BABA Battered, Brexit Breakthrough, & Bailout Busted - Buck & Bond Yields Drop

Jack Ma might be (or have been) the richest man in China, but right now he is learning the hard way, you don't mess with the gods. Since his criticism of China's financial regulations during an appearance at a high-profile industry conference in October, he has seen his Ant Group IPO canceled, regulatory crackdowns on lending (the company's main business), and last night saw further action by Chinese officials investigating anti-trust violations. These actions have clubbed the giant Chinese tech firm (and Ma's wealth) like a baby seal...its worst day ever!

(Click on image to enlarge)

Of course, in response, this happened...

Alibaba and the 40 Short Sellers

— zerohedge (@zerohedge) December 24, 2020

Perhaps more is to come, as hedge fund manager Kyle Bass, a prominent China critic, speculated that Ma isn't actually retiring - rather, his carefully choreographed decision to step down is the result of being "forcibly removed from his position, stripped of his shareholdings (transferred to "five unnamed individuals" with the same address), and will likely be jailed or 'disappeared' within the next year."

We guess Emperor-for-life trumps 'untouchable' oligarch. Still, could be worse... you could be stuck in a truck in Dover for Xmas...

LOOK: Stranded truck drivers spelled “HELP” with traffic cones in Dover.⁰

— Bloomberg Quicktake (@Quicktake) December 24, 2020

Thousands of truckers were stuck in logjams around Britain’s Port of Dover on Christmas Eve, separated from families, despite some progress moving traffic https://t.co/8DUR10dqYc pic.twitter.com/40h7Z5o1LP

A lack of COVID Relief (after Trump poked the hornet's nest of pork... to mix metaphors), sent stocks lower on the day, pushing S&P, Dow, and Nasdaq red for the week (and erasing some of the Small Caps' gains). Late-day ramp pushed Nasdaq and Dow back into the green...

(Click on image to enlarge)

Financials and Tech led on the week (and were the only sectors green on the week) while Energy lagged

(Click on image to enlarge)

Source: Bloomberg

VIX plunged to a 21 handle today, back at quad-witch spike lows...

(Click on image to enlarge)

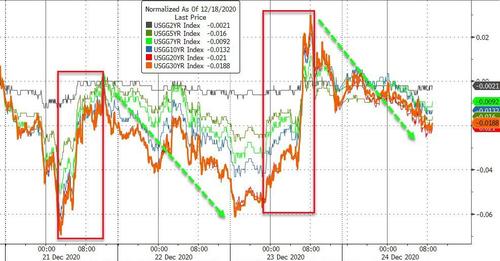

Bonds were bid today, erasing yesterday's spike and ending the week lower by 1-3bps...

(Click on image to enlarge)

Source: Bloomberg

Once again, it seems the invisible hand of 'someone' stepped in to hold yields back from breaking out...

(Click on image to enlarge)

Source: Bloomberg

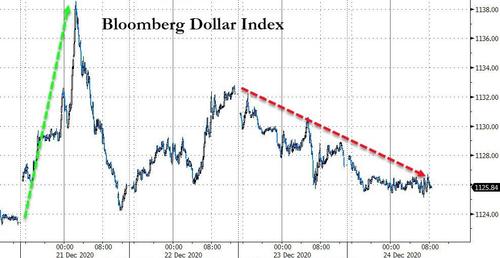

The dollar slipped lower on the day, but higher on the shortened week...

(Click on image to enlarge)

Source: Bloomberg

As Cable rallied up to recent high stops on Brexit deal headlines...

(Click on image to enlarge)

Source: Bloomberg

Bitcoin was flattish this week, oscillating around the $23k-$24k mark...

(Click on image to enlarge)

Source: Bloomberg

But XRP was monkey hammered after the SEC probe headlines, erasing all the year's gains...

(Click on image to enlarge)

Source: Bloomberg

Commodities were mixed with PMs flat on the week but Copper and Crude lower as COVID-Lockdown Relief faded away and lockdowns spread around the world...

(Click on image to enlarge)

Source: Bloomberg

Gold managed to get back above its 50DMA...

(Click on image to enlarge)

Source: Bloomberg

But WTI managed to scramble back above $48 again...

(Click on image to enlarge)

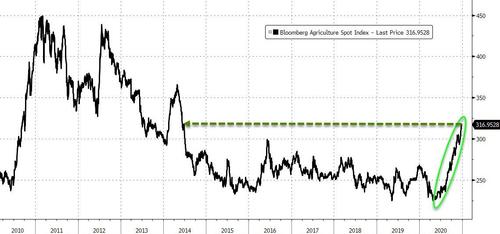

Finally, have no fear... there's no inflation (except in what you eat!!)...

(Click on image to enlarge)

Source: Bloomberg

And as real yields plunge back near record lows, gold is due to catch up (and has risen 16 of the last 20 years over the next week)...

(Click on image to enlarge)

Source: Bloomberg

And as if it matters, US economic data has been collapsing recently...

(Click on image to enlarge)

Source: Bloomberg

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more