Berkshire Bounces Back From Record Loss, But Shares Still Lag Despite Buffett's $5.1BN Buyback Surprise

Was DDTG founder Dave Portnoy on to something when he suggested earlier this year that Warren Buffett, the "Oracle of Omaha", might be past his prime?

Berkshire's Q2 earnings certainly don't make a strong case to the contrary.

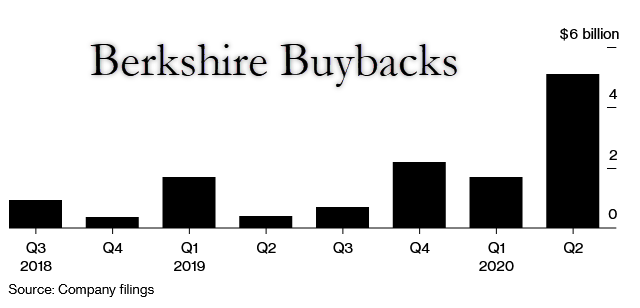

Released on Saturday morning (as per tradition), Berkshire reported that it spent a record $5.1 billion of the proceeds from cashing out its airline stocks, and others, during the March selloff buying back its own shares. While Bloomberg and other financial media focused on the $5.1 billion record buyback angle. BBG dared to ask its readers, in the opening paragraph of its earnings story, whether the great "Oracle of Omaha", in placing so much confidence in his own company's relatively unloved shares, might simply be one step ahead of the crowd once again.

Shares of Berkshire Hathaway Inc. were left out of the stock market rally in the second quarter. Warren Buffett clearly thought the disconnect wasn’t warranted.

They suggest this, despite Berkshire's streak of decidedly "un-oracular" performance, and despite the fact that such deference would sound more like sycophancy if it were directed at another financier. But as always, "the Oracle of Omaha", the folksy progressive defender of the "potential" of American capitalism.

Shares of Berkshire Hathaway Inc. were left out of the stock market rally in the second quarter. Warren Buffett clearly thought the disconnect wasn’t warranted.

Berkshire bounced back to an operating profit after booking a record quarterly loss last quarter.

Its shares have still lagged.

Even with the massive infusion of capital provided by Buffett himself in the open-market buybacks...

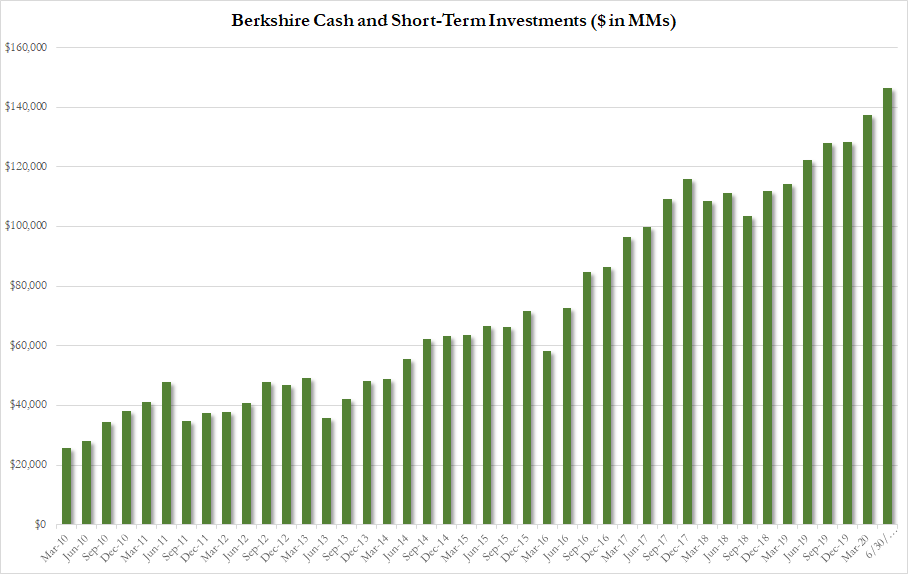

Berkshire's shares largely lagged both the S&P 500 and a popular index of airline stocks, and the conglomerate's cash pile, which has grown alongside perceptions of Buffett's indolence, has reached its own record high of $146.6 billion.

