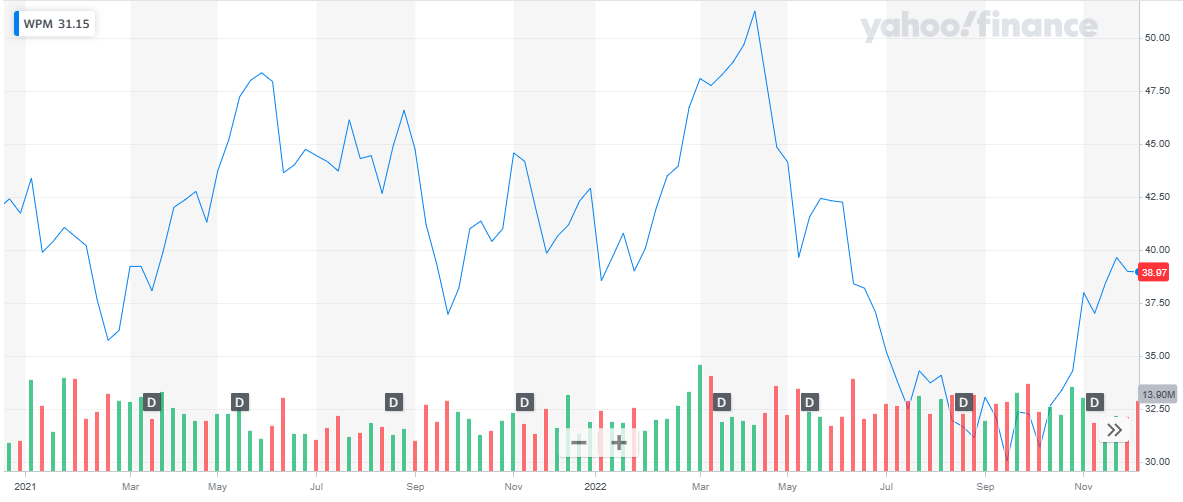

Wheaton Precious Metals Corp. has a market cap of $ 17.6 billion. Its shares are trading at $ 38.97.

The stock has been volatile in the past two years. The stock started the year 2021 at $ 41.74 and closed it off at $ 42.93 representing a 3 % appreciation during the year.

In 2022, the stock spike upwards and peaked at $ 51.9. After that, the stock suffered a huge dip and touched a low of $ 30.04. Eventually, the stock last closed at $ 38.97. To date, the stock has declined by 9.3 %.

(Click on image to enlarge)

Commercial Metals Company

Commercial Metals Company and its subsidiaries manufacture, recycle, and fabricate steel and metal products and provide related materials and services through a network of facilities that includes seven electric arc furnace (“EAF”) mini mills, two EAF micro mills, one rerolling mill, steel fabrication, and processing plants, construction-related product warehouses and metal recycling facilities in the United States and Poland.

The below table shows the financials of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 2.5 billion | $ 2 billion | $ 1.98 billion |

| Net Income | $ 312 million | $ 383 million | $ 233 million |

| Earnings per share | $ 2.58 | $ 3.16 | $ 1.92 |

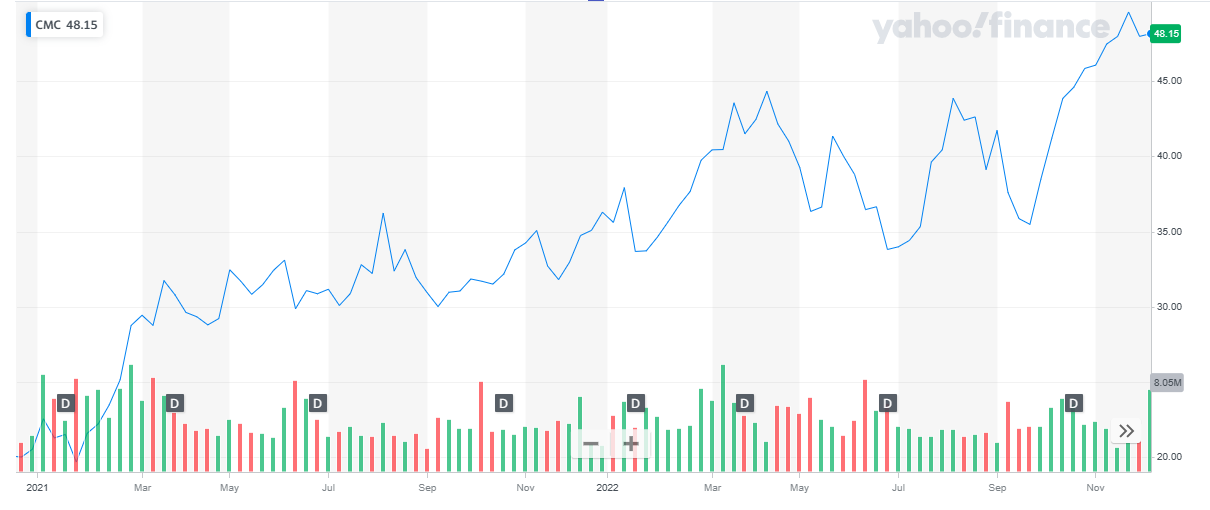

Commercials Metal Company has a market cap of $ 5.65 billion. Its shares are trading at $ 48.15.

The stock of the company has been on a bullish run for the past two years. It started the year at $ 20.54 and following a bullish run throughout the year closed off at $ 36.29. Overall, the stock appreciated by 43.4 %.

In 2022, the stock continued its bullish run. To date, the stock has appreciated by 33 % last closing at $ 48.15.

(Click on image to enlarge)

MP Materials Corp.

MP Materials helps fuel the electrification of global infrastructure. They are the largest producer of rare earth materials in the Western Hemisphere, through their state-of-the-art, zero-discharge operations in Mountain Pass, California. MP currently delivers approximately 15% of the global rare earth supply with a long-term focus on Neodymium-Praseodymium (NdPr), a crucial input to the powering of electric vehicles, wind turbines, drones, robots, and many other advanced technologies. As electrification and advanced clean technologies proliferate, MP Materials is the American leader in delivering sustainable products for sustainable industry while also closing a critical gap in U.S. economic and national security.

The below table shows the financials of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 124 million | $ 143.5 million | $ 166 million |

| Net Income | $ 63 million | $ 73 million | $ 85.5 million |

| Earnings per share | $ 0.33 | $ 0.38 | $ 0.45 |

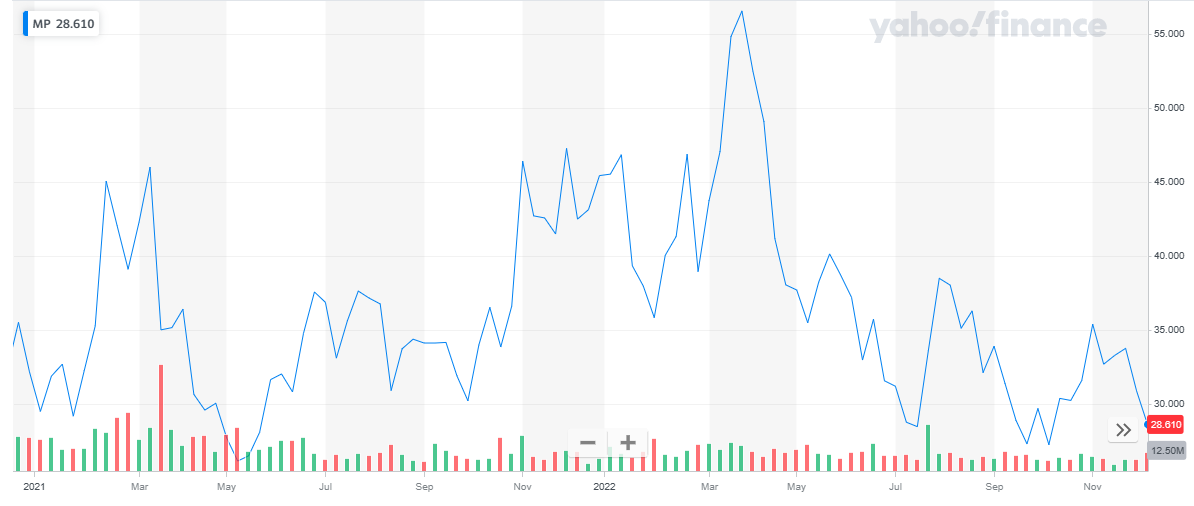

MP Materials Corp has a market cap of $ 5.08 billion. Its shares are trading at $ 28.61.

The stock has been volatile in the past two years. From $ 32.17, at the start of the year 2021, the stock closed the year at $ 45.42 representing a 41 % appreciation during the year.

In 2022, the stock continued with its volatile behavior. From $ 45.42, the stock peaked at $ 56.54 and eventually closed at $ 28.6. To date, the stock has declined by 37 % till date.

(Click on image to enlarge)

Hecla Mining

Hecla Mining Company, together with its subsidiaries, discovers, acquires, develops, and produces precious and base metal properties in the United States and internationally. The company mines silver, gold, lead, and zinc concentrates, as well as carbon material containing silver and gold for sale to custom smelters, metal traders, and third-party processors, and doré containing silver and gold. It owns 100% interests in the Greens Creek mine located on Admiralty Island in southeast Alaska; the Lucky Friday mine situated in northern Idaho; the Casa Berardi mine located in the Abitibi region of northwestern Quebec, Canada; and the San Sebastian mine situated in the city of Durango, Mexico.

The below table shows the financials of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 146 million | $ 191 million | $ 186.5 million |

| Income/Loss from Operations | ($ 25.5) million | $ 7.7 million | $ 14.7 million |

| Net Income | ($ 23.6) million | ($ 13.6) million | $ 4 million |

| Earnings per share | $ 0.04 | ($ 0.03) | $ 0.01 |

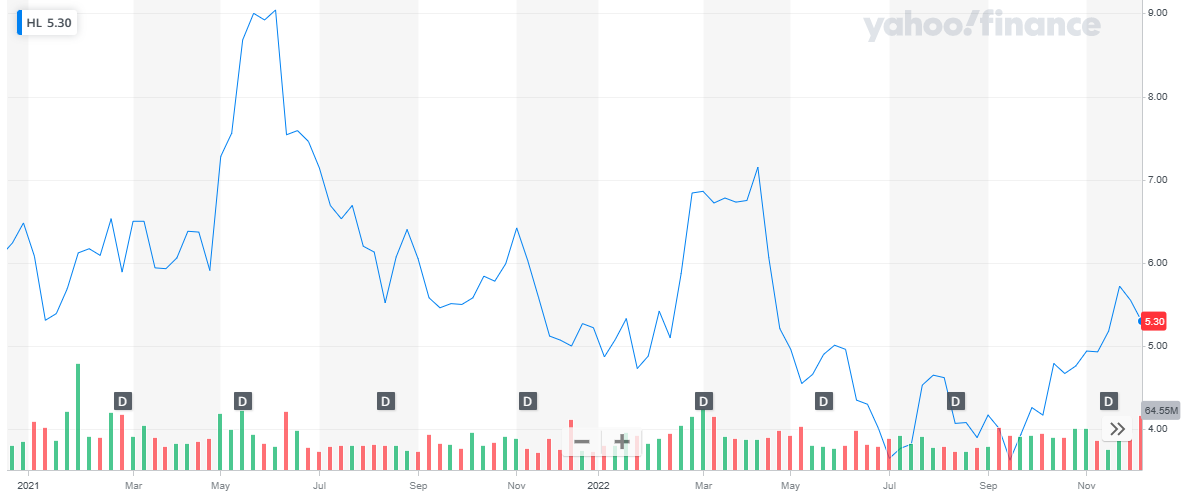

Hecla Mining has a market cap of $ 3.2 billion. Its shares are trading at $ 5.3.

The stock has been slowly declining over the past two years with a few spikes along the way. The stock started the year 2021 at $ 6.48. during the year, the stock went as high as $ 9.04 and eventually closed the year at $ 5.22. Overall, the stock declined by 19 % during the year.

In 2022, the stock followed the same pattern. During the year it went as high as $ 7.15 and last closed at $ 5.3. To date, the stock has almost remained the same.

(Click on image to enlarge)

Lithium Americas

Lithium Americas is focused on advancing lithium projects in Argentina and the United States to production. In Argentina, Caucharí-Olaroz is advancing towards its first production and Pastos Grandes represents regional growth. In the United States, Thacker Pass has received its Record of Decision and is advancing toward construction.

The below table shows the financials of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Net Loss | ($ 40.9) million | ($ 16.6) million | ($ 46.1) million |

| Earnings per share | ($ 0.3) | ($ 0.12) | ($ 0.35) |

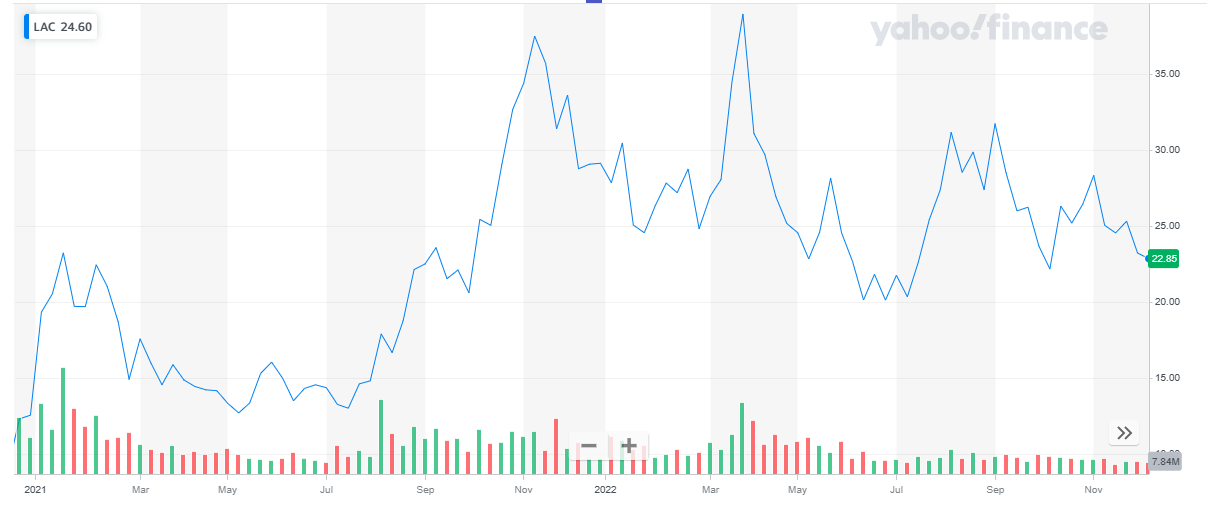

Lithium Americas has a market cap of $ 3.1 billion. Its shares are trading at $ 22.85.

The stock started the year 2021 at $ 12.55 after an initial decline, the stock spiked and hit $ 37.49 and eventually closed the year at $ 29.12. Overall, the stock appreciated by 132 %.

The stock exhibited volatile behavior in the current year. From $ 29.12, at the start of the year, the stock last closed at $ 22.85. To date, the stock has declined by 21.5 %.

(Click on image to enlarge)

Conclusion

Demand and prices for industrial metals are linked to the rise and fall of the global economy. A recession typically causes demand and prices to fall. This eventually leads to declining profits and stock prices of companies focused on producing industrial metals start to decline.

The value of precious metals, on the other hand, tends to have an inverse relationship to the economy. Because investors buy these metals to protect their wealth or to hedge against inflation, which is more likely to rise after central banks lower interest rates to counter an economic downturn.

Therefore, it will be a smart approach to seek companies that focuses on industrial metals with one that focuses on precious metals to smooth out returns.

More By This Author:

Microsoft Elliott Wave Sequence Favors Extension Lower

AMX: Should It Be Ready For Next Rally ?

USDJPY: How A Dollar Dynamic 2.2 Can Impact The Yen

Disclaimer: Futures, options, stocks, ETFs and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as ...

more