Bayer: With Great Acquisitions Comes Great Responsibility

Recommendation Summary

(Click on image to enlarge)

*Source: Bloomberg

With a correction in the stock price going on for one year now, is Bayer (BAYRY) ready to turnaround and start growing?

Bayer currently trades around 55 EUR, which puts the company’s stock price in a decline by about ~50% for the last 12 months. Despite this I find the company overvalued by more than 25%, I believe the market has underemphasized the low margins the company has compared to the global agriculture market. Additionally, in the years ahead I think Bayer will focus more on agriculture as a main revenue driver which will put the company in a lower margin threshold than the pharmaceuticals or consumer care businesses.

Company Background and Overview

*Source: Company Presentation

Bayer is a German multinational pharmaceutical and life sciences company and one of the largest pharmaceutical companies in the world. Bayer's areas of business include human and veterinary pharmaceuticals; consumer healthcare products; agricultural chemicals, seeds, and biotechnology products.

In the last 2 years (including TTM) the company has grown revenues at a steady pace of an average of 11% per year mostly fueled by the Monsanto acquisition and has experienced an EBIT margin drop of around 40% in 2018, from 16.8% in 2017 to 9.8% in 2018. Below you will find the main revenue segments broken down, the numbers are for the last TTM:

- Crop Science – €17,849 million in revenue, accounting for 41% of total revenue

- Pharmaceuticals - €17,025 million in revenue, accounting for 39% of total revenue

- Consumer Health - €5,436 million in revenue, accounting for 12.5% of total revenue

- Animal Health - €17,849 million in revenue, accounting for 3.4% of total revenue

Below you can find several company metrics (based on my calculations) and see where the company stands right now. Since I expect Bayer to focus more on crop-science in the coming years I have used global industry averages for the chemical specialty sector. The numbers I have used for calculating these metrics are as follows, share price of €54.49 per share, Enterprise Value of €90,844 million, an EBIT of €4,531 million (EBIT has been calculated by including an adjustment for operating leases of €202 million and an adjustment for R&D expense of €756. 6 million) and shares outstanding of 980.2:

- P/E Ratio – 46x – Global industry average: 32.96x

- EV/Revenue – 2.1x – Global industry average: 1.89x

- EV/EBIT – 20x - Global industry average: 15.10x

Keep in mind the numbers I have used for global industry averages are gotten from professor Damodaran’s website.

Investment Thesis

Currently, I believe the market sees Bayer as a distressed company, fueling this is the third consecutive litigation over the chemical Roundup, which Bayer acquired as part of its $63 billion purchase of Monsanto last year.

I think the downside trend will continue at least until the end of the year for the following reasons:

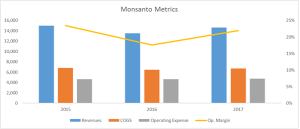

Monsanto Acquisition

(Click on image to enlarge)

*Source: Company filings and author’s own estimates

Since there is enough news out there on Roundup and the lawsuits connected to it, I will not bore you with the details on that and try to look at different perspectives. Even if we take Roundup out of the equation I find the acquisition of Monsanto a bad deal for several reasons. Bayer paid $63 billion for the acquisition of Monsanto, which is considered to be the most expensive acquisition in German history, for this amount Bayer got, considered by some, one of the “most hated brands” on the planet. But let’s forget the negative PR for a minute, look at Monsanto’s financials and compare that to how much Bayer paid for Monsanto. I took Monsanto’s last published annual report and did a DCF analysis on it.

For the DCF analysis I have used the assumptions listed below, which got me to an equity value of $29,236.8 million and a share price of $65.88 per share with diluted shares outstanding of 443.8 million:

- A 9.8% WACC.

- An average revenue growth for the next 10 years of 8.3%.

- Operating Margin at an average of 16.57%.

- A ROIC at an average of 13%.

- A sales to Capital ratio which of 1.05

In conclusion, Bayer paid $128 per share for this acquisition and until now we have seen a 41% drop in operating margins, a 13% increase in Revenues and a 50% decline in the stock price for one year. In my opinion, we have not seen any benefits arising from this acquisition.On top of all this Bayer ended up giving up much of its seeds and agrichemical business in the name of fair competition, to one of its biggest competitors BASF.

Market Share Trouble

Bayer (Monsanto) has mostly dominated the US market, but as weed develops tolerance to glyphosate I would expect that to change in the coming years with the help of China. On January 8th China approved several GM products for import including DowDupont’s (DWDP) Enlist 3. According to Cleveland Research Company, the Enlist platform of herbicides and chemical resistant seeds could win a comparable market share to Bayer’s Xtend platform.