Buffett refrained from dumping all of the $13 billion in cashed-out shares back into Berkshire, perhaps because Buffett told the public a few months ago that this wasn't a particularly compelling time to buy back shares.

More from BBG:

The famed investor spent a record $5.1 billion buying back Berkshire’s own stock in the second quarter, more than double the amount he’d ever purchased before. That came as he unloaded almost $13 billion of other companies’ shares, including airline stocks and some financials, in what was Buffett’s biggest selling quarter in more than a decade.

Buffett has shown signs of buying appetite in recent weeks, but the second-quarter results show those are a new phenomenon as the Covid-19 pandemic has slammed the economy but failed to put a permanent dent in stock-market valuations. Buffett’s been building up cash this year even as other investors have sought to seize on opportunities amid the turmoil, and the pain Berkshire’s own businesses are feeling may inform his thinking.

"Our operating business groups are preparing for reduced cash flows from reduced revenues and economic activity as a result of Covid-19,”Berkshire said Saturday in a regulatory filing. “We currently believe our liquidity and capital strength, which is extremely strong, to be more than adequate."

Buffett’s cash pile surged to a record $146.6 billion at the end of June, in part from dumping all of his airline shares in April. He’s been more active lately, striking a deal for natural-gas assets in July and snapping up at least $2 billion of Bank of America Corp. stock in recent weeks through Aug. 4.

Berkshire’s Class A shares, which fell in line with the S&P 500 in the first three months of the year as the pandemic spread in the U.S., fell another 1.7% last quarter while the broader index rallied 20%. Buffett said in early May that repurchases weren’t more compelling than at previous times, but the buybacks in the quarter suggest his thinking shifted.

The company’s stock has rallied in July and August, but still is underperforming in 2020. Berkshire Class A shares were down 7.4% for the year through Friday’s close, compared with the 3.7% gain in the S&P 500.