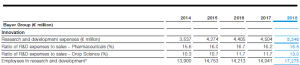

The shift to agriculture

(Click on image to enlarge)

*Source: Company’s 2018 10K

Bayer’s other main revenue driver is pharmaceuticals, making 39% of the company’s TTM revenue and having almost 3 times bigger margins than agriculture. I think this is where Bayer shines and in my opinion, shifting to agriculture will slow down the company in future years, thus lowering overall company margins. The shift also means allocating R&D expenses to agriculture. With pharmaceuticals being a strong R&D intensive business, allocating R&D away from it could lead to loss of market share, margins and revenue growth for Bayer.

In conclusion, I see Bayer’s future as mixed. With the growing court cases against Roundup, low margins in agriculture (around 10%) and a fiercely competitive agricultural market, I expect Bayer’s stock price to continue experiencing interruptions in the coming years. With the arising Roundup issues finding a replacement for glyphosate seems to be no easy task. I expect all this to open doors to some healthy competition, thus lowering Bayer’s market share in agriculture.

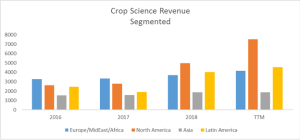

Industry analysis

(Click on image to enlarge)

*Source: Company filings and author’s own estimates

From the graph above we can clearly see that the regions bringing in the most revenue in the crop science segment are North America and Latin America, so I have tied the crop science revenue increase to the production of cotton, maize, soybean and citrus in these two regions.

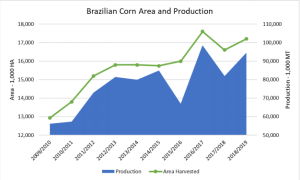

Latin America

Let’s have a look at Latin America and more precisely Brazil and Argentina, some of the biggest corn and soybean producers on the planet.

(Click on image to enlarge)

*Source: USDA

With the high-corn prices and early soybean harvest, farmers planted safrinha corn at a record pace. Although a little bit early, Brazilian corn exports are expected to easily surpass the 22 million tons of corn exported in 2018. Corn yields in Brazil are expected to be higher than in 2016/17, which was the last record high yield corn year. In 2019/2020 production is forecasted to expand further to 97.5 MMT, with 18 million hectares of corn harvested.

Forecasts on soybean in Brazil doesn’t look that bad. Soybean planted area in 2019/2020 is about to increase by 36.5 million hectares, an expansion of just 1%. This is fueled mainly by uncertainties surrounding the soybean demand from China, considered to be the largest soybean consumer in the world. Despite this, soybean production is forecast to expand by 9%.

Cotton-planted area is also expected to increase 5% in 2019/2020, with the estimated 2018/2019 cotton planted area being the largest in the last 2 decades. This is fueled mainly by the high prices and strong export demand internationally.

Argentina along with Brazil is one of the largest soybean growers. Due to escalations of the China-US trade disputes Argentinian exports could continue to rise as China starts buying more soybeans from South America. According to the USDA due to limited Brazilian soybean supplies this fall, we could expect higher soybean export from Argentina.

Corn production in 2019/2020 is anticipated at record level due to high yields, with generally favorable weather fueling crop development. According to some reports, Brazil and Argentina are actually expected to take over US corn markets.

United States

(Click on image to enlarge)

*Source: BusinessInsider

Corn prices recently jumped, with crop planting continuing to lag behind historic averages and certain areas in the US being “too wet for planting”. Recently a report from AccuWeather estimated lower corn and soybean production in the US for 2019 fueled by continued wet weather. On top of this, we have China tariffs weighing in on US exports.

For 2019/2020 soybean crop is expected to be 394 million bushels below last year’s record. USDA expects a rebound in soybean exports and an average farm price of $8.10 per bushel.

In conclusion, the changing market dynamic shouldn’t hurt Bayer’s margins or revenue growth. I expect Latin America to offset the lower North American corn and soybean production. Right now Bayer has a solid market share in both markets.

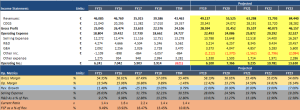

Financial Statement

(Click on image to enlarge)

*Source: Company filings and author’s own estimates

Profitability: In 2018 the company experienced a fall in margins by 41%, this fall would have been even bigger if it wasn’t offset by the sale of certain crop science businesses to BASF in connection with the Monsanto acquisition. If I keep the TTM “other income” number as in stable years Bayer would actually experience an operating loss.

Growth: The company has an average growth of 2% for the last 5 years which puts it in the below average category in the chemical specialty sector, which has experienced an annual average growth for the last 5 years of 6.41%.

Liquidity: In terms of liquidity Bayer has experienced a drop in both current ratio and free cash flow as a % of revenue since 2017. On top of all this, the company has a large amount of debt, €42 million to be exact and with only $4 billion in cash the future looks a tad worrisome.

Catalysts

Catalysts in the next 12-24 months for the price to decrease include:

Glyphosate Ban

With all the commotion going on around Roundup and especially glyphosate I could not rule out a ban of the substance in Europe and even possibly in the US. Right now several countries are considering, limiting or completely halting glyphosate use:

- Argentina – In 2015 30,000 doctors and healthcare professionals demanded a glyphosate ban. Now there are 400 towns restricting the use of glyphosate

- Brazil – Earlier this year Brazil conducted a health analysis on glyphosate and determined that it does not cause cancer while recommending exposure limits as international pressure to reduce the use of the chemical grows. Despite these findings, the agency recommended banning products sold with concentrations over 1 percent of the glyphosate active ingredients and proposing daily limits of 0.5 milligrams per kilogram of body weight for the general population and 0.1 milligrams for rural workers using the chemical.

- Europe – Last month the EU proposed to appoint four member states (France, Hungary, the Netherlands, and Sweden) acting jointly as 'rapporteurs' for the next assessment of glyphosate. The current approval of glyphosate will expire on 15 December 2022, which means that an application for renewal must be submitted by December 2019, but many countries in Europe already restricted or banned the use of glyphosate. France recently announced a 2021 glyphosate ban with the country planning to cut pesticide, insecticide and fungicide use by half. Germany also set some restrictions on Glyphosate, which plans an exit from the use of the weed killer. In the UK several cities are also looking at limiting glyphosate use.

Even if Europe or Latin America do not fully ban glyphosate use I see this as very negative news for Bayer and would expect sales and market share in 2019 and 2020 to get affected by this.

Organic Farming Trend

According to a report released this year in 2017, organic land area increased by 20% over the 2016 numbers. Despite this only 17% of the world’s organic agricultural land is arable and although this is a very small number, it represents a double-digit increase since 2016.

In recent year growth of organic farming and supporters of it have grown by the numbers, the US is the leading market followed by Germany, France, and China. France’s organic market has doubled in five years with the organic market “proving to be a real job engine “.

Global organic farming is expected to experience an 8.4% growth rate by 2026, this is fueled mainly by the increasing demand for organic food.

Despite this being a very small market in terms of size and very costly in terms of labor the rising demand and size of the organic market could prove to be disruptive for Bayer and other companies in the sector in the coming years. I also expect the glyphosate trials to further solidify the organic movement around the world.

Valuation

DCF Analysis

The analysis I have done here is a base case scenario built on Bayer’s current and expected future performance in the market.

For the DCF analysis I have used the assumptions listed below, which got me to an equity value of €39,092 million and a share price of €39.82 per share with diluted shares outstanding of 980.15:

- A 9.6% average discount rate for the next 10 years.

- Revenue growth for the next 5 years at an average of 14.5% per year and then slowly declining when reaching year 10 to the terminal growth rate of 3%.

- Operating Margin at an average of around 15% for the next 10 years.

- A tax rate at an average of 26% for the next 10 years.

- A ROIC at 4% at year 1 and slowly increasing throughout the years until reaching 13% at year 10 and getting closer to industry averages.

- A sales to capital ratio from 0.42 at year 1 until reaching 0.85 in year 10, thus getting closer to the global industry average rate for the sector of 1.27

Key Takeaway: The analysis is sensitive to the assumptions listed above – however, I have given Bayer the benefit of the doubt that in the years to come the company will be able to further grow its agricultural segment and will be able to cut costs. The discount rate I have given here may seem high, but it represents the three key revenue segments in Bayer (Pharmaceuticals, Specialty Chemicals and Consumer Healthcare Products), takes into account the global market reach, the high debt Bayer has right now and the company’s operating leases.

Risks

Risks in the next 12-24 months for the price to increase include:

Cost cuts

Last year Bayer announced its plan to cut 12,000 jobs and exit the animal health business. Recently in April, Bayer announced another cut of 4,500 jobs in Germany which do not include another 10,000 job cuts resulting from the spinoff of brands, divisions and selling 60% of its joint venture in Currenta Solutions. As a result, Bayer is expected to save €2.6 billion per year from 2022 onwards. These workforce cuts could fuel Bayer’s financial allocation to more promising projects in both pharmaceuticals and agriculture

Key Takeaways

In considering all catalysts and risks, I think there is a high possibility that Bayer’s stock price will continue experiencing a downwards trend. The company seems to be experiencing various risks both from shifting its revenue stream and intensifying competitive pressure. Bayer could turn out to be a great buy, but not with today’s valuation and story.

Disclosure:

I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, ...

more