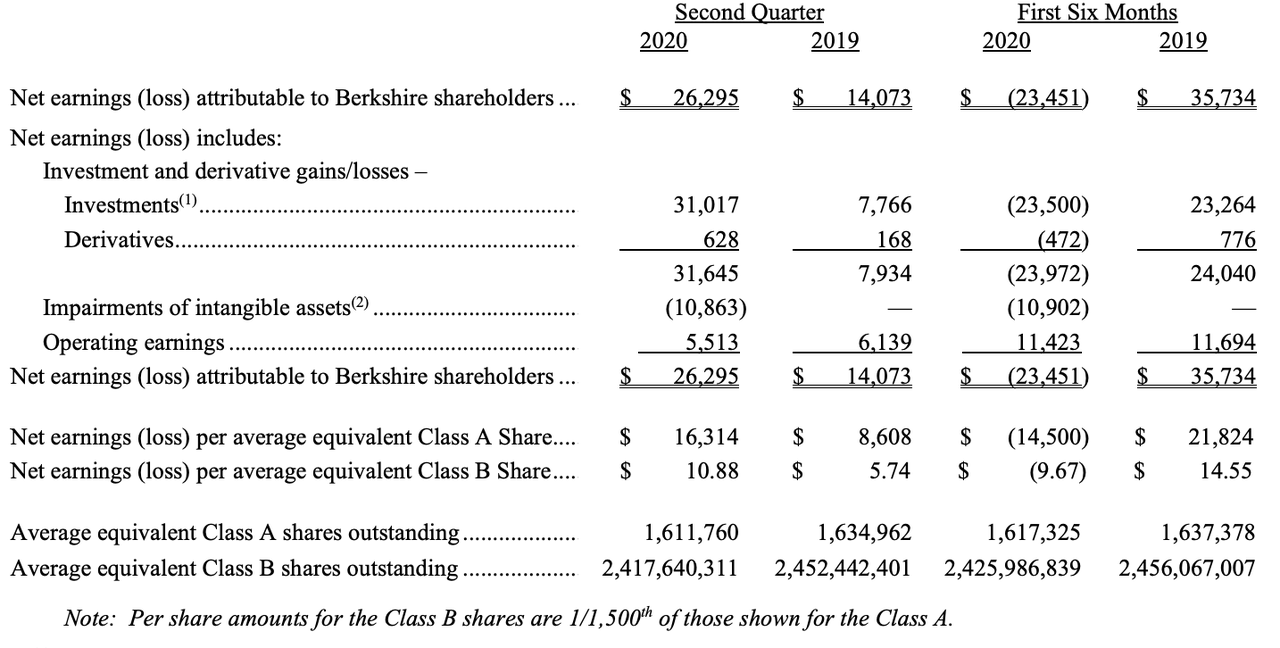

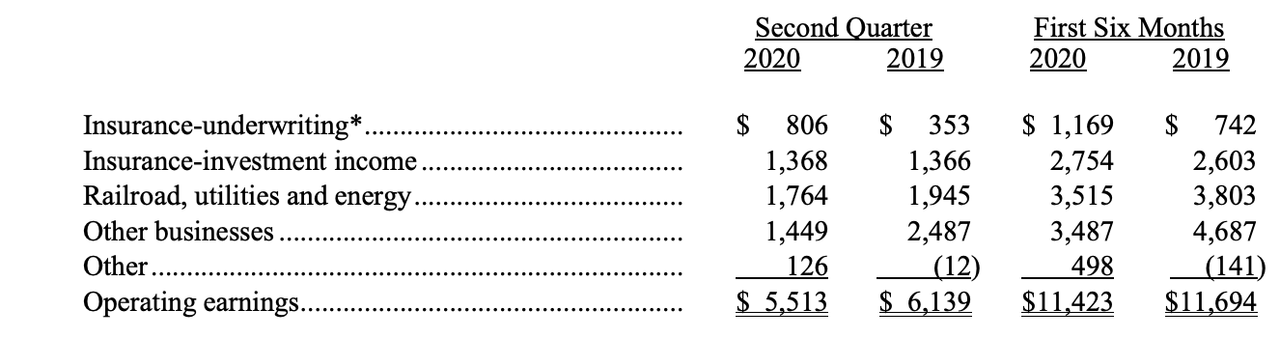

An analysis of Berkshire’s operating earnings follows (dollar amounts are in millions).

Heaping more injury upon injury, Berkshire also announced a $10 billion impairment charge stemming from one of Buffett's biggest and most recent deals, the purchase of Precision Castparts, a maker of airplane parts and engine components.

The company also took $10 billion of impairment charges related to its Precision Castparts unit. Berkshire bought Precision Castparts in 2016 in a transaction valued at $37.2 billion, making it one of Buffett’s biggest deals. Now the maker of jet-engine blades and aircraft structural components is bracing for lean times as Boeing Co. and Airbus SE cut jetliner production and less air travel reduces the need for replacement parts.

That’s forced the aerospace-parts maker to undergo “aggressive restructuring,” with the company cutting its workforce by about 10,000 employees during the first half of 2020.

“We believe the effects of the pandemic on commercial airlines and aircraft manufacturers continues to be particularly severe,” Berkshire said in the filing. “In our judgment, the timing and extent of the recovery in the commercial airline and aerospace industries may be dependent on the development and wide-scale distribution of medicines or vaccines that effectively treat the virus."

Here are the other key takeaways from the quarter, courtesy of BBG:

- Unrealized gains and losses in Berkshire’s massive stock portfolio count toward the bottom line. So the S&P 500’s rally in the second quarter pushed net income to $26.3 billion.

- Insurance underwriting profit more than doubled to $806 million in the period. That was helped by gains at auto insurer Geico as fewer accidents benefited the business.

- Berkshire warned that Geico might be hurt in the next three quarters by a program that’s giving drivers a credit on their premiums.

Read the full press release below:

Berkshire Hathaway Inc by Zerohedge on Scribd

And here's the annual report:

Printmgr File by Zerohedge on Scribd

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